I often get asked about the concept of “socially responsible investing”. The idea is to only invest in the “good” companies in order to affect change through your investing dollars. The list in this post shows some select omissions from Vanguard’s socially responsible index fund. It invests in “companies demonstrating strong Environmental, Social and Governance practices”.

Here’s what I think about socially responsible investing:

• I honor the intention! With all the bad we hear about in the world and all the dollars we put into investing, it would be great if we could impact change with those investing dollars.

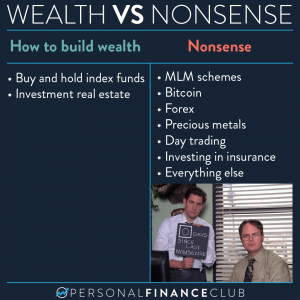

• From a financial perspective, I expect these two index funds to perform nearly identically. Since the market is efficient, all available information is priced into these stocks and thus these funds. Therefore we can’t expect socially responsible investing to do better (or worse) than the total market. (Note that VFTAX has about 500 stocks compared to VTSAX’s 3,700 stocks, but both of those numbers are big enough that I wouldn’t expect much more volatility from VFTAX)

• I don’t personally believe investing in this way will actually impact much or any change. Again, the market is efficient. If investing just in the crossed-out stocks would yield a higher return, plenty of investors will jump on that and the market will even out. I imagine it like taking a cup of water out from one side of an Olympic swimming pool and dumping it into the other. It’s not gonna make a difference.

• It’s pretty darn subjective. Is Amazon good, Walmart bad? Bank of America good, Wells Fargo bad? It doesn’t seem so black and white to me.

• The much bigger impact you can make is in how you SPEND your money. If everyone stops buying cigarettes, Philip Morris will go out of business (or have to change their business). I think your time, money, and effort will be much more effective if you focus on your behavior and your spending, rather than your investing.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram