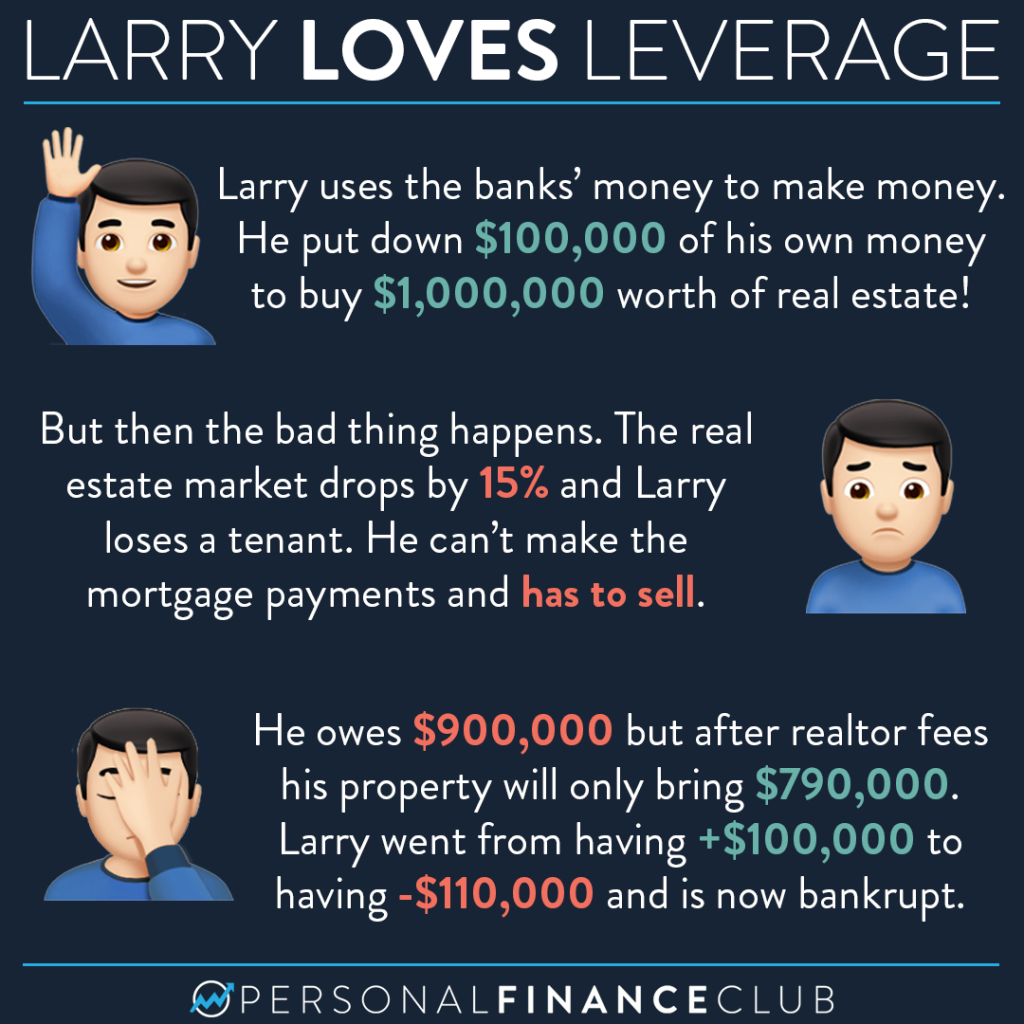

I went to a real estate meetup a few years ago. I don’t remember a single thing from the presentation, but I distinctly remember the elevator ride on the way home. I talked to this guy who basically did exactly what Larry did. He put about 10% down on millions of dollars of real estate, then the market dropped by about 10%. He couldn’t make his payments. The banks came calling. He lost everything. No equity, no properties, no income. He lost his job. His wife left him. It was a disaster.

I don’t expect this post to be very popular or gain me a lot of followers. No one wants to hear about the downside of overly aggressive investing. And at the moment, the stock market and real estate market are going up. So it lulls people into a false sense that it always will go that way. I’m hearing more and more sentiment like “why not put 0% down on a house?” or “why not go all in on Tesla?” But as they say, everyone is a genius in a bull market. But when things turn, that’s when those decisions can burn you. As Warren Buffett says “It’s only when the tide goes out that you learn who has been swimming naked.”

Buffett always talks about his “margin of safety” in any investment. He also says “be fearful when others are greedy”. And that dude has like 85 billion dollars. So cautious investing isn’t bad. It’s what protects your wealth so you don’t go broke. And not going broke is a very important part of becoming wealthy.

Leveraging appreciating assets CAN be a valuable tool. (i.e. borrowing some money to buy a bigger investment property). But always remember to maintain your margin of safety. Don’t be caught naked when the tide goes out.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

Ketanji Brown Jackson confirmed! First Black woman in the Supreme Court

Ketanji Brown Jackson was just confirmed as the 116th Supreme Court justice in US history! 108 of the 115 who that preceded her were white