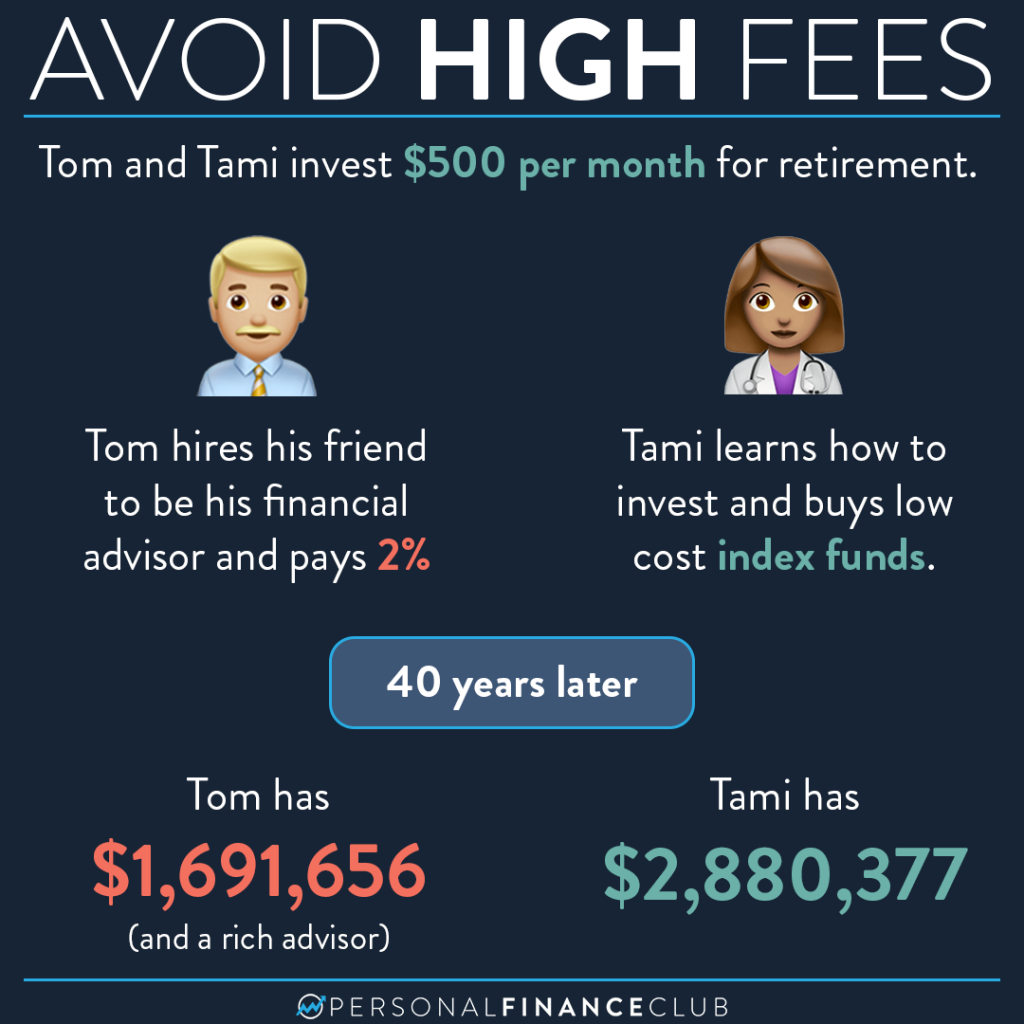

You might think, no one is actually paying 2% in fees, right?! Unfortunately, it’s more common than you think.

The financial advisory industry has been pushed closer to 1% in recent years. But, we have a front row seat into a lot of people’s investments and sadly we often see fees ranging between 1.5%-2%. And it’s not just small accounts. We’ve seen this on seven figure portfolios.

In our example, the 2% fee over 40 years makes a $1.1M difference! We focus on fees a lot because it’s one of the few things we have control over. We can’t always control our income or how our investments perform, but we know there are steps we can take today to ensure we use low cost index funds and don’t pay high advisor fees.

Some might think they are paying a high fee in exchange for even higher returns. After all, you would happily pay 2% if you got a 3% higher return! Unfortunately, due to the rule of averages, not everyone can be above average. Of those who charge a 2% fee to beat the market, on average all of them will equal the market (because they’re competing against each other). Net of fees, on average they’ll lose to the market by the cost of their fees.

If you have a financial advisor, make sure you know exactly how you pay them. There’s nothing wrong with paying a reasonable and transparent fee for high quality advice. If you’re looking for a trustworthy and affordable financial advisor, check out Nectarine!

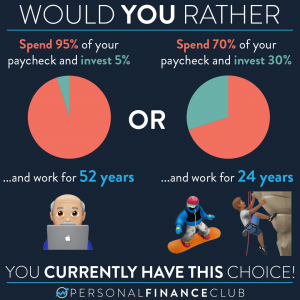

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane