Sin #1: Holding cash in a retirement account. This one always breaks my heart when I see it from a new investor. Here’s how it goes. You’re young and finally get a job making some money. You keep hearing this funny phrase “Roth IRA”. You know it’s something you probably are going to wish you had done as soon as possible, so you finally get around to opening one. You find a brokerage website, go through all the steps to open your account, link your bank account, and contribute money. PHEW, you did it, you think. You’re done.

NO YOU ARE NOT DONE MISTER. NOT BY A LONG SHOT. Because putting money into a Roth IRA just moves the cash to that account. But then it just SITS THERE DOING NOTHING unless you DO SOMETHING with it. A Roth IRA is just an account (like a checking or a savings account). But after you put money IN the account you need to take another step to BUY the investment you want.

So if you login to your Roth IRA and see money sitting in something called “Core” or “Money Market” or “Cash” or “Settlement Account” then that money is sitting there doing NOTHING. Not growing like it should be. And you’re very naughty because you have committed the first sin of investing. But you will be forgiven if you login and click “buy” or “trade” or “transact” and dump your money in a target date index fund.

Sin #2: This one pains me a little, because I know investing in individual companies can be exciting and can entice new investors to get started. And for that reason I actually think it’s great. Anything that gets people started investing is a good thing.

THAT SAID, I still consider investing more than 10% of your portfolio in individual stocks to be a sin. Here’s why:

The stock market is very “efficient”. That means every publicly traded stock is priced based on the consensus of the sum total of human knowledge. And it’s a zero sum game. For someone to beat the market, someone else has to lose. It’s like everyone is on a seesaw trying to fly to the sky, but we’re all anchored by the pivot in the middle.

When you think to yourself “Hm… Tesla cars are cool, they’re the way of the future so I should buy that stock.” Everyone else ALSO knows that. So that information is “priced in” to the stock. You have to pay SO MUCH MONEY for Tesla stock it suddenly becomes not worth it. (As evidence of this, Tesla is currently LOSING MONEY EVERY YEAR, yet the stock market has decided the company is worth more than Ford, General Motors and Daimler COMBINED).

And you also have to think about what you’re up against: There are companies who employ people full time to do nothing but analyze Tesla stock. They put satellites into space to photograph Tesla factories to count cars coming off the line. They pay former employees hundreds of dollars an hour to learn about Tesla’s strengths and weaknesses. They crunch massive sets of data to predict car buying trends and future growth prospects. All this to answer the simple question “Is Tesla stock going to outperform an index fund”. And even THEY generally don’t beat an index fund. And neither will your hunch.

So if you want to play with individual stocks, keep it to 10% of your contributions. With 90% buy and hold index funds.

Sin #3: I think we all love the idea of picking winners. And we all love jumping on bandwagons. After all, isn’t that why the Yankees have fans?

But being a bandwagon fan in investing can cost you a lot of money. I see it all the time. Someone pulls up a list of investments like they’re looking at a menu at a fancy french restaurant. “Well,” they think, “I clearly want the BEST thing.” So they sort the list by past performance. “Oooh! This inverse triple leveraged Indonesian oil future mutual fund returned 126% last year, I’ll just put all my money there!” But guess what. Maybe last year was a great year for inverse triple leveraged Indonesian oil future mutual funds, but that doesn’t mean next year will be.

When you chase past performance, you’re essentially “buying high” AFTER it went up so much in value and MISSING OUT on the thing that’s going to go up in the FUTURE.

The oil future nonsense was a silly example, but I’m seeing it a lot right now when people ask, “Should I bother investing in an international index fund? It has sucked lately!” Yeah… the last 10 years international stocks have been handily beat by US stocks. But time only goes this way ->. So what you really want to know is what will happen the NEXT ten years. I don’t know that. If I did I wouldn’t be here writing an instagram caption alone at midnight, I’d be on my super yacht in the South Pacific neck deep in hookers and blow.

But what I DO know is that over the last FIFTY years or so, international and US stocks have alternated having better periods. So I don’t know when international will start outperforming US again, but it will probably be right after you drop it from your portfolio.

So instead of trying to choose what to buy based on what has recently done well, just have a solid, well diversified portfolio of index funds and leave it alone for decades.

Sin #4: “Timing the market” is basically doing ANY SORT of strategy change based on what the market is doing. It’s an attempt to try to get in or out of the market or certain investments based on what you think the market is going to do in the future. I get asked a zillion times a day, some flavor of “should I time the market?” and the answer is always no. I’m SURE in response to this post some people are going to ask me “but should I time the market?” so I’m going to try to list a FAQ section below:

• “Should I sell now before the market crashes?” No. Invest early and often. Buy and hold index funds.

• “Is it a good time to move to gold or bonds?” No. Invest early and often. Buy and hold index funds.

• “Should I wait to contribute to my IRA?” No. Invest early and often. Buy and hold index funds.

• “Should I avoid investing while the market is in turmoil?” No. Invest early and often. Buy and hold index funds.

• “Should I put more money in now that the market is down?”. Well, that money should have already been in the market. Invest early and often. Buy and hold index funds.

• “What do you think about the feds move to blah blah blah or the future of blah blah blah?” I have no idea what will happen over the next few days or weeks or months. But I do know that over many years the market will go way up. And we don’t know when that will happen. So get on the train now and don’t get off.

• “Should I sell now before the market crashes?” You already asked that above.

• “Yeah I know but I just saw on CNBC that the CAPE ratio has inverted and we’re all doomed.” You don’t even know what the CAPE ratio is.

• “I know that’s why I’m asking you.” OH MY GOD. Set up auto contributions into your investments, delete your login info and please stop messaging me.

In conclusion. Ignore the market. Never make changes to your investment strategy based on what you think the market is doing. Stick to your plan through thick and thin. Any response to the market is way more likely to hurt you than help you.

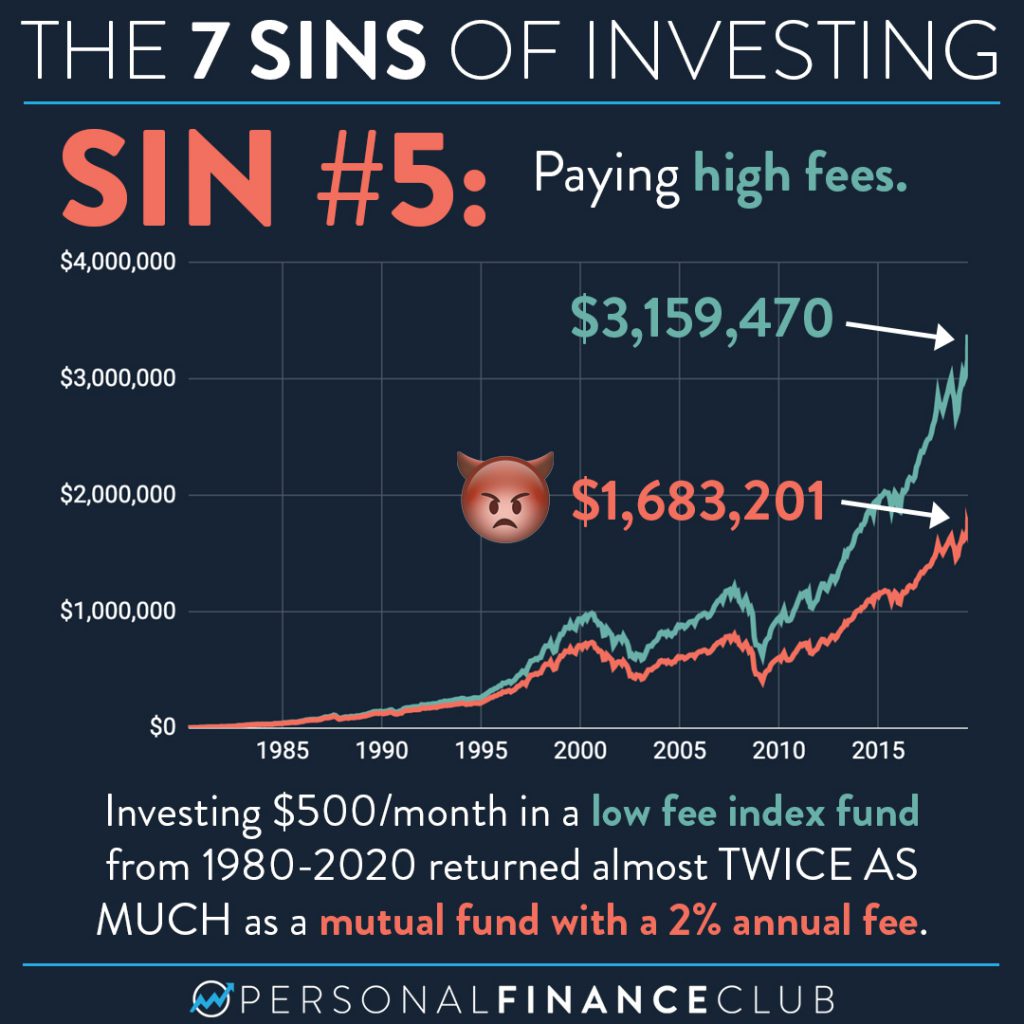

Sin #5: PAYING HIGH FEES. Fees are the silent but deadly killer of your investments. In the example in this post just a eeny teeny 2% annual fee ends up eating almost HALF of an investment over 40 years.

And fees can hide all over the place. Annual fees, account fees, loads, expense ratios, transaction fees, convenience fees, and inconvenience fees. The financial services industry makes BILLIONS of dollars each year from these fees under the guise of helping you with your investments. But those dollars aren’t ADDING to your investments, they’re scraping it off the top from the growth of your money into their pockets!

Another great study looked at 11 different features of an investment and the effect it has on future performance. (i.e. past performance, manager, size, morningstar rating, beta, etc.) TEN of the eleven were found to have NO CORRELATION to future performance. Only ONE feature was found to be able to predict future performance: The fees. The lower the fees, the better the investments did going forward. And makes sense, right?! Given the unknown future, if you have two choices, one which is draining some of your money each month, and the other which leaves it all in the investment, which do you think will do better?!

Anyway. Be aware of fees. If you signed up for an investment with an acquaintance who recommended a bunch of fancy mutual funds or insurance products you may be getting killed by fees. If you have a 401k from an old job still sitting in that account, you can likely lower the fees by rolling over to an IRA.

Sin #6: There are so many bad ways to get rich quick. Bitcoin, forex, day trading, MLMs, etc. Those who try to get rich quick are almost certainly doomed to stay broke forever.

But I get it. If you’re new to investing and you want your money to make money FAST. You’re anxious to do it NOW. If you have $1,000 and want to make some MONEY, 10% per year doesn’t sound so good. “So I put this $1,000 into an index fund and wait a YEAR and MAYBE I end up with $1,100”. Yeah. I can see how that doesn’t get you excited.

But here’s the thing. Get rich quick isn’t a option available. You get to choose from these:

A.) Invest early and often and get rich slowly over decades

B.) Try to get rich quick and stay broke for decades

C.) There is no option C

So if we look at that boring old 10% a little differently, it’s not so bad. Instead of $1,000 one time for a year to make $100 in profit. What if you do $250/month for 40 years. Your little $250/month turns into $1.3 million! That 10% over time, compounding with all the years of previous growth gets HUGE. As long as you’re thinking long term.

Also, to those freaking out about our current huge market crash. The S&P 500 share price is exactly where it was on October 15, 2019. A little over 4 months ago. Do you remember what happened to the market between February 2004 and June 2004? Me either. And neither will you remember this if just ignore it and keep investing early and often. The only way to lose is to let it scare you into selling or from continuing to invest.

Sin #7: Our very last sin of investing. And it’s a doozie. All the other more nuanced sins aside, you’ve gotta invest early and often if you want to end up with any money. Getting every little detail right doesn’t matter much if you don’t put any money in. And if you’re plowing money in early and often, you’ll end up with a lot even if you mess up some details.

So don’t let confusion, or lack of momentum, or analysis paralysis stop you from getting started. Open an account with a fancy app like Betterment, Acorns, or Robinhood. Follow my steps to open a Roth IRA. Set up an auto transfer to an investment. Whatever. Just don’t let ten years blow by you and have you wishing you had started so long ago. You’ll learn more along the way and get some of the other stuff right.

When I was thinking of my two rules, I was considering rule #2 to be “buy and hold index fund”. That’s my favorite type of investing. But it’s not really what’s at the CORE of building wealth. The most important thing is just INVESTING early and often. It could be investment real estate. It could be commodities or precious metals or high fee mutual funds or whatever. But you’ve got to be doing it if you want to get ahead. So get out of debt (being debt free falls under Rule #1), then get started investing!

September Sale!

September Sale!