There’s this myth out there that something magical happens at 65 years old that allows you to stop working. But that’s not true. In the US we do have social security, but it will only cover a fraction of your living expenses, if it even survives until we retire. (I’m projected to get about $1,500/month at age 67). Do you ever see people in their 60s, 70s, and beyond working at grocery stores pushing carts or as greeters? It’s likely not because they love it, but because they still need the income to survive.

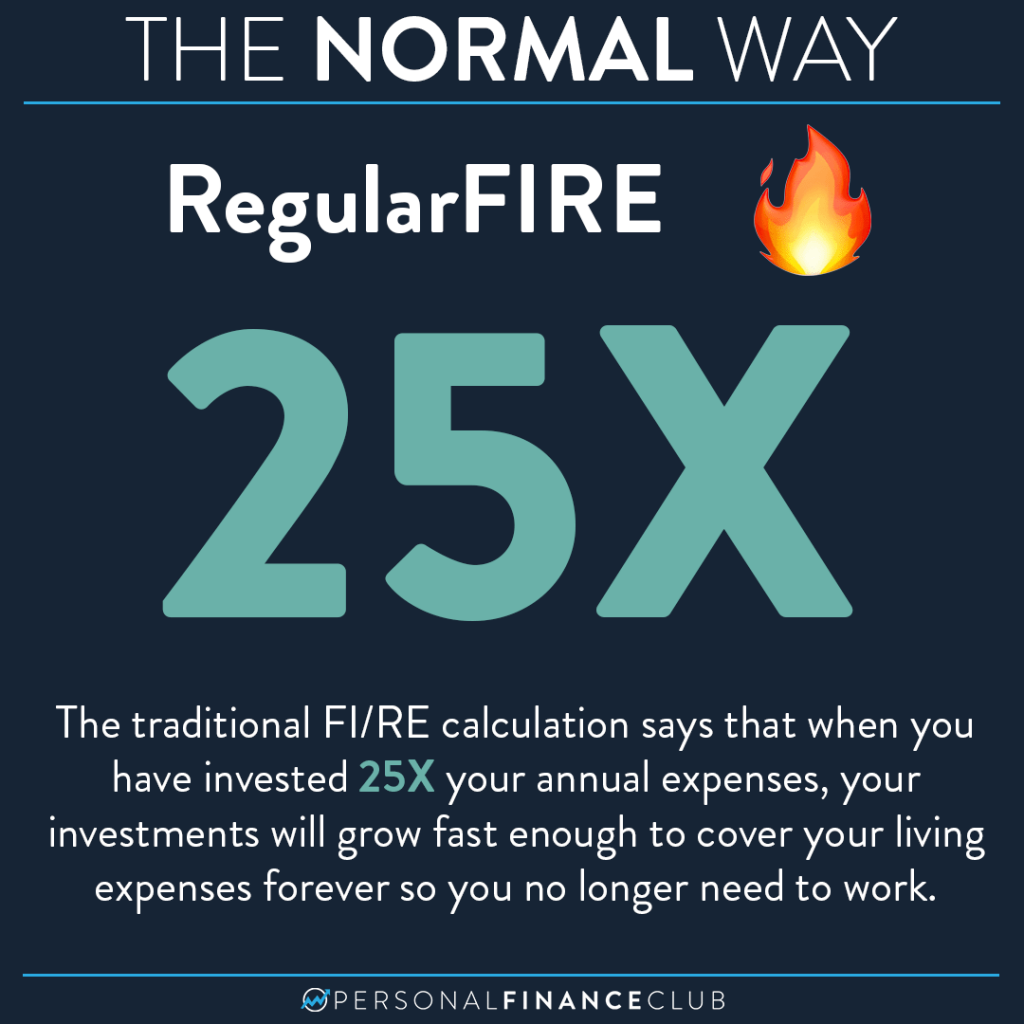

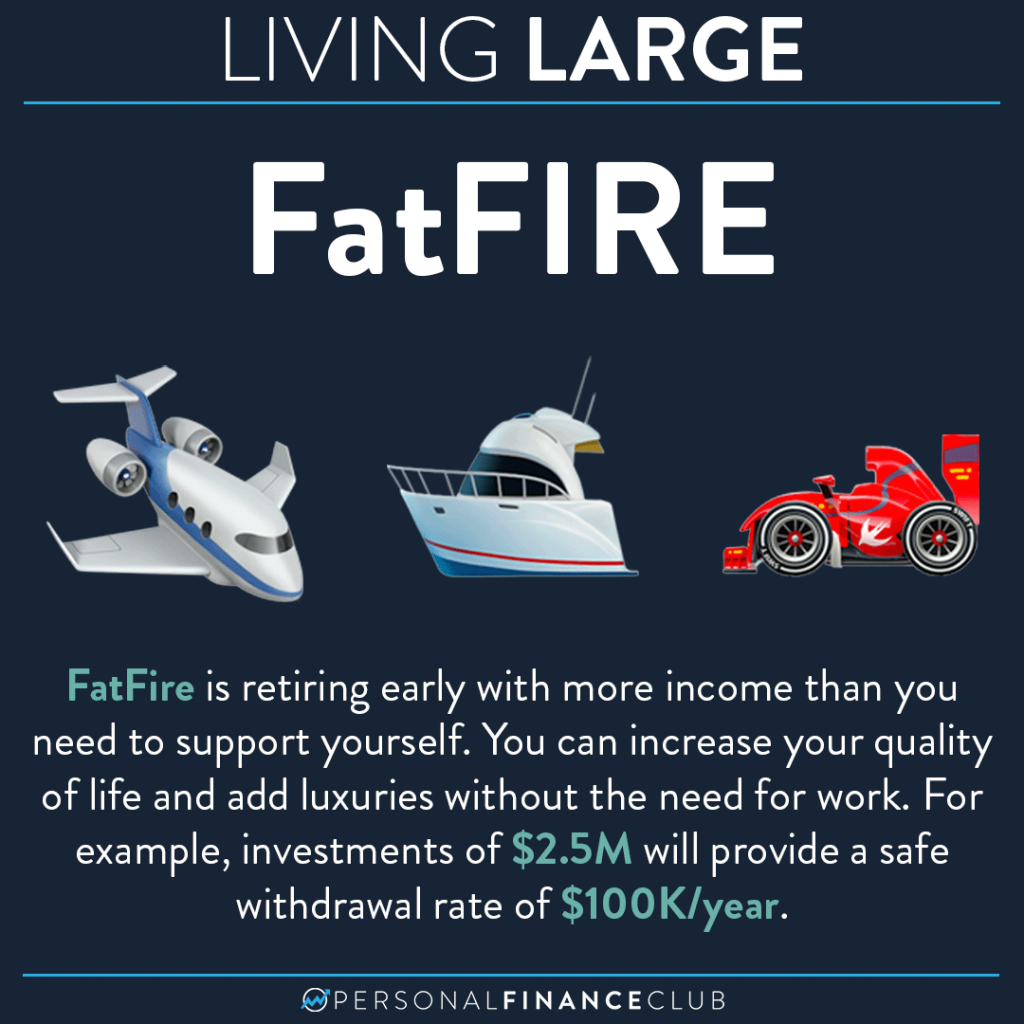

But there’s an even worse problem about working your whole life waiting for 65 to arrive. You’re missing the OPPORTUNITY to retire earlier! Retirement isn’t an age at all! It’s an amount of money. Once your investments have reached about 25X your annual expenses, you can safely withdraw enough to cover your annual expenses (and even increase for inflation each year) forever!

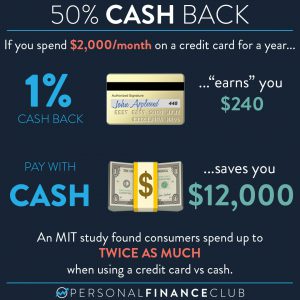

How do you do that? In short, you spend less than you make and invest the difference. If you’re starting from ZERO and invest HALF your income, it will take you about 15 years to get there. Adjust your spending and investments and that number can move up or down.

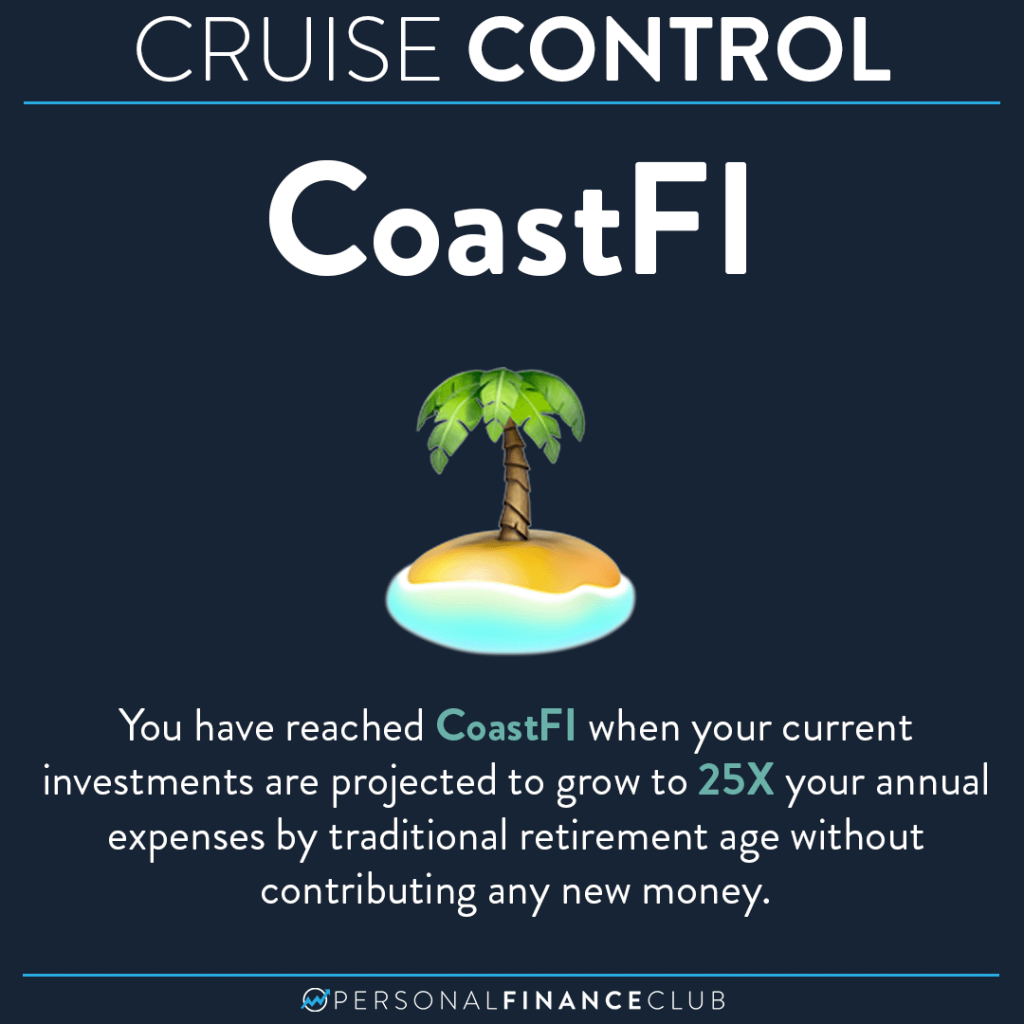

And as this post shows, the 25X rule isn’t written in stone. Maybe you could get to 12X and become BaristaFI. Quit the job you hate and work part time or at a job you love to cover the difference. Or maybe you love your job and don’t mind working most of your life. Once you hit CoastFI, you can consider dropping your investment contributions and spending more now to maximize your life value.

Some people call it FI (Financial Independence) some call it FIRE. Either way it’s not about being lazy and not wanting to work, it’s about putting your money to work so you’re not at the mercy of a job and have the freedom to maximize your own life’s value!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!