FI/RE stands for Financial Independence/Retire Early. This is an example of what FI/RE can look like.

Accomplishing this is not easy. And it’s likely not possible if you have a below average income or are still getting out of debt. But debt free, on an average or better US income and extraordinarily frugal living, it’s possible to pull this off!

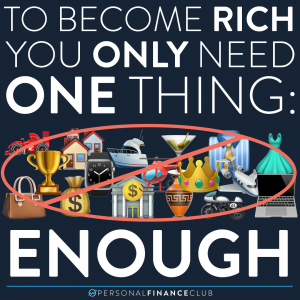

The frugal living is the hard part. It’s eating at home. It’s driving a 15 year old car and biking to work to save gas. It’s figuring out how to keep your cell phone bill under $30/month. It’s date nights going for a walk at the park. Splurging is opening a bottle of two buck chuck. Living with roommates or building your own tiny home. Never borrowing money.

Investing is the easy part. You dump massive amounts of money every month into a target date index fund. The US stock market has returned about 10% per year for the last hundred years. The math on this page assumes a 7% return which accounts for inflation.

Some of the money will go into an IRA or 401(k). But at this savings rate it’s likely you won’t be able to put it all in a tax advantaged account, so the rest is just invested in a normal brokerage account.

Once you “retire” you simply start withdrawing 4% per year to live on and allow the remaining amount to grow at 10% indefinitely. The “Trinity Study” shows that with the volatility of the market, 4% is the “safe withdrawal rate” that you can take out annually and be very unlikely to go broke.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram

September Sale!

September Sale!