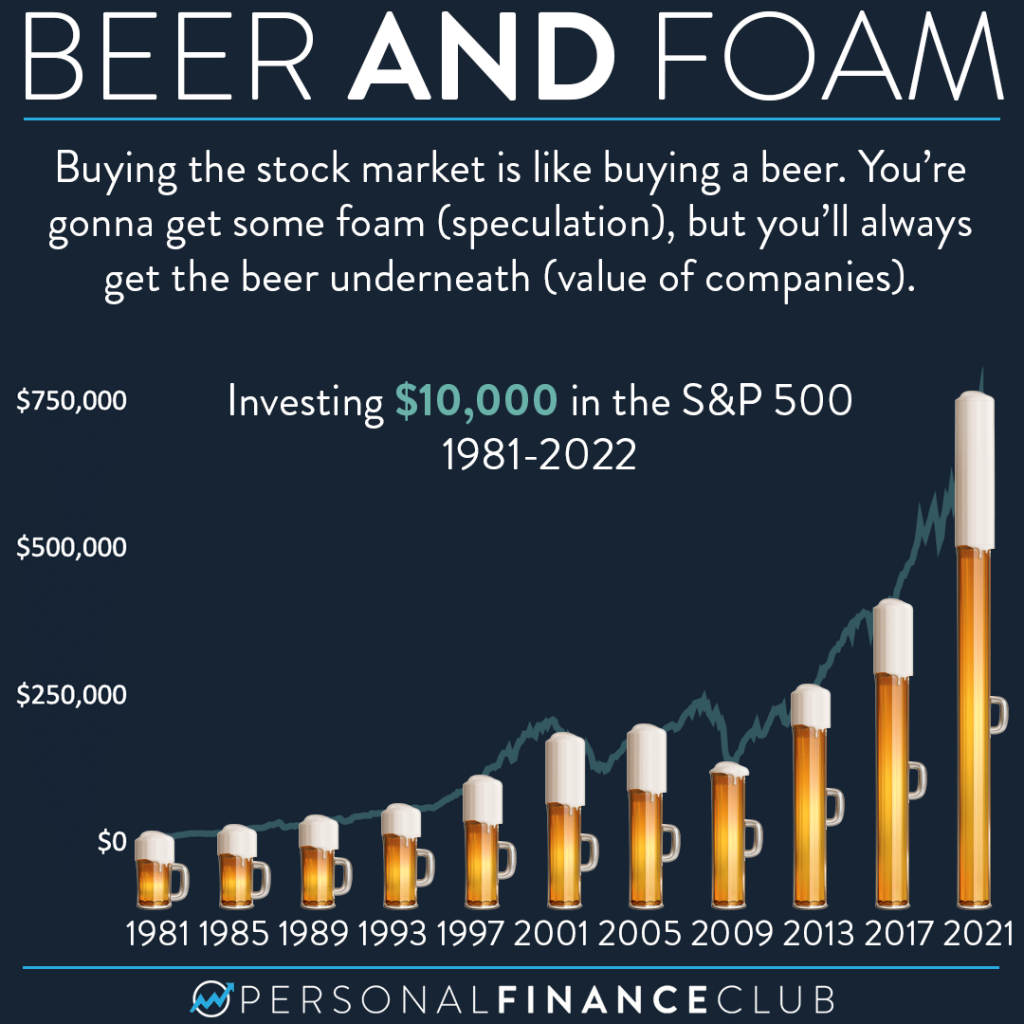

Credit for this beer analogy goes to JL Collins. He described it in his book The Simple Path to Wealth, one of my all time favorites.

Almost everything you hear about the stock market is talking about speculation, or the foam on the top of the beer. What’s the market gonna do this year? Is it overvalued? Is Tesla due for a crash? Is Amazon still a good buy? The answer to all of those questions is “who knows”. But somewhere beneath that speculation is the true value of all the companies in the stock market. When you buy into the stock market, we accept some unknown quantity of foam/speculation on top, but trust that we’re getting the appreciating asset beneath. Well, maybe the analogy breaks down there because beer is generally consumed far before it goes up in value, but you get the idea.

Some are saying that the market is way overvalued right now. They were saying that 10 years ago too, when it was about 25% of where it is today. Maybe they’re right! We might be buying more foam than we’ve ever bought before. But I bet we’re also buying more beer than we’ve ever bought before too. And the volatility of the foam that we expect over the upcoming months and years should be no concern if we’re investors and not speculators. Buy the beer for the beer, not in an attempt to guess how much foam there is.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram