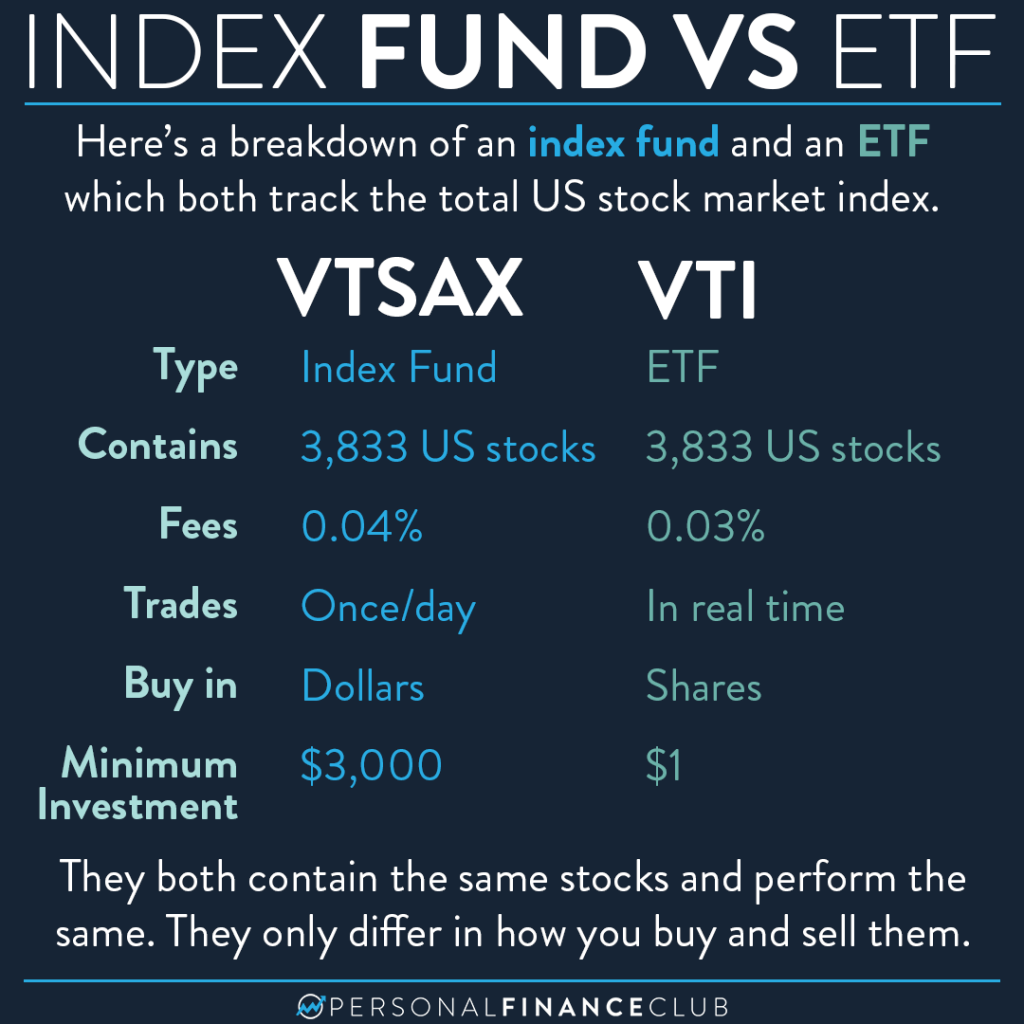

“How is an ETF different from an index fund?” is one of the most common questions I get. They have a lot more in common than they have different!

Both ETFs and index funds are an easy way to buy all the stocks in a big list (an index). For example, both an S&P 500 ETF and an S&P 500 index fund would hold stock in the 500 biggest companies in the US.

They only differ in the semantics of how they trade. ETFs trade in real time like a stock, in full shares. Index funds are purchased in dollar amounts and trade at the close of the market each day.

I prefer index funds over ETFs. Here are the reasons:

• Investing in dollars is simpler. If you just contributed $3,000 in your Roth IRA and want to invest it all, with an index fund you just click “buy” and type in “$3,000” and you’re good. If you are purchasing an ETF you have to figure out how many shares you can afford, buy that many and you’ll have some leftover cash in your account sitting there doing nothing. (Many brokerages now offer fractional shares, making this less relevant)

• Index funds encourage buy and hold. Index funds trade only once per day at the close of the market. I believe investors will make the MOST money if they buy and hold for years or decades at a time. Buying and selling ETFs mid-day may encourage bad behavior and give you more rope with which to hang yourself!

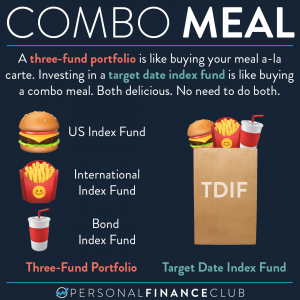

• Target date index funds exist. These are “funds of funds” that include, US stocks, international stocks and bonds. They auto rebalance and auto reallocate as you age. This keeps things even simpler, further optimizing the individual investor’s wealth. To my knowledge, there’s no such thing as a target date ETF.

ETFs are still fantastic. If your brokerage doesn’t offer index funds, or there’s a minimum investment required for an index fund, ETFs are the perfect solution. Many non-US investors will likely need to invest in ETFs.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy