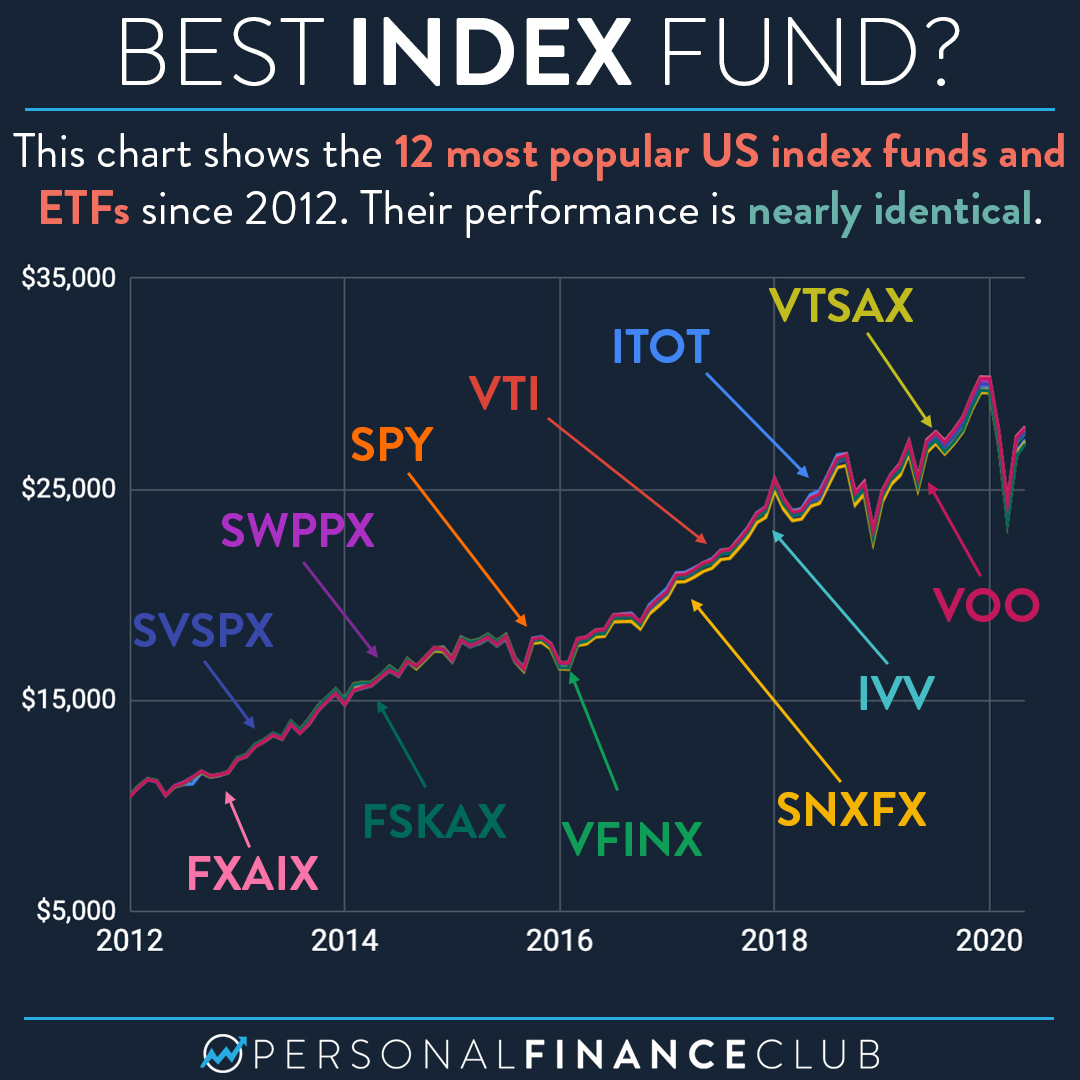

I often get asked, “what is the best index fund?” And the answer is really “You’re kinda missing the point”. There aren’t really “good” or “bad” index funds. They all do the same thing and that’s the point. They follow the index they’re assigned to. And all the little details just don’t matter that much.

The twelve index fund listed here are kind of a mixed bag:

• 7 are mutual funds, 5 are etfs.

• 7 follow 500 of the biggest stocks. 1 follows 1,000 stocks. Four follow the total stock market (~4,000 stocks)

• They’re offered by a bunch of different companies (Vanguard, Fidelity, Schwab, iShares/Blackrock, State Street)

• Their expense ratios range from 0.015% (FXAIX and FSKAX) to 0.14% (VFINX).

With all those differences, they all essentially do the same thing. Own a bunch of US stock. EVEN the fact that some follow 4,000+ stocks vs others follow only 500 doesn’t make a big difference (for those asking me S&P 500 vs total market).

With all those differences, and after over eight years of tracking them the top performing index fund outperformed the lowest performing one by growing the $10,000 to $27,972 versus $27,168. Not a big deal.

It turns out the S&P 500 index funds all outperformed the total market index funds by about 2% over this time. That doesn’t mean that trend will continue in the future (I actually expect it won’t), rather I think it reflects that large companies fared slightly better than small ones during the pandemic.

And if you want to know which one actually performed the best. Drumroll… It was, surprise surprise, the one with the lowest expense ratio: FXAIX (Fidelity 500 Index Fund).

The moral of the story is don’t get caught up in the weeds. Don’t worry about which exact index fund to buy, just pick one with a low expense ratio and spend your effort plowing more money into it.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram https://instagr.am/p/CAsRhqKHGBA/