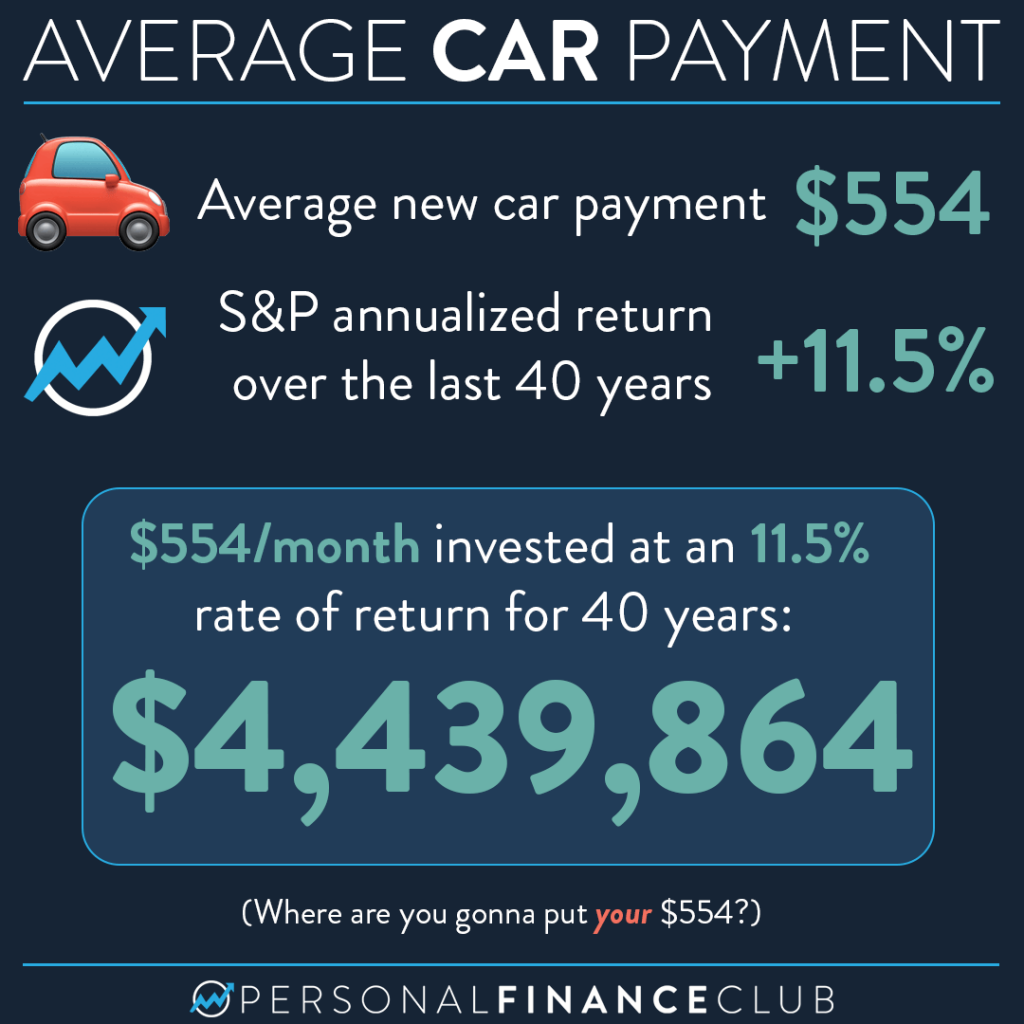

Your eyes do not deceive you. The S&P 500 has had a cumulative annual growth rate of about 11.5% over the last 40 years. And the average car new car payment is $554. If you put a car payment into an investment at that growth rate and wait a few decades, you’re easily a multimillionaire.

Cars generally appreciate at about -10% per year. A $30,000 car today will be worth about $27,000 next year. In 10 years, about $10,460. In 40 years? About $443. (But realistically it was probably junked and sold for scrap by then).

That same $30,000 earning 11.5%? 40 years later it’s worth over $2.3 million. $2.3 million is a lot more than $443. That’s why it’s good to own things that go up in value, rather than go down in value.

And yeah, yeah, yeah, I know. You can’t drive an index fund. I wish you could, it would be sweet. So obviously you couldn’t take that full car payment you’re making and invest it and still have something to drive. A while back I posted about how to pay cash for used cars and drive for under $100/month. That leaves $454 to invest. $454 @ 11.5% x 40 years = $3.6M. Not too shabby!

Hit me with all of your excuses!

• “It doesn’t account for inflation!” Sure, $3.6M in the future won’t buy as much as it will now. But that average car payment is gonna go up too! To account for inflation we should model this with an increasing contribution every month!

• “11.5% isn’t guaranteed going forward!” Definitely not. But whatever it is, owning stocks that pay dividends and go up in value is going to pay more than owning a car that rusts and dies.

• “My mom used to loan me her car but now she says that’s enabling me and wants me to move out of the house!” I’m with your mom. It’s time to grow up, Terrence! You’re 35. Go get an apartment.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram