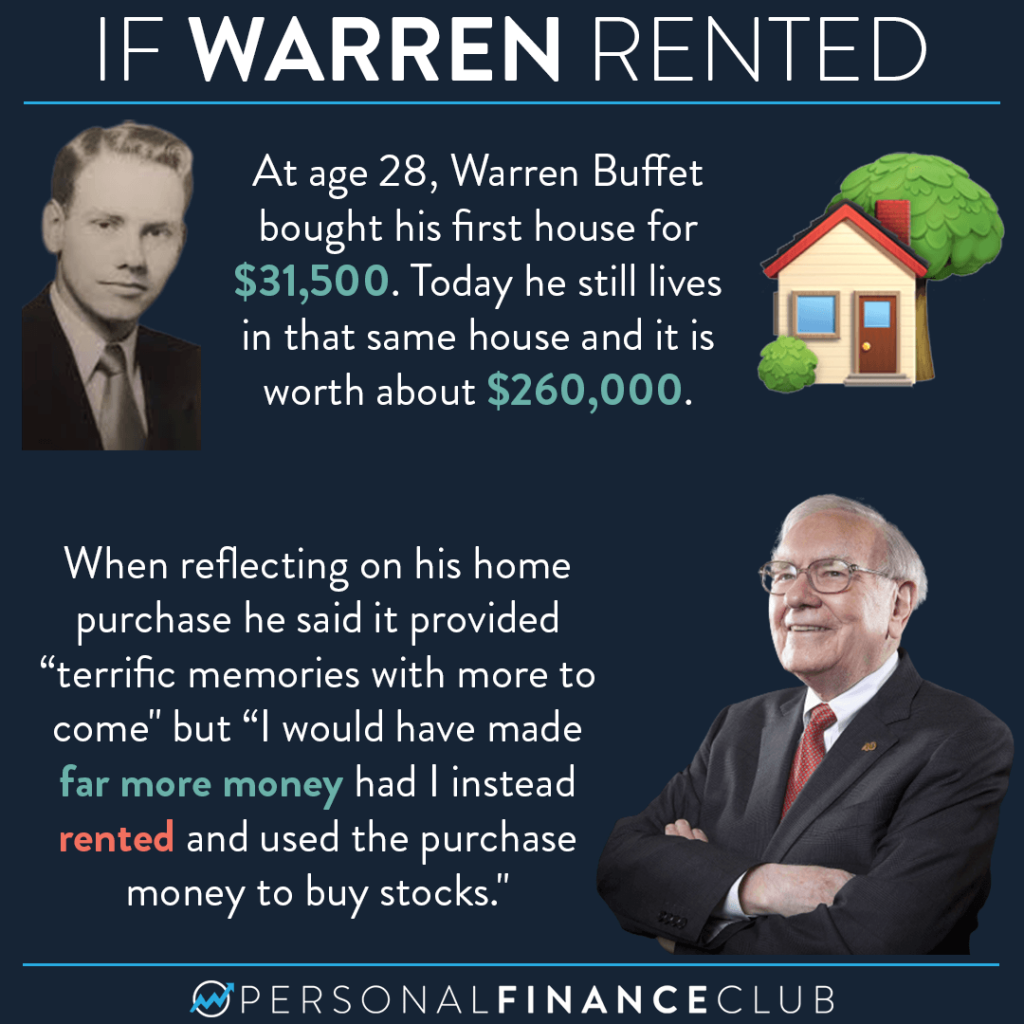

Warren invested $31,500 into his house that’s now worth $260,000. If he had invested that same $31,500 into an S&P 500 index fund? Today it would be worth $13,500,000.

Of course (much to my dismay) you can’t live in an index fund, but even Warren Buffet thinks he would have been better off if he rented and put the lump sum of money to work in a more productive asset!

Remember, whether you rent OR buy, your primary home is an expense. Minimizing that expense, and putting more dollars to work for you (in investments like index funds and investment real estate) will result in you building more wealth! :)

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

Source: www.mybanktracker.com

via Instagram