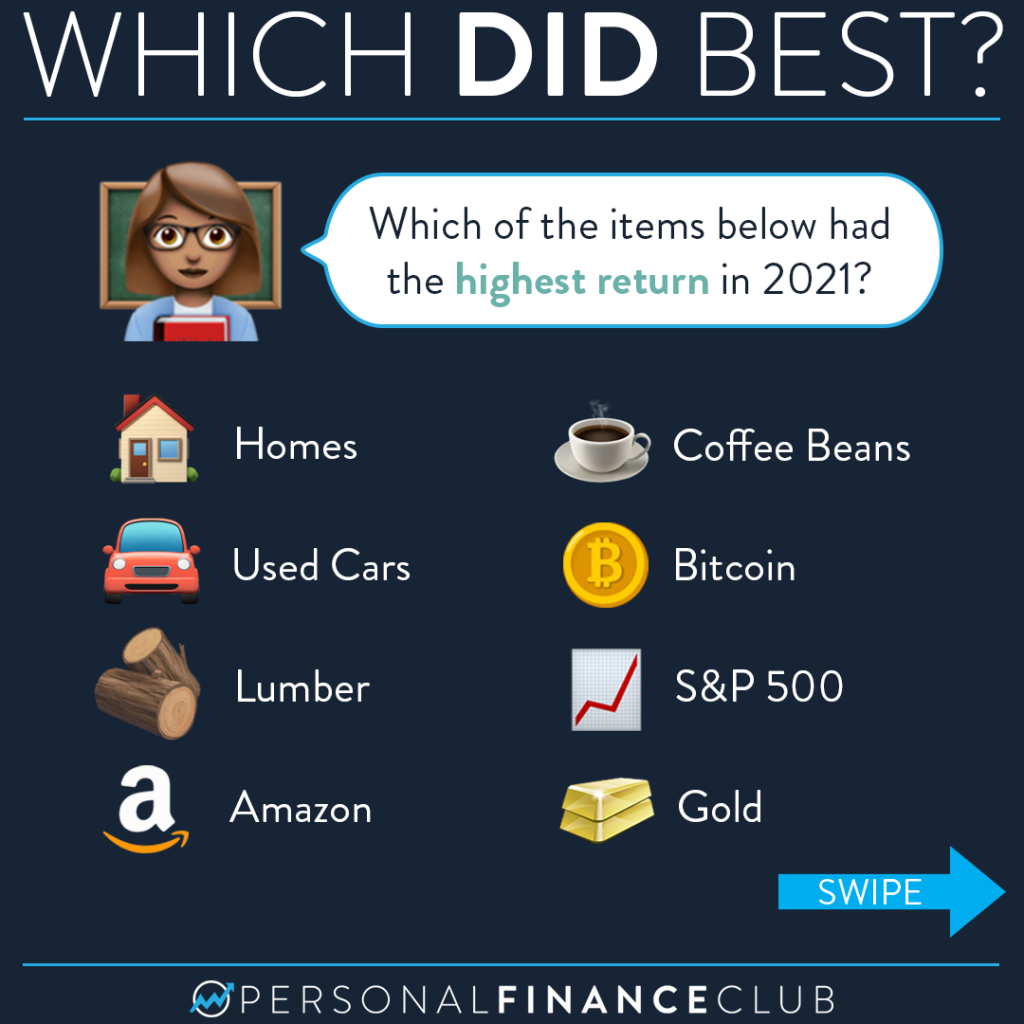

For the record, Shane made this graphic and I didn’t guess coffee beans. Even with KNOWLEDGE of the previous year, I still got it wrong. So which one is going to perform best in 2022? I have no clue. And neither does anyone else. And if they tell you they do, they’re either full of shit or trying to sell you something.

But there is one item on this list that has one key difference from the other seven. Only ONE of them pays you an income just for owning it. Which one? The S&P 500! None of the other items on this list pay income or dividend (unless you rent out the home, in which case it joins the S&P 500 as an appreciating asset that provides income!) So while the all of these assets will fluctuate in value, I only invest in the ones that are likely to appreciate AND pay income. Those two factors combine to produce the massive power of compound growth.

You’ll often find speculators cherry picking a time frame to prove a certain asset is the best investment. In 2020, I was hearing non-stop about how gold was “the best performing asset of the last two decades”. And it was actually true. From 2001 to 2020, gold had an annualized return of 10.2%. Wow! Over that same period (that included three market crashes), the S&P only returned 6.8%. On July 29th, 2020 I made a post warning gold speculators about chasing past performance. I explained that I never invest in a non-income producing shiny rock. Since that day, gold is down 7.0% while the S&P is up 40.3%. Take that as a warning to beware of the hype and never chase past performance.

Are coffee beans going to be up 72% again next year? I highly doubt it. Which asset will be #1? I have no idea. I don’t gamble on the volatility of non-income producing assets that are collectively likely to match inflation. Instead, I buy and hold index funds to harness the massive power, growth, and profits of the collective companies of the world.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram