Health Insurance in the US sucks. It’s expensive and confusing. Our cost of care and patient outcomes compare poorly to pretty much every other wealthy nation. BUT, we still gotta navigate this system, so this is what I do.

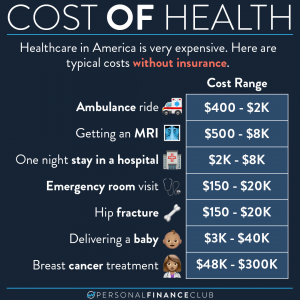

The main point of health insurance is to make sure you don’t go bankrupt. An NIH study in 2019 found that over 66% of bankruptcies were tied to medical bills. Ouch!

Outside of avoiding bankruptcy in the event of a serious injury or illness, I don’t find much value in trying to pay more monthly premiums to get “better” health insurance. But thankfully, that simplifies the health insurance buying process.

One thing that the US recently got RIGHT is that every health insurance provider has to have an “annual out of pocket max” AND no lifetime maximums. That’s the “insurance” part. If you rack up hundreds of thousands of dollars in medical bills, you’ll be covered.

So when I’m looking for health insurance, I basically look for three things.

- Premium. This is how much you pay per month. The lower the better.

- Annual out-of-pocket max. This is how much you could potentially be on the hook for in a calendar year. The lower the better.

- HSA compatibility. Conveniently, most low(er) premium, high-deductible health plans allow you to contribute to an HSA. This is great for saving for medical expenses AND investing!

Another main feature to look for is HMO vs PPO. These are the two main types of health insurance plans. HMO is where you basically always have to go to your primary care doctor first and they refer you to other doctors in their network if necessary. A PPO lets you choose your own doctor/specialist more freely, but there’s usually still in/out of network considerations. I’ve used both and currently have an HMO.

If you don’t have health insurance, you should. Go sign up!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy