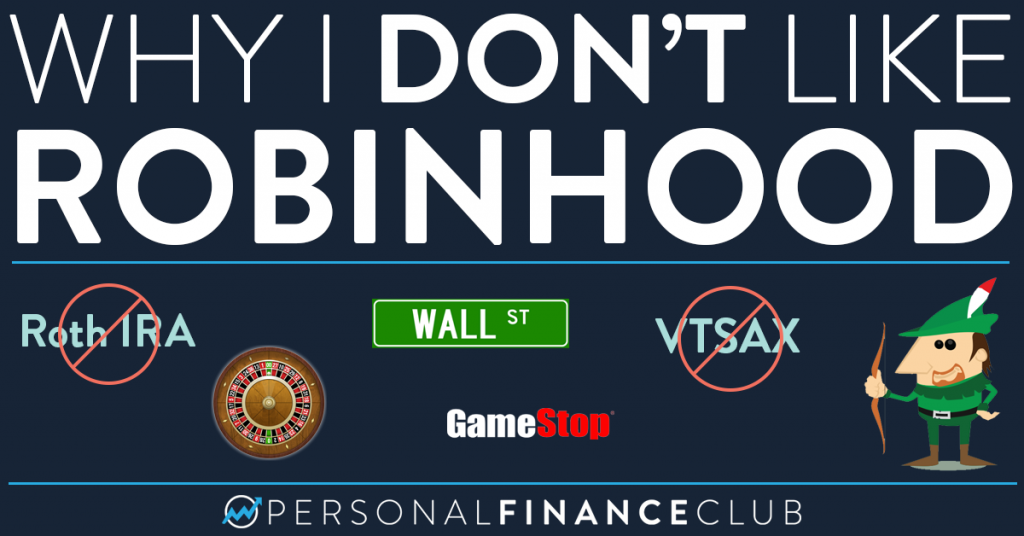

I try not to be negative about products or services that are “good but not perfect.” Knocking something that’s a step in the right direction doesn’t serve the greater cause. I used to consider Robinhood to be in this category. Not my choice of brokerage, but a net positive for getting new investors interested and involved. But based on recent events, I think it’s time to speak up about the negatives of investing with Robinhood.

Before I get into the bad, let’s talk about what’s great about Robinhood:

Robinhood Pros

- Free Trades. You can’t talk about Robinhood without acknowledging what they did for lowering fees in the brokerage industry. Before Robinhood entered the market, you basically had to pay money every time you wanted to buy or sell a stock or ETF. Typical prices were $5 to $20 per trade. Robinhood entered and staked their business model on free trades. When the legacy brokerages started to feel the threat, they all followed suit, and now it’s free to trade stocks and ETFs on basically every major online brokerage (in the US… non US brokerages aren’t on this free trade bandwagon yet).

- Great User Experience. I give credit to Robinhood for making it easy to get started investing. They tempt you with a free stock. The app is easy to download and use. You’re off to the races trading in minutes. It makes “investing” feel accessible to young investors in a way the old stodgy brokerage websites do not. They deserve credit for making it attractive and accessible to get started, and moving some young people from the “not an investor” to the “investor” columns of the world. That’s a significant shift.

Robinhood Cons

Well, it can’t all be sugar and spice. I have some serious reservations about using Robinhood as a brokerage.

- No Roth IRAs. Robinhood basically only offers one type of account: A taxable brokerage account. Based on the demographic of Robinhood users and how most of them are young, likely lower income earners, it’s almost criminal to suggest they invest inside of a brokerage account before they’ve taken advantage of the massively beneficial tax break offered by a Roth IRA. Their website mentions they “hope to” in the future, but who knows.

- No Other Accounts. In addition to IRAs, they don’t offer joint accounts, trust accounts, custodial accounts, HSAs, 401ks, 529s, ESAs, credit cards, etc. As you progress through your investing career you’ll likely end up using most of these. (I use almost all of them inside my Fidelity account).

- Focus on Trading. From the marketing, to the hype, to the “free stock”, you’re tempted with for signing up, Robinhood seems to be all about trading and speculation. Anecdotally, every Robinhood user I’ve talked to seems to think it’s all about gambling on stocks and guessing when to get in and get out. Very few seem to appreciate the necessity buying and holding for the long term in order to build real wealth.

- No Mutual Funds. Admittedly, since they offer fractional shares and automated investments this isn’t logistically a big deal. But you do miss out on my favorite type of investment, a target date index fund. I also prefer the mutual fund version of index funds over ETFs due to investing in dollars and trading only once per day as that encourages long term buy and hold behavior.

- Their Business Model. This is the big one. Those free trades don’t come from charity. According to their website, Robinhood makes money “When you buy or sell stocks, ETFs, and options through your brokerage account, your orders are sent to market makers for execution”. Those “market makers” then give Robinhood rebates, which I assume means they pay Robinhood money. This process isn’t entirely clear and could present massive conflicts of interest. For example, Robinhood could route your trade differently based on who is willing to pay for it. Or route your trade poorly causing you to get a less than optimal market price. Or these market makers could use the data they receive from Robinhood for algorithmic trading. While a single Robinhood trader might not notice, the algorithmic traders make massive profits at the cost of the aggregate of Robinhood users. The recent GameStop fiasco shined a spotlight on this conflict of interest. After Wall Street hedge funds started losing billions on their risky short sale bet against GameStop, Robinhood stepped in and blocked buying but not selling of GameStop stock (and others), causing the price to plummet. Robinhood released a blog post saying they “restricted transactions for certain securities to position closing only”. As of the time of this writing they’re restricting buys on 51 different stocks. That blog post reads as HR platitudes without giving a clear reason why. It certainly feels like Robinhood’s true loyalty doesn’t lie to the individual investor, rather to the powerful institutional investors. It feels to me like robbing the poor to pay the rich.

Conclusion

I hesitate to jump to conclusions about Robinhood having malicious intent. We should cut them some slack as a five year old startup who has had to contend with massive growth. It’s entirely possible that their recent restrictions on trading were done out of self preservation, not special interest. I still find it hard to believe that, on the aggregate, Robinhood investors aren’t underperforming market gains at the cost of institutional players making money on the margins.

But even if you ignore the conspiracy theories, I could never suggest a new investor starts with Robinhood due to their lack of a Roth IRA. Avoiding those taxes is a no brainer.

September Sale!

September Sale!