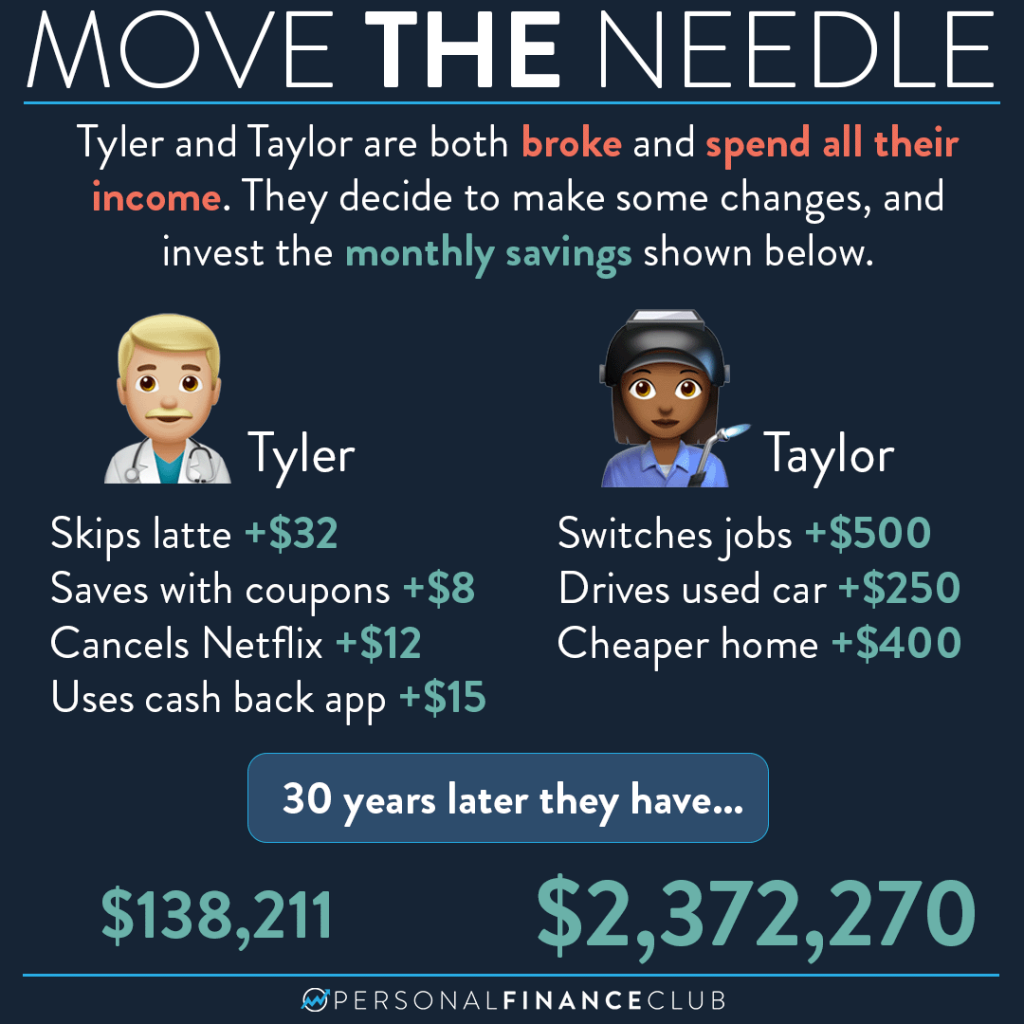

This post pains me to make a little bit, because I fear there are some people who are going look at the left side and say “Ha! See, I knew I shouldn’t bother being frugal” then still not do the things on the right side. That’s not the idea.

The idea is the age old saying: Don’t be penny wise and pound foolish. There’s a “frugality trap” where we focus so much on the minutiae, like clipping coupons, saving 10 cent per gallon, or earning some credit card points, that we miss the BIG things.

For example, switching jobs often results in a pay bump of 10% or more. And that’s in your control since you don’t have to accept a job offer for anything less. If you’re making $60K and can bump to $66K (and keep your cost of living the same) that’s MOVES THE NEEDLE. It’s not comfortable or easy to start that process. Generally no one is asking you to do it. But the payoff for a little bit of initiative and discomfort makes up for about FIFTY Netflix subscriptions.

That said, don’t fully discount the left side of this post either. A quick google search shows me the median net worth of 55-64 year old Americans is $212K. Do you think the HALF of Americans who have less than that would like to DOUBLE their money with a few simple changes over the last 30 years? I think so.

When making this post I had to rack my brain for the most inconsequential frugality tips I could think of to demonstrate a dramatic contrast. I almost included “bring your lunch to work”. But if that (conservatively) saves you $5/weekday, that’s about $100/month which turns into over $200,000 in 30 years when invested! So focus on the things that move the needle, but remember that small stuff can add up too!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy