There’s not many businesses on earth that won’t let you pay with cash, check, or credit card. Even dreaded medical billing, as complex and unfair as it may be, will still happily accept direct payment for services rendered.

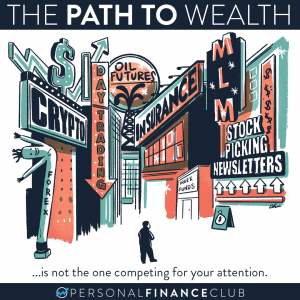

Yet in the world of financial advice, there’s this strange phenomenon. For most advisors, you simply can’t pay them directly for their service. Some will claim it’s free (it’s not). Some will give other half-truths like “I’m paid by my company” or “we make money when you make money”. I’ve heard many stories about new investors walking out of an advisor’s office without paying and a very concerned feeling about what just happened. But the truth is you’re still paying them. It’s coming out of your investments but often in a way that’s hard to find.

If you ask a financial advisor “can I pay with a credit card?” they may answer “Yes!” If so, you’re talking to an “advice-only” financial advisor. This is someone who is paid for their advice, and will sit next to you, educate you, advise you, and help you make the best decisions about your finances and investments. Since you pay them directly, and they don’t have control over your accounts, they have no incentive other than to give you great advice, and no way to drain their fees from your investments.

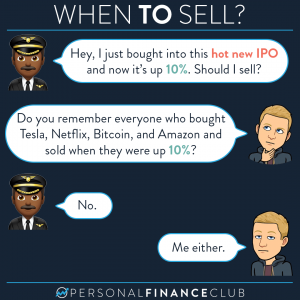

If they answer anything other than “Yes!”, it can be difficult to find out how and how much they charge. Sometimes the fees are clearly on your statement. Sometimes they’re baked into the share price of your investments in the form of an expense ratio. If your advisor isn’t vigilantly transparent about their fees, it can be pretty hard to track down the total amount once they have access to your investments.

My advice about finding a good financial advisor is this: It’s very hard to tell the good ones from the bad ones without learning how to invest first. But once you do learn to invest, if you’d still like to talk to an advisor, find an “advice-only” financial advisor.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!