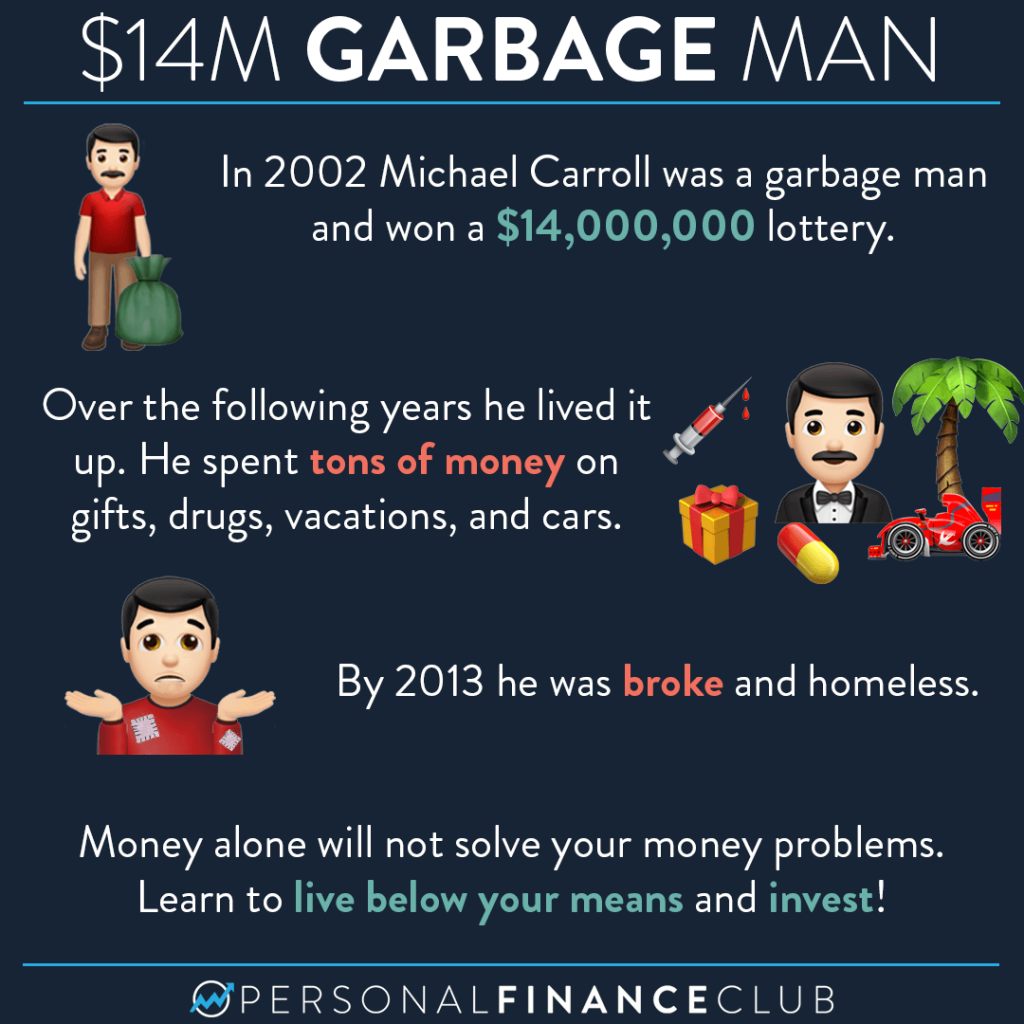

This is a true story of a lotto winner in England! Obviously it’s an extreme example in his windfall, spending, and downfall, but I think all of us can fall victim to a similar mentality. This idea that success or happiness with money is just the next raise or windfall away. When when that money comes, it gets spent and you need even more to continue your now more expensive cost of living.

Beware of lifestyle creep. Make a plan to save and invest part of your income and future raises before you spend them. Find happiness in relationships and experiences, not in spending and stuff.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram