BEFORE I jump into how to do this, if you haven’t already heard we are having a HUGE SALE on our two courses through next Monday. You can get either of our courses for $59 each or both for $99! (Full price is $79 or $158!) They make great graduation gifts. Link in bio for more details.

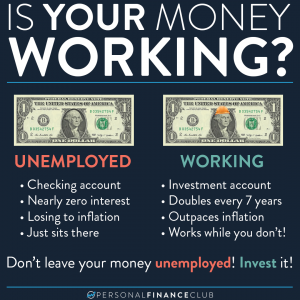

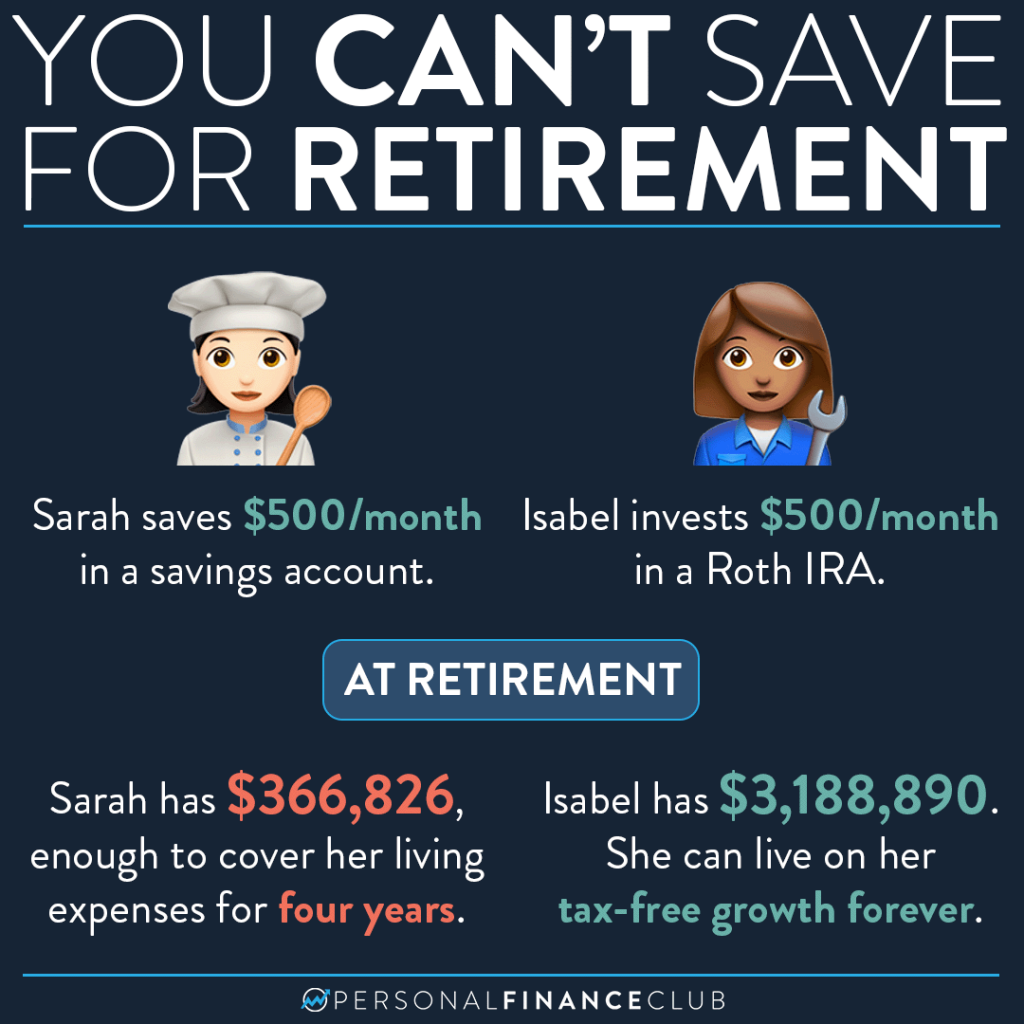

I live and breathe this stuff, but every day I talk to someone whose mind is blown when they realize that saving doesn’t work. Of course, the general skill of saving money is crucial. But if you just leave that money in a savings account, it erodes to inflation and you miss out on the huge opportunity of putting your money to work for you!

The math in this post is based on a savings account interest rate of 2% per year (about average over the last 40 years) vs investing in an index fund at 10% per year. WHAT THE HECK IS PAYING 10%?! Well, if you invested in the S&P 500 over the last 40 years, you would have earned a compound annual growth rate of 10.98% per year. Even with all the gloom and doom headlines we hear about, the S&P 500 is UP this year about 9% so far! And it’s only May! Over the last 10 years that number is 11.73%.

And what’s a Roth IRA?! It’s a special account where anything inside grows TAX-FREE forever! So Isabel’s 3 million bucks is all hers 100% tax-free. And If you assume 7% growth in retirement, it kicks off over $200,000 per year in tax-free growth. That’s almost as much as Sarah has to show for 40 years of a savings account.

If you want to strengthen your knowledge on any of this, now is a perfect time to grab our “Build Wealth By Investing in Index Funds” course. It walks through everything, A-Z, including what investments to buy and what buttons to click on. It’s on sale starting TODAY until Monday for $59 or bundle with our “How to Money like a Millionaire” course for $99.

p.s. The courses have a 100% satisfaction guarantee. If you don’t like them, let us know and we’ll give your money back. Our reviews on TrustPilot are at 4.98 stars!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy