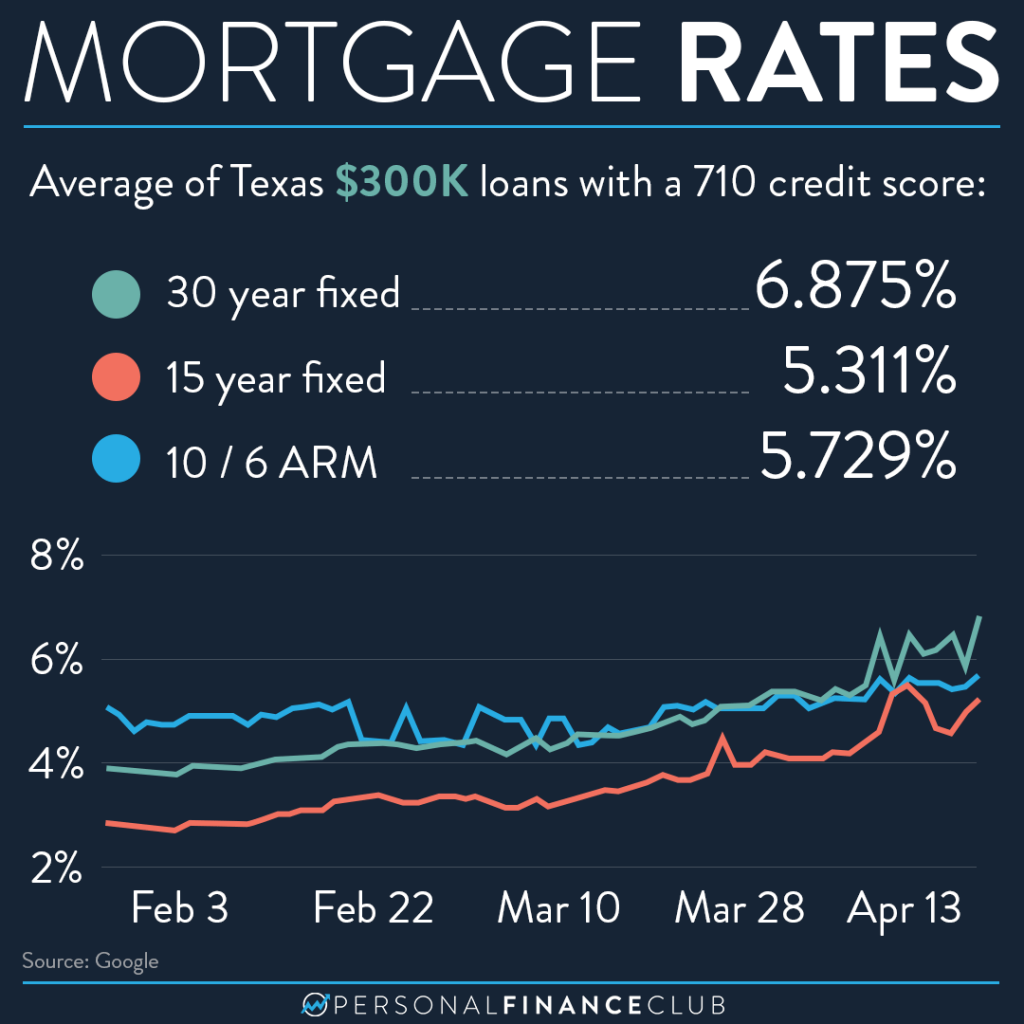

Mortgage rates have shot up almost 3% in the last two months! I don’t personally have a mortgage, but I happened to Google “mortgage rates” and these numbers popped up. I was shocked! For years we’ve been enjoying these historically low mortgage rates. Some of my friends have rates of 2.5%! But as a point of comparison, in 1981 the average mortgage rate topped 18%. CAN YOU IMAGINE?! Those are like loan shark numbers. Might as well put it on your credit card.

Over the last 20 years or so, rates have hovered around 3-5% and I think we all started taking that for granted. But with inflation high and the fed responding by raising rates, we may see these numbers go up for a while.

What does that mean for you? Well, if you have a set monthly budget to buy a house, the same payment is going to buy less house. For example, at a 3% rate, a $2,000 monthly mortgage payment would cover a $474,300 loan. But at 7% it would only cover $300,500.

That may push housing prices lower as most buyers will be able to afford less house. It may also give current owners an incentive not to sell, which will reduce supply and keep housing prices high. None of us can tell the future!

What should YOU do? Whether you rent or buy, you should live below your means and invest the difference. Buying too much house on a loan can cause you to be “house poor” and limit your wealth and force you to work more to make that big payment!

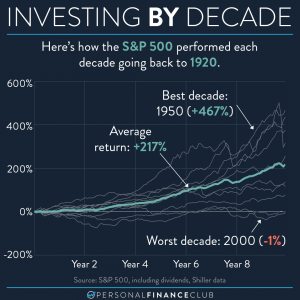

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram