I wish I could tell you how to double your money in the stock market in a month. I wish I could tell you which stock is the “next Amazon” or how to read stock charts to know when to buy and sell. But I can’t. Because that is all nonsense. In fact, it’s not even investing. It’s speculation.

What IS investing? It’s buying something that pays the owner and is likely to go up in value over time. Investors simply buy and hold these assets and build wealth as compound growth taxes effect over time.

So how DO you get a better return in the stock market? Well it’s not sexy, but here are the four ways to do it:

1.) Put more money in. This is the most important thing to do. Earn more, spend less, invest the difference. Someone doing a mediocre job investing $1,000/month is going to end up with way more than someone perfectly investing $100/month.

2.) Invest for longer. $500/month at a 10% rate of return for 10 years turns into about $100K. But do it for 40 years and it’s $2.7 million. Time is your most powerful ally in investing.

3.) Minimize fees. That $2.7M above? If you pay just a 2% annual fee to advisors or expense ratios your end value is almost cut in half to about $1.6M. That’s $1.1M lost to fees!

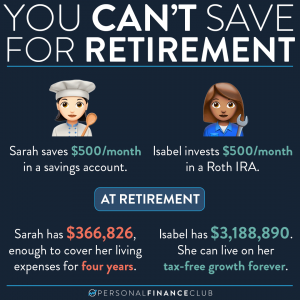

4.) Minimize taxes. Uncle Sam is always going to get his, but by prioritizing tax advantaged accounts like Roth IRAs and 401ks you can minimize how much of your gains you send to the government.

I know it’s not sexy, but it’s how rich people get rich. And if you spend 10 years trying to get rich quick and find yourself broke, you’re gonna wish you started the optimal sure thing path sooner.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!