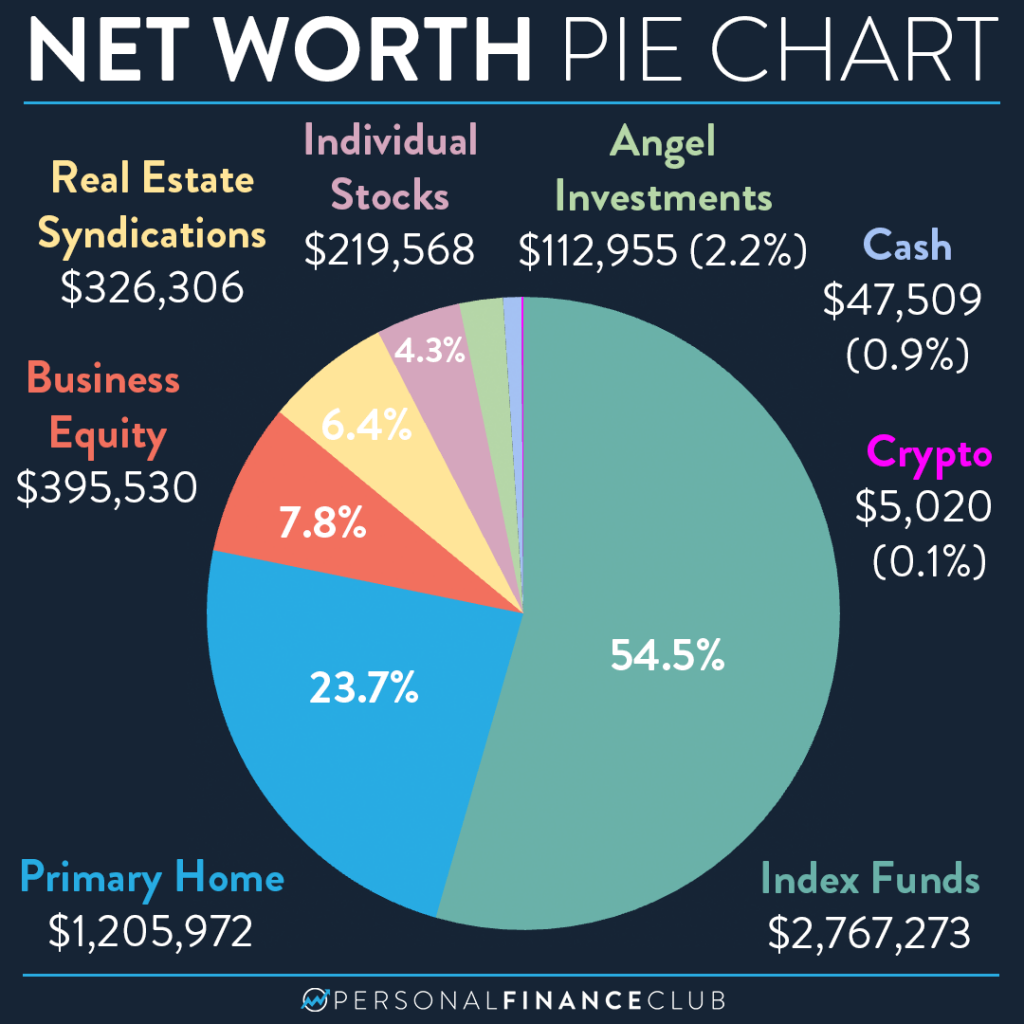

Yesterday I shared how my net worth officially begins with a 5! You can calculate your own net worth by adding up everything you own (all of your assets) minus everything you owe (all of your debts). My debt pie chart is simple. I have no debt. I’d say my house is “paid off” except I never borrowed money for it. So I guess it’s just paid.

This pie chart looks at the “Assets” portion of net worth. I’ll break it down in further detail here:

• Index funds: If you follow me, you know this one! It’s my favorite investment and what I plan to buy and hold for the remainder of my days.

• Primary Home: At 23% it’s creeping up on “too much house” as primary homes have high expenses and low to no returns. But they also have the added benefit that you get to live in them, so it’s tempting to spend a lot of money on one.

• Business Equity: This is basically my share of the cash that’s being held in Personal Finance Club and a couple other businesses I have started.

• Real Estate Syndications: I don’t currently directly own any physical property outside of my primary home, but I have invested in a few syndications. These are basically huge properties that someone else raised money to buy and manage with the intention of selling again one day for a return to the investors. I hope they’re not ponzi schemes.

• Individual Stock: Mostly AppFolio I stock I bought when I sold my company to them. It’s more of a keepsake at this point and I don’t plan to sell.

• Angel investments: I’ve invested in a couple small businesses. These types of investments usually go to zero, but until then I’m just counting my investment as what I put in.

• Cash: I don’t hold too much cash, but what I do keep in cash what I plan to spend in the next year.

• Crypto: You can’t even see the slice on the chart!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!  Sign up to be notified of our Dead Box launch on 6/16/2025!

Sign up to be notified of our Dead Box launch on 6/16/2025!