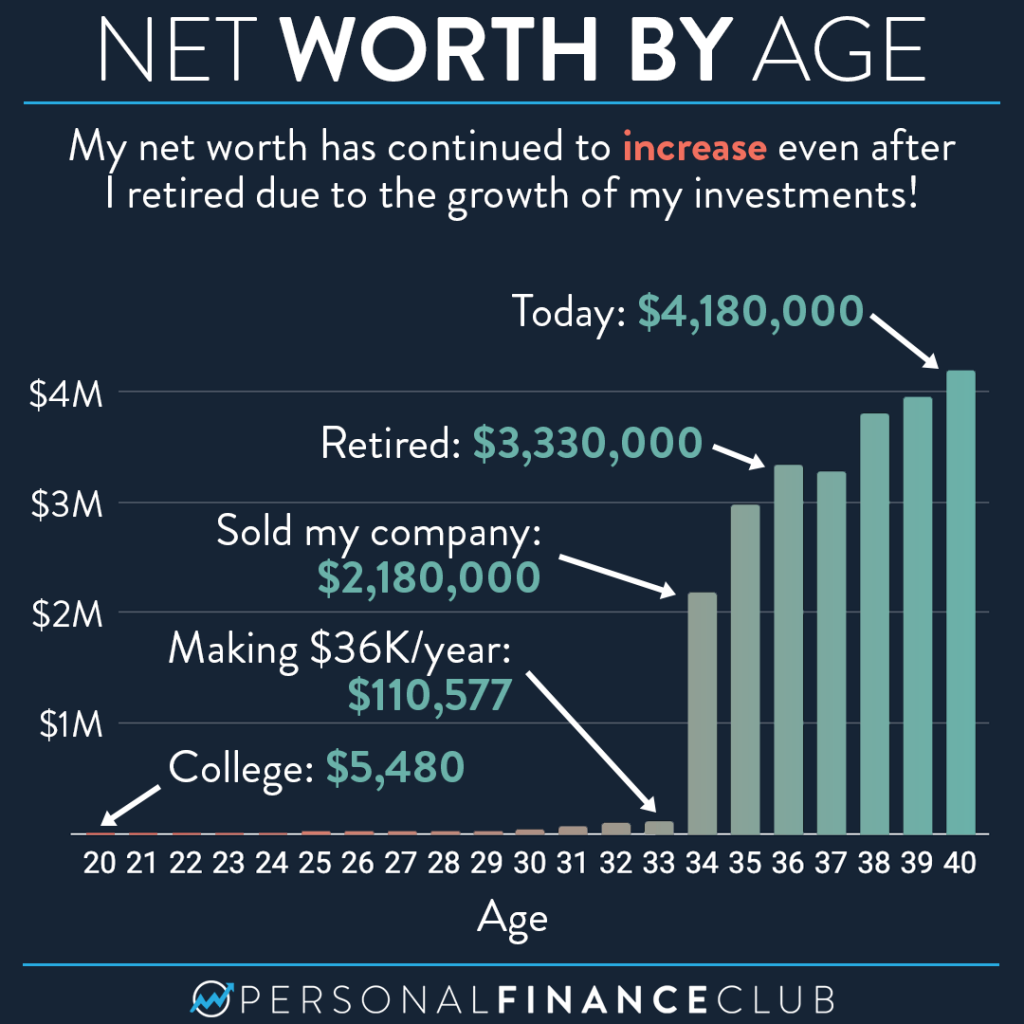

I’m the kind of nerd that keeps spreadsheets of things like this, so here’s a look at my net worth dating back to my junior year of college (I graduated in 2002 at age 21).

Obviously, the big jump happened the day I sold my internet company, which I started in college, for a bit over $5M. My share after taxes was about $2M which is what you see here. That jump MIGHT be a bit misleading because I am assigning a value of zero to my company until the day I sold it. But, from my perspective, until that wire cleared I had no reason to believe anyone would ever give me a penny for it!

There are some other nuggets hidden in this chart. For example, even if the company never sold I was on pace to be a millionaire before retirement on a $36K salary (the most I ever took home from my company). I had a net worth of over $110K at 34 and was maxing out my Roth IRA every year. Assuming just a 7% return, that would have made me a millionaire by age 58. (The market has gone up about 10% per year on average, but I usually use 7% for forward looking projections to account for inflation).

I’ve also made about as much since I sold my company (~$2M) as I did from the company itself! How does that happen? Well, in broad strokes, given a 10% rate of return money doubles about every seven years. If you dropped $2M in the S&P 500 in April of 2015 (when I sold my company), today it would be worth over $4.3M! That’s not EXACTLY what I did (although, in hindsight I would have been slightly better off) but that’s the gist. I also invested internationally, in the stock of the company that purchased my company, and in some real estate deals. All productive assets that go up in value. I buy and hold. My biggest investing regrets have been the few times I have sold.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!  Sign up to be notified of our Dead Box launch on 6/16/2025!

Sign up to be notified of our Dead Box launch on 6/16/2025!