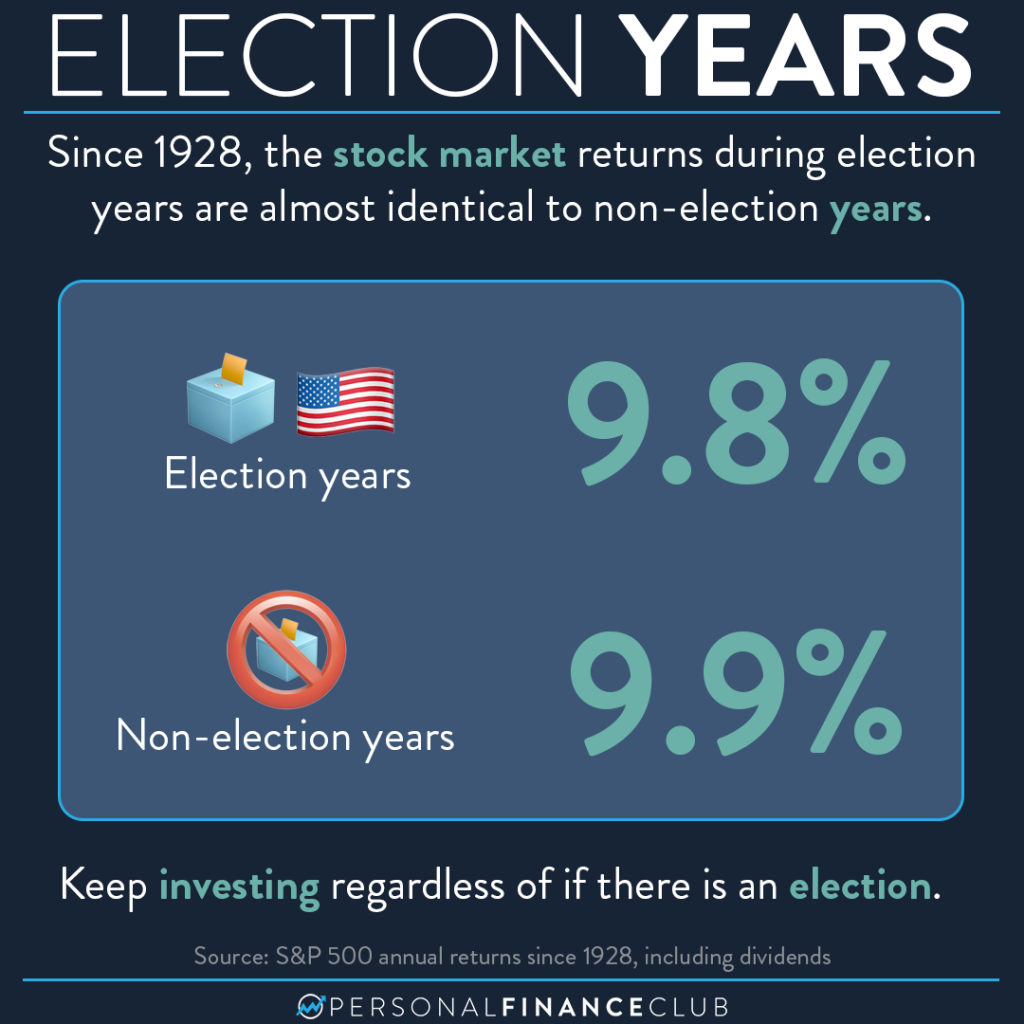

We keep seeing comments about how the stock market is only up because it’s an election year. So we looked at the data over the last 100 years to see if there is any truth to this.

The stock market returns don’t seem to care one bit if it’s an election year or not. Using the compound growth rate of the S&P 500 going back to 1928, presidential election years vs non-election years had just about the same annualized return.

Does the stock market react based on who is predicted to win and who ends up winning? Absolutely it does. We have seen this time and time again. But, it’s impossible to accurately predict who will win a presidential election. AND, even if you can accurately predict it, it’s not always obvious how the market will react.

On any given election year, the stock market could be WAY up or down. For example, 2008 was down 38% (had more to do with the housing crisis than the election). But, 1980 (+26%) and 2020 (+16%) were way up.

Politics are important since governments make decisions that can impact our lives. So, make yourself as informed as possible and go vote! But when it comes to investing, trying to make tricky decisions to time the market based on an election year is a big mistake.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane