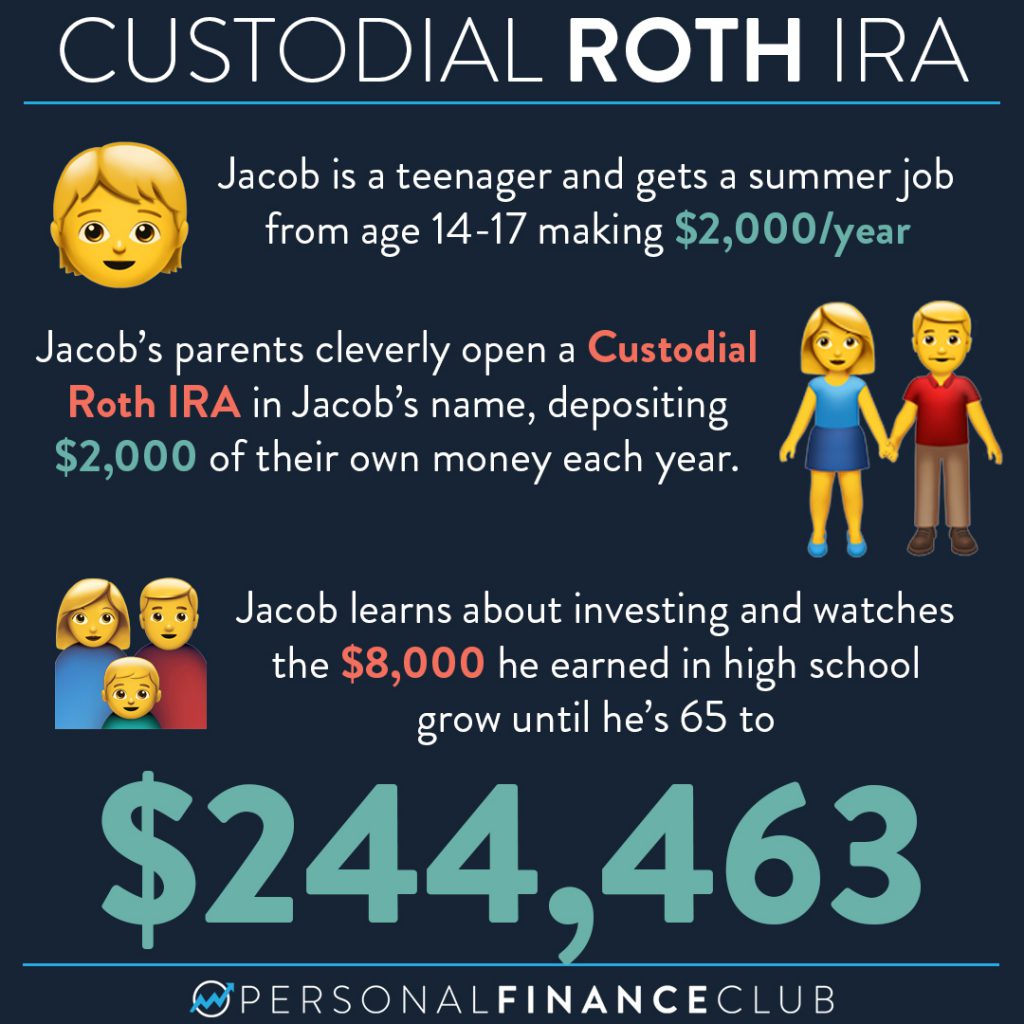

If you’re a parent and have your own financial situation in order, this is a great way to make future millionaire out of your child. Here’s the details of how it works:

Custodial Roth IRA: It’s just like a regular Roth IRA, but since those under 18 can’t open investment accounts in their own name, this is opened by the parent or guardian and automatically transfers to the child when they turn 18.

Who is eligible: Any child with earned income (and thus paying taxes) is eligible for a Custodial Roth IRA!

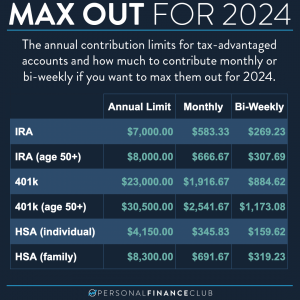

• How much can be contributed: The same limits apply as regular Roth IRAs. Namely no more than $6,000 per year and also no more than the total earned income. (So if the child earns $1,000, you can’t put $6,000 in there. That’s why the parents match the exact earnings of Jacob in the example).

• What to invest in: As always, I think it’s best to buy and hold index funds. Since kids have such a LONG investing timeframe, I might skip bonds all together and do something like 70% US total market index fund, 30% international total market index fund.

• Where to open: Vanguard, Fidelity, and Schwab all offer Custodial Roth IRAs.

• How it grows: This example assumes a 7% rate of return, which is about the historical “real” return of the stock market. That means the $244K accounts for inflation and spends like it does today. Wouldn’t it be nice if your high school job magically turned into a quarter million at retirement?!

• Talk about it: This is also a great opportunity to talk to your kids about investing. I might even insist that they contribute part of their earnings. For example, you could make them a deal. They put in 10% and you do a 9 to 1 match to fill up the other 90%. Hard to find a 401(k) with that kind of matching plan!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram