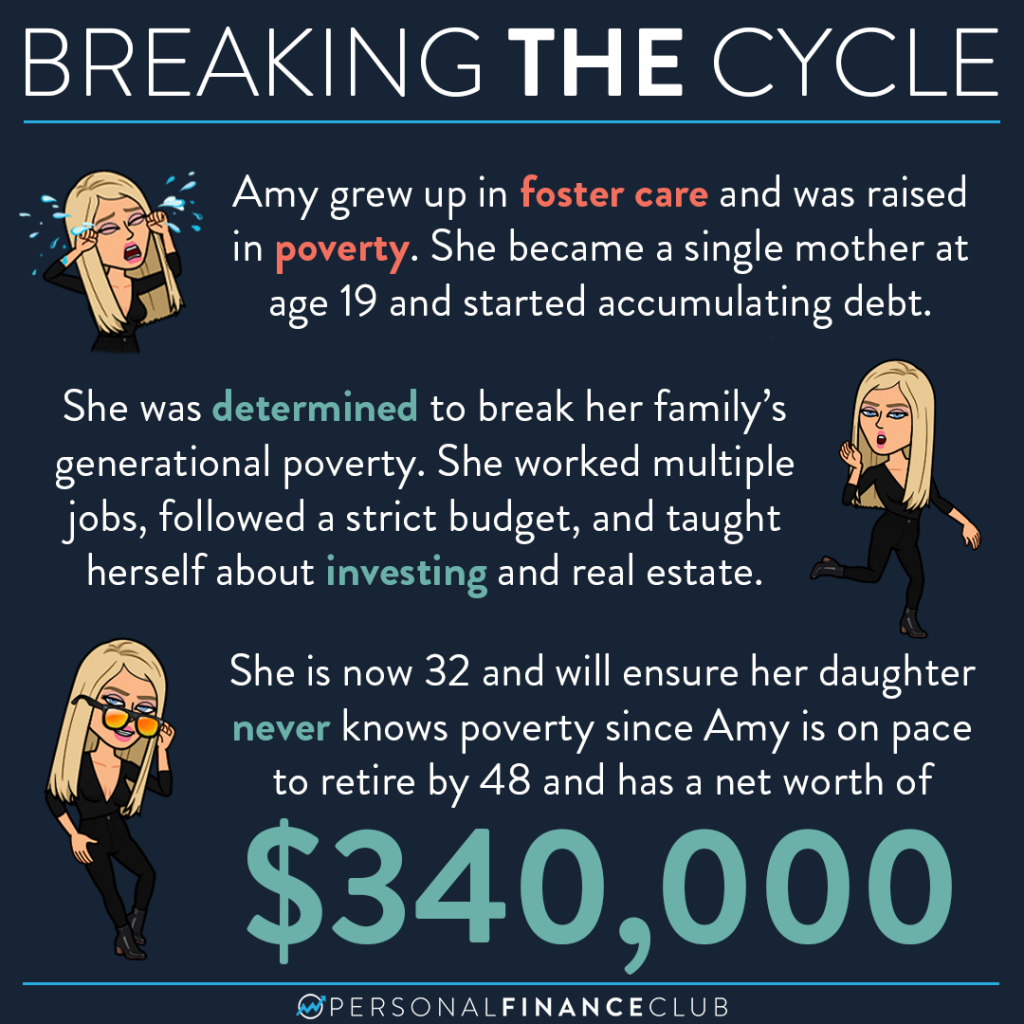

Amy is a real person and you can find her at @amyfelicetty_ . She shared her story in our Facebook Group and she was kind enough to let us post about it here as well!

Amy came from generations of poverty. She grew up in foster care until she had a stable guardian at age 8. By 14, she applied for a workers permit so she could get a job to start earning money. And, by 16 she went to go live with her mom.

She and her mom had to walk everywhere for a period of time because they couldn’t afford a car. They regularly didn’t have enough money to buy groceries and would rely on the kindness of the local store to let them keep a running tab.

By the time Amy was 20, she had a 1 year old child and had every type of bad debt imaginable, from credit card debt to a judgment against her to a car loan she defaulted on. She had no money and was working multiple jobs to stay afloat.

Instead of accepting her fate, she was determined to break the cycle of poverty. In 2014, she focused all her energy on using the snowball method to pay down debt. She started educating herself about money, implemented a strict budget, and only bought things that were absolutely necessary. She sold things around her house to get more money to pay down debt faster. Four years later she was DEBT FREE! From there, she remained on a strict budget and used her savings to invest. She has even started investing in a custodial account for her daughter!

Amy’s advice to others that are trying to change their financial life: START NOW! Give yourself a weekly budget. Cancel forgotten subscriptions. Declutter your home and sell the items you don’t use! Above all else, Amy wants you to know that if she was able to rightsize her financial life and be on track to achieve financial independence, there is nothing stopping you from achieving all of your financial goals!

Amy is doing a Q&A in her stories at @amyfelicetty_ if you want to learn more!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane