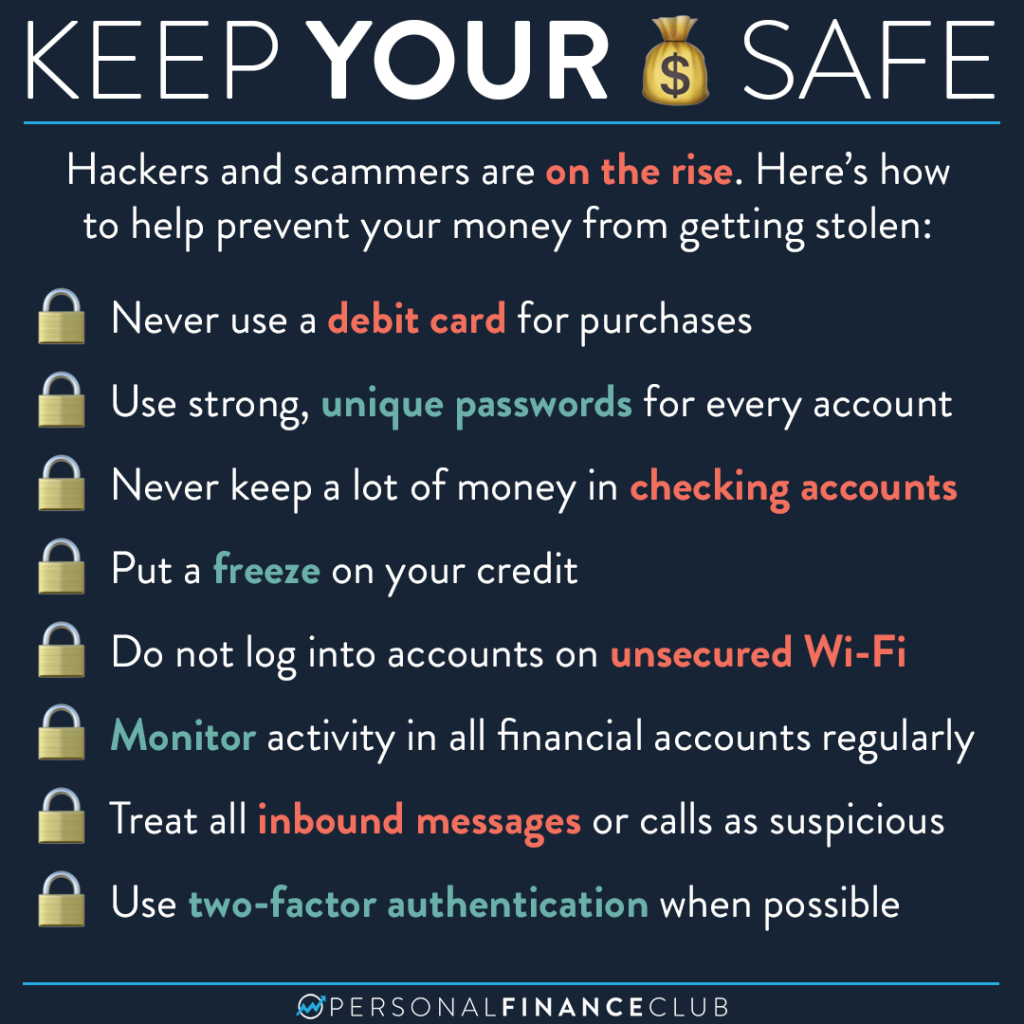

No one ever thinks they’ll get hacked until it actually happens to them. Take the time today and ensure you’re limiting the chances of it happening to you. Here are notes on some of the key things mentioned in this post:

Debit cards: Don’t use these to make transactions. This can give a hacker direct access to take money from your bank account. It can take the bank months to sort things out and you’ll be out the money during this time. With a credit card, you don’t have to worry about that problem.

Strong and unique passwords: If your password is your college name, followed by your graduation year for every account, you are a sitting target. If one account gets compromised, the hackers will have access to all of your accounts. Use a password management system, like LastPass, so you can securely store unique passwords for every account.

Checking accounts: Checking accounts are less secure than other accounts. Your account and routing number are written on every check you write. And, similar to the debit card, if someone gets access to your money, it could be months before the bank gets your money back.

Freeze credit: To prevent bad people from trying to get a loan in your name, you can not allow your credit to be run unless you unfreeze your credit. To do this, contact each of the three major credit bureaus (Equifax, Experian, TransUnion) and request to do this.

Monitor activity: Carve out a few minutes each month to review all account statements to make sure everything looks right. Also, request a free copy of your credit report each year from each credit bureau to double check accuracy and ensure there is no fraud.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane