You should keep a reasonable amount of cash on hand, but not TOO much. Anything extra should be invested in index funds.

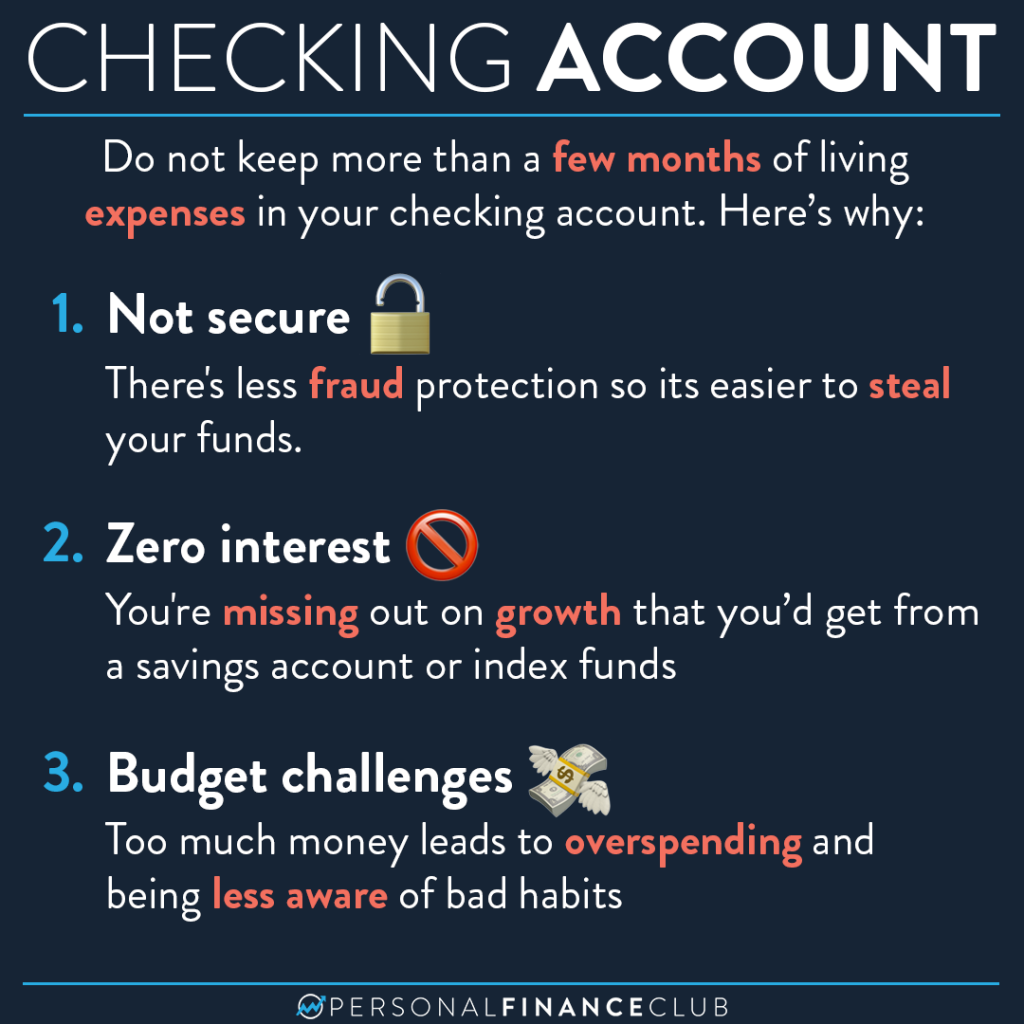

Checking accounts are one of the least secure accounts. Your account and routing numbers are displayed on every check you write. And, if someone is able to get access to your money, it could be many months before your bank gets the money back.

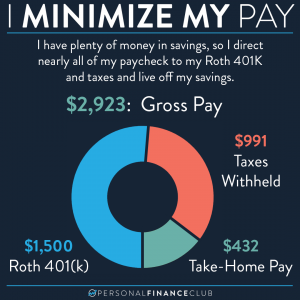

So where should you put your money? Your checking account should have between 1-3 months living expenses in it. This way you’re not living paycheck to paycheck and don’t have to worry about over-drafting the account.

Your emergency fund or money that you plan to spend in the next few years should be in a High Yield Savings Account (HYSA) or a similar account with a decent interest rate. This was less important a couple years ago, but today these accounts are actually paying between about a 4-5% return!

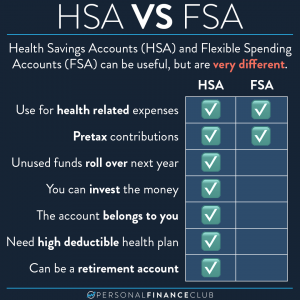

Everything else should be invested in low cost index funds. This last bucket is what will make you wealthy over time. Start filling up investment accounts in order of tax advantage (401k match, HSA, IRA, 401k, brokerage). Do this consistently every year and let compound growth work its magic!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

#stocks #investing #stolen #money101 #safe #banks #money #buildingwealth #protection #investingtips #smartmoney