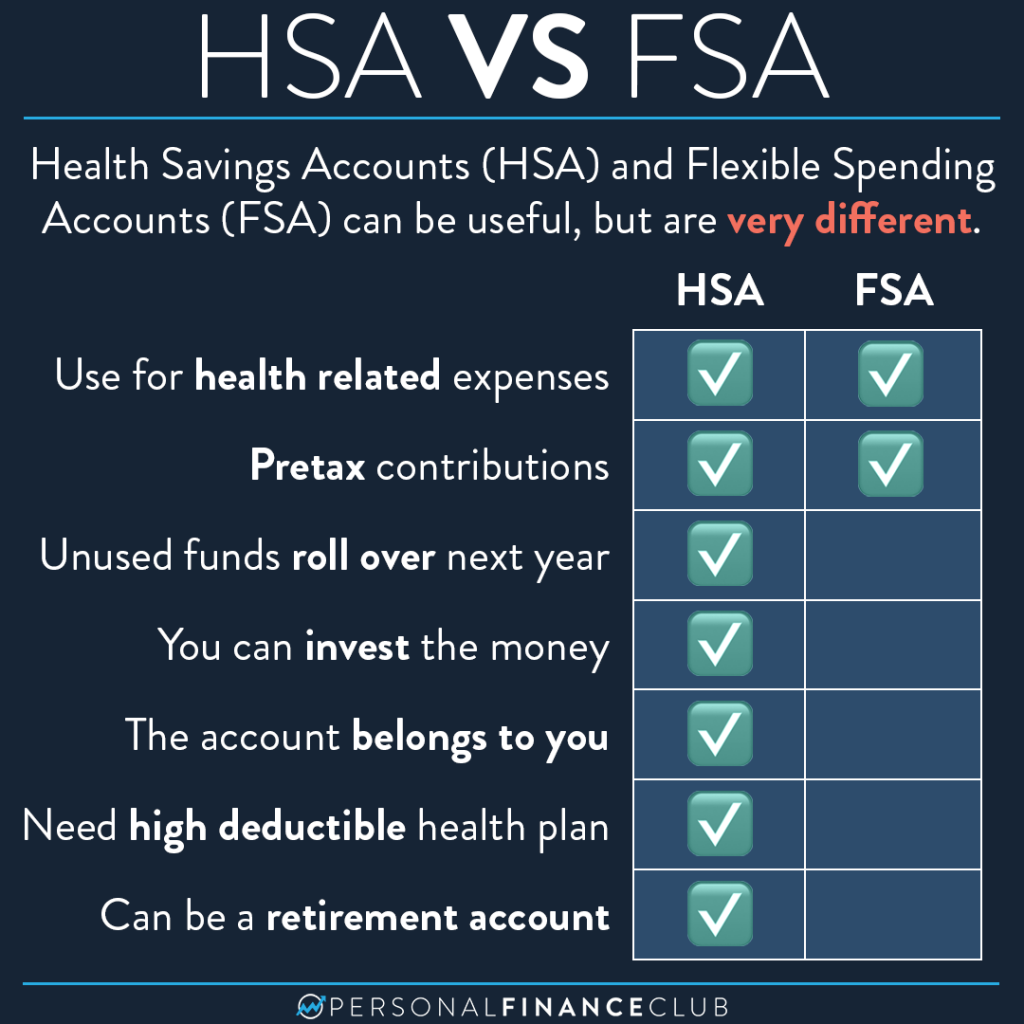

An HSA is one of the best tax-advantaged accounts that exist. It works somewhat similar to a Traditional IRA, except you can also do tax-free withdrawals for qualified medical expenses at any age.

You can only open an HSA if you have an “HSA Compatible” health insurance plan. You can verify with your health insurance provider to see if you have one of these plans. You should prioritize getting the right health insurance for you and your family and then if that plan is HSA compatible, great! But don’t choose a health plan just to get an HSA. There are some things that are definitely more important than investing, like your health!

For 2023, the HSA max contribution is $3,850 for an individual or $7,750 for a family. You can open an HSA through your employer if they offer one or on your own.

Flexible Spending Accounts are nowhere as cool as HSAs. They allow you to set aside pre-tax dollars from your paycheck for medical or dependent care related expenses. You can only open one if your employer offers it.

The main downsides with an FSA are that you can’t invest the money and you have to use the money each year or you lose it! It doesn’t mean using one of these accounts can’t be beneficial. In many cases it is, especially when you know you have high dependent care costs (childcare for example). And if your employer offers any form of matching, that makes it even more attractive to consider doing one.

With open enrollment season coming up in the next couple of months, it’s important to review all of your benefits and make sure you are taking full advantage of everything that is offered to you!

P.S. For the first time ever, we are doing a free webinar that will cover the basics of insurance including health, auto, life, and others. We’ll go over how insurance works and how much of it you need. See you there on Tuesday 9/12 at 5 PM PT/8 PM ET! Sign up with the link in bio!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane