A good friend of mine messaged me this morning and asked me what I thought about one of these ETFs. I looked into it, and my response to her was “I think it’s ridiculous for every reason.” Let’s break down some of those reasons:

• This won’t affect political change. I promise you if lots of people started buying companies that someone has deemed support one political side or the other, there will be MORE THAN ENOUGH PEOPLE who will happily buy the other side the moment it becomes the tiniest bit profitable to do so. It’s like walking up to an olympic sized swimming pool, taking a thimble full of water out of one side, then dumping it into the other. It won’t make an impact.

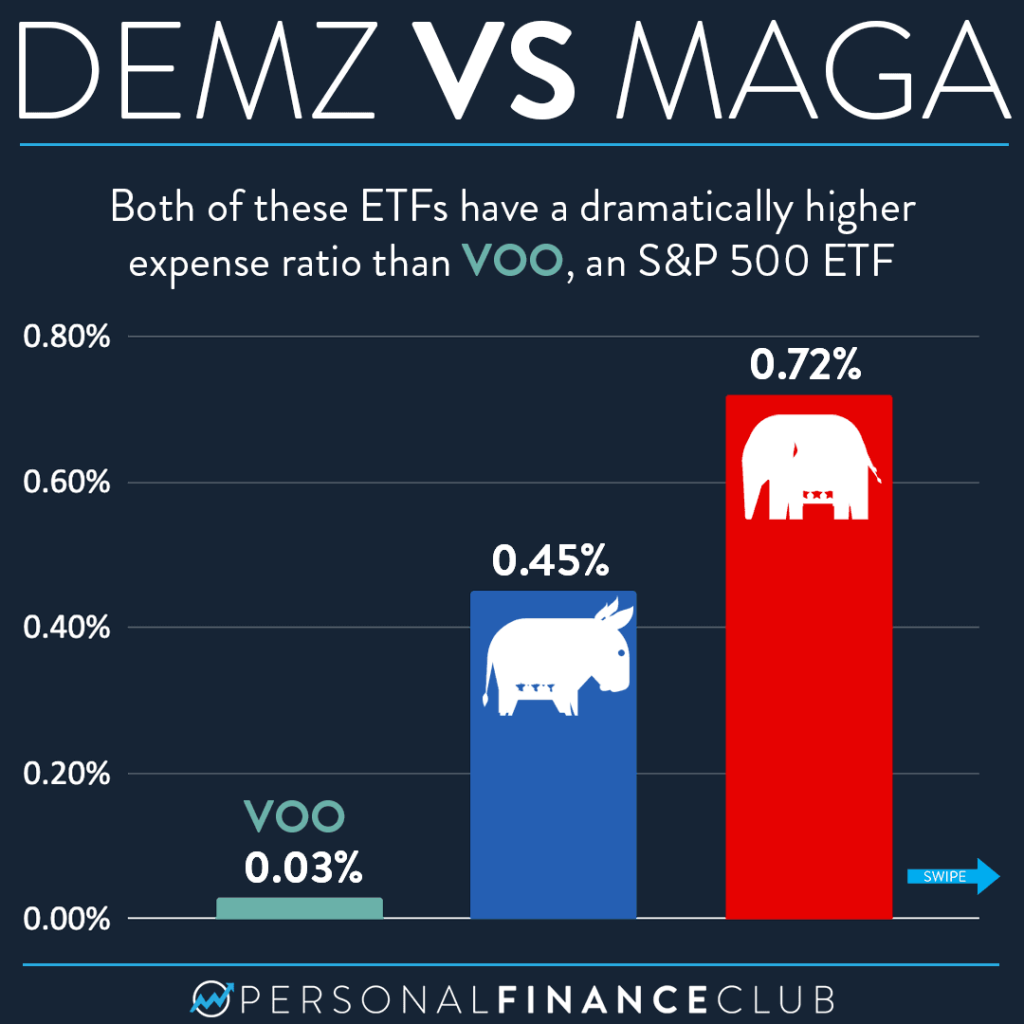

• Higher fees. As shown in the graphic the fees are between 15X and 24X higher. This is just a play by some clever financial institution to profit off the current climate of political strife. I wouldn’t be surprised if the same people (hidden behind some shell companies) are offering both ETFs, playing both sides of the aisle at the cost of your future returns.

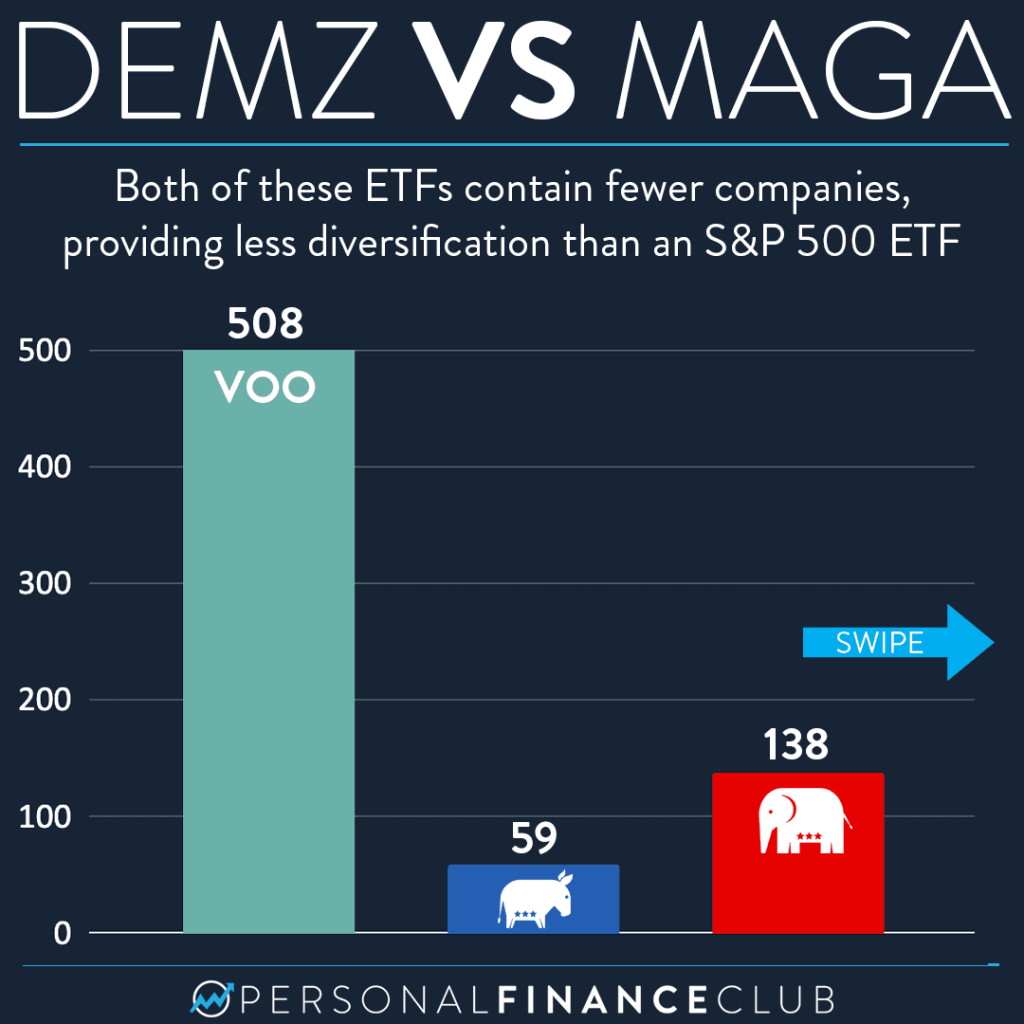

• Less diversification. I compared these to the S&P 500 ETF VOO. But even better you could buy a global ETF like VT or a target date index fund that contain many thousands of stocks. Why buy a few dozen when you can buy many thousands at a much lower cost.

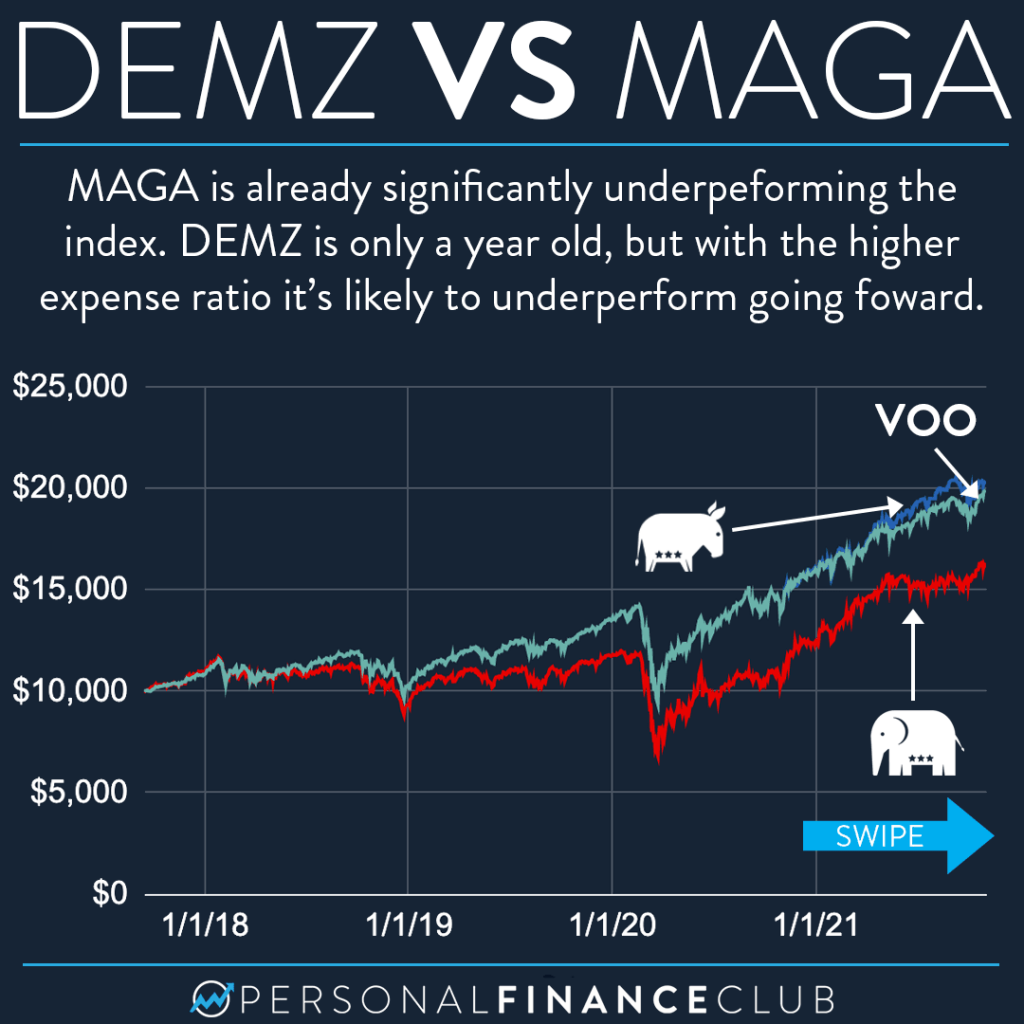

All of this boils down to you taking on more risk and getting lower returns. In investing, that’s a very bad deal. I’d steer clear of these gimmicky ETFs and stick to low cost, broad market index funds.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram