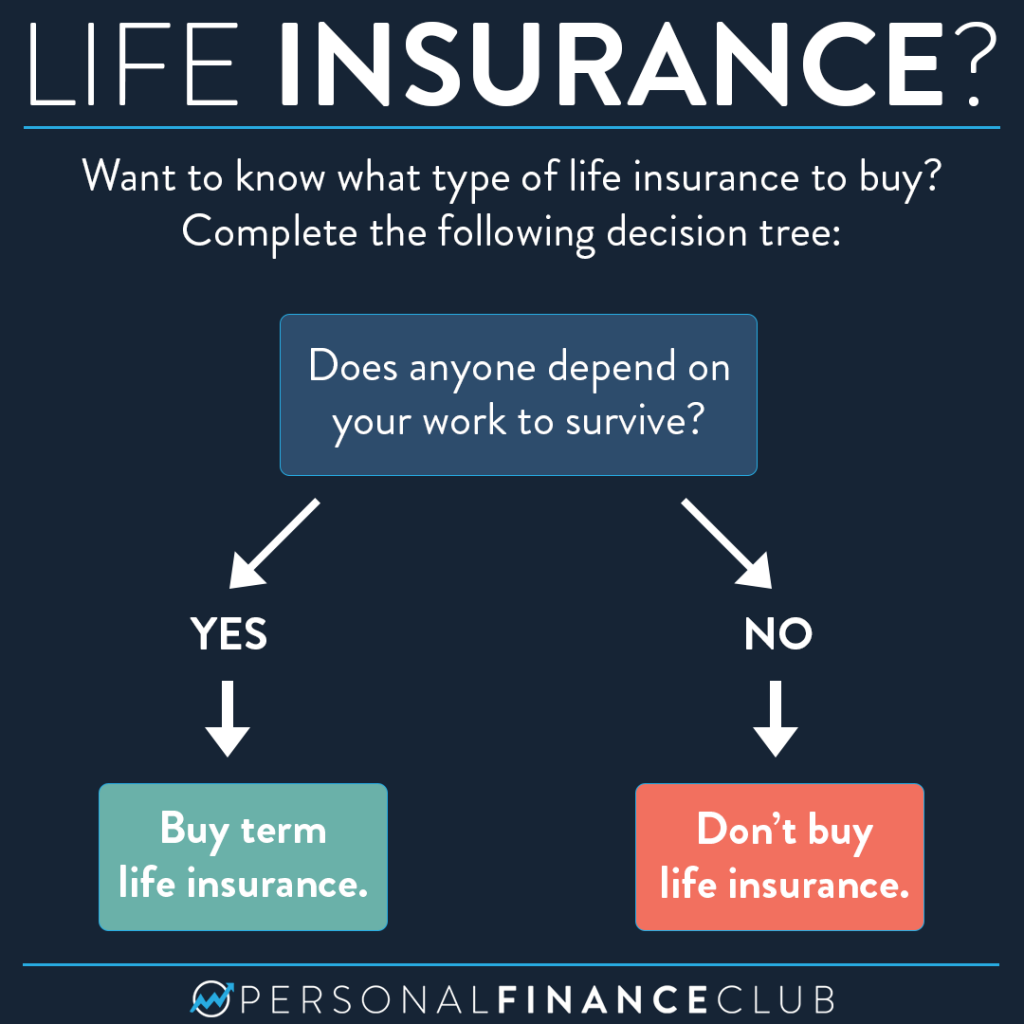

I don’t have life insurance. I don’t need it because I don’t have kids or a spouse who depends on my income to survive. If I had children or a spouse, I still wouldn’t need life insurance. Why? Because I have about $4.5 million in the bank. If I died, and those people existed, they would get that money. There’s no reason to buy something I don’t need.

In concept, life insurance is really simple. If someone depends on your work (paid or in the home) to survive, you can pay a small amount of money per month. If you die, your dependents get a big payday to financially cover what you will no longer be able to.

“Term” life insurance covers a certain term of time. For example, 10 or 20 years. For younger people, it’s generally very inexpensive, because young people have a very low chance of dying within the next 10 or 20 years.

Term life insurance is the only type of life insurance you need because you only need it until one of two things happens:

1.) No one depends on your work to survive (i.e. because your kids are grown up)

2.) You have enough money that your dependents would be fine if you die

One or both of those things generally happens within about 10 or 20 years. Especially if you’re investing alongside buying your inexpensive term life insurance. You only need to buy enough term life insurance to bridge the gap (time or financial) to one of those things.

Other than term, I hate every other type of life insurance I’ve ever seen. Whole life, universal life, IUL, permanent life, etc. These are much more expensive policies with lots of tricky rules designed by insurance companies and sold by commissioned agents as a way to take more of your money. Don’t buy them. If someone suggests life insurance as a way to invest or build wealth, don’t believe it. These life insurance policies are never bought, they’re only sold by commissioned agents. Beware of the hard sell they’ll bring to you.

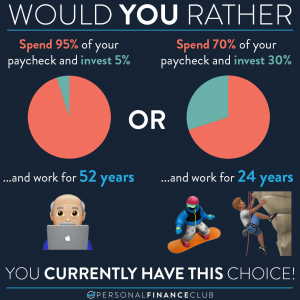

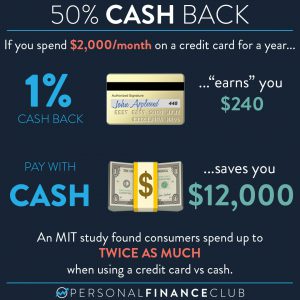

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram