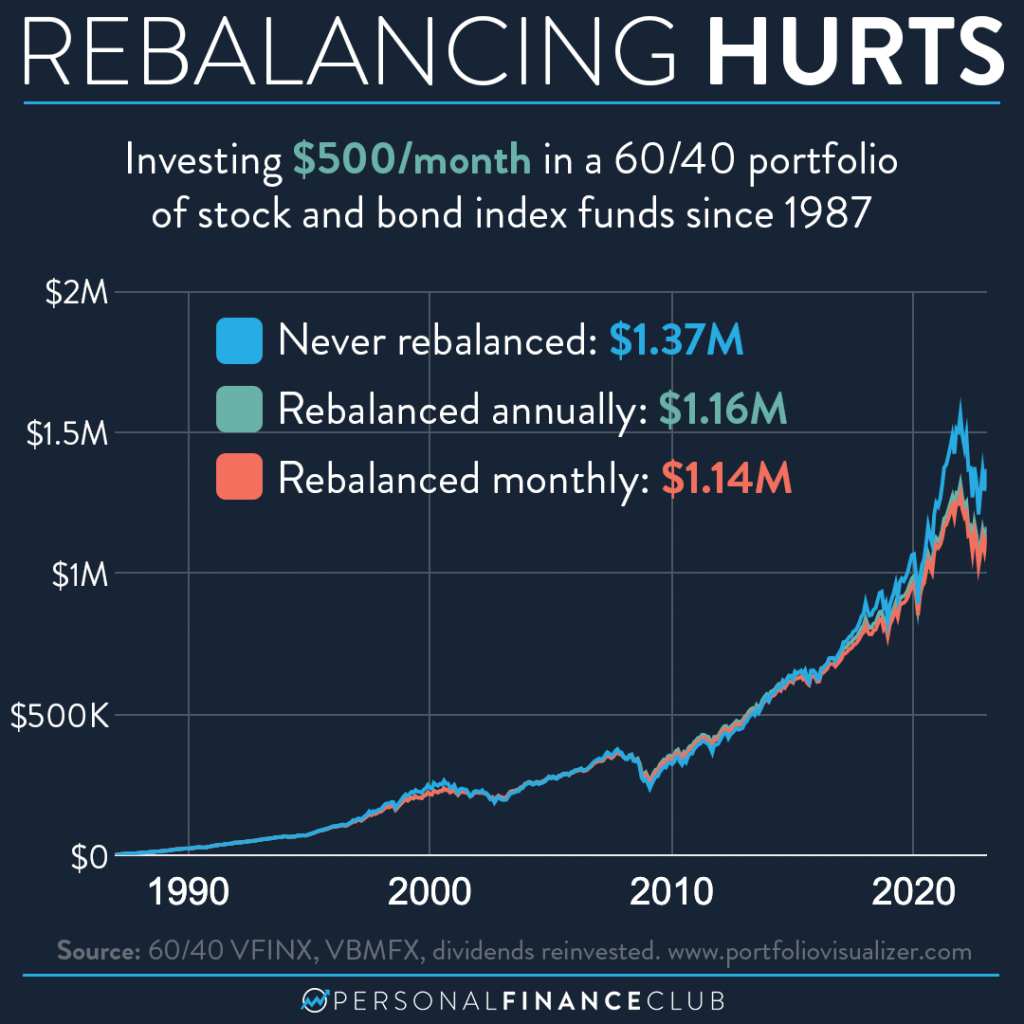

Rebalancing is an investing best practice when you have target percentages for the investments you own. As time goes on, your investments grow at different rates. Rebalancing is when you trade what’s out of balance to get back to your target percentages.

For example, in this chart the investor picked a 60% stock index fund and 40% bond index fund portfolio. As time goes on, stocks and bonds behave differently and so things can get out of balance. For example, a couple years in, you might find stocks have grown faster than bonds and you end up at 65/35 instead of 60/40. So to rebalance, you can essentially sell 5% of your portfolio that’s in stocks and use the proceeds to buy bonds. Then you’re back to 60/40.

As the chart shows, this can often HURT your returns over time. Why? Because when you’re rebalancing, you’re often selling what went up faster (stocks) to buy what goes up slower (bonds). That can hurt total growth over long periods. If you never rebalance, over time you’ll end up with a more aggressive portfolio. Maybe your 60/40 portfolio has become a 80/20 portfolio over time.

So why WOULD you rebalance? Because you picked your asset allocation for a reason. If you look around the 2002 dotcom crash and 2008 financial crisis, the rebalanced portfolios actually outperformed the non-rebalanced portfolio. If you’re at or nearing retirement, maybe you don’t want a super aggressive portfolio. If the market takes a dive right when you retire, you’ll be glad you have the 60/40 portfolio instead of 100% stocks.

The big takeaway here is that rebalancing isn’t a HUGE deal. Even in the most extreme cases of rebalancing MONTHLY vs NEVER we don’t see a very dramatic difference after 36 years. But when I talk to those older investors at or beyond retirement, they do appreciate a more conservative portfolio that’s not going to drop too much if the market flinches.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!