At the Thanksgiving table you may hear an uncle talking about how it’s a bad time to invest. They’ll mention something about inflation or politics or the end of the dollar. But don’t listen to any of that.

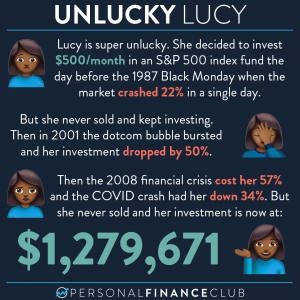

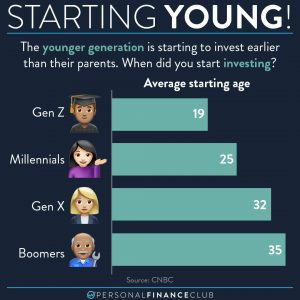

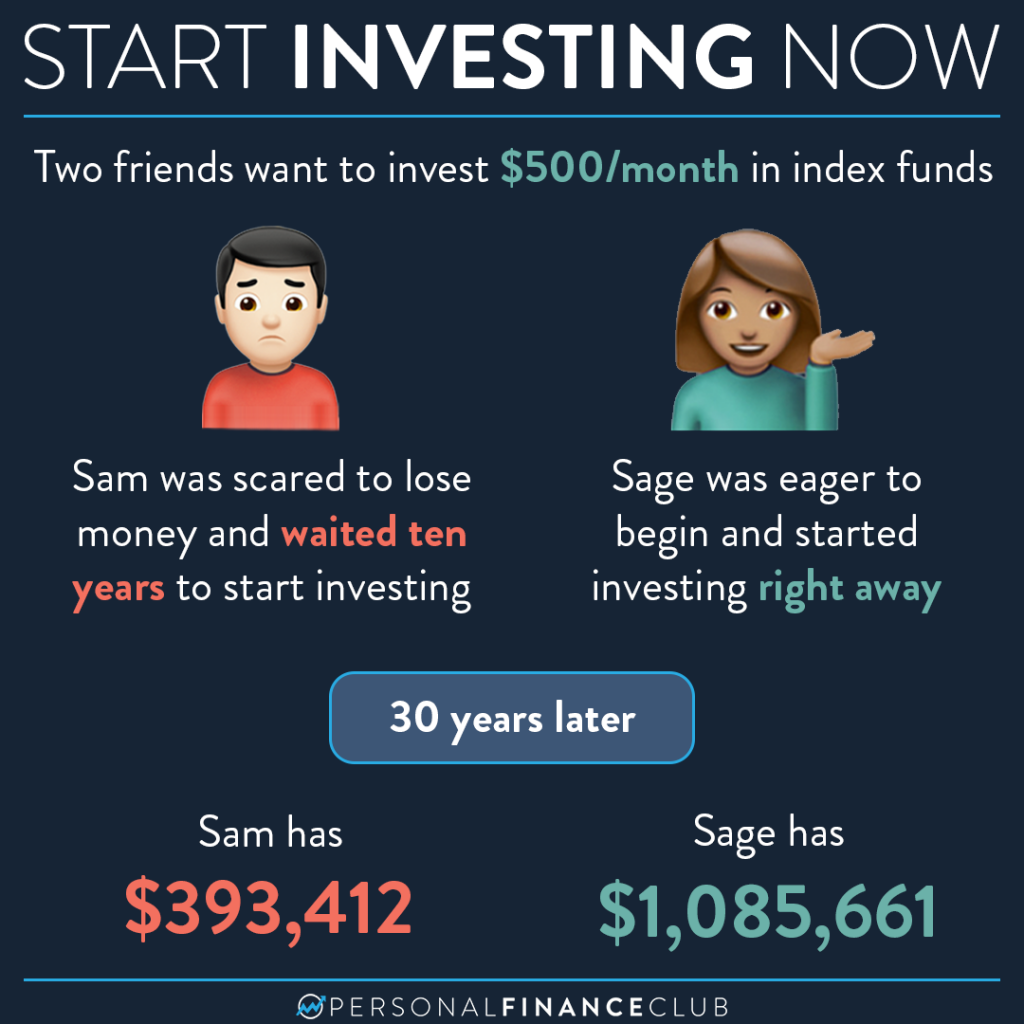

The reality is, one of the most important variables with investing is time. The sooner you get started, the more you let time work on your side. This is what enables your portfolio to experience compound growth and balloon into a BIG number.

In our example, we are assuming Sam and Sage invest in an index fund that tracks the S&P 500, which has had a 10% annual growth rate over the last 100 years, including dividends. Sam puts $500/month in the bank for ten years until he is finally ready to start investing. Sage puts $500/month into index funds every single month.

So, start today. If you don’t have the money, invest a very small amount. Getting started can be the hardest part. There will always be reasons to delay getting started. But, starting now instead of later can make a huge difference.

If you want to learn more about investing and learn how you can grow a million dollar portfolio, we are hosting a free webinar TONIGHT, Tuesday Nov 21, at 5pm PT/8pm ET. It’s going to be an action filled one hour with a ton of fun content. Our profile has more information to sign up! Everyone who signs up will get the recording emailed to them as well. See YOU there!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane