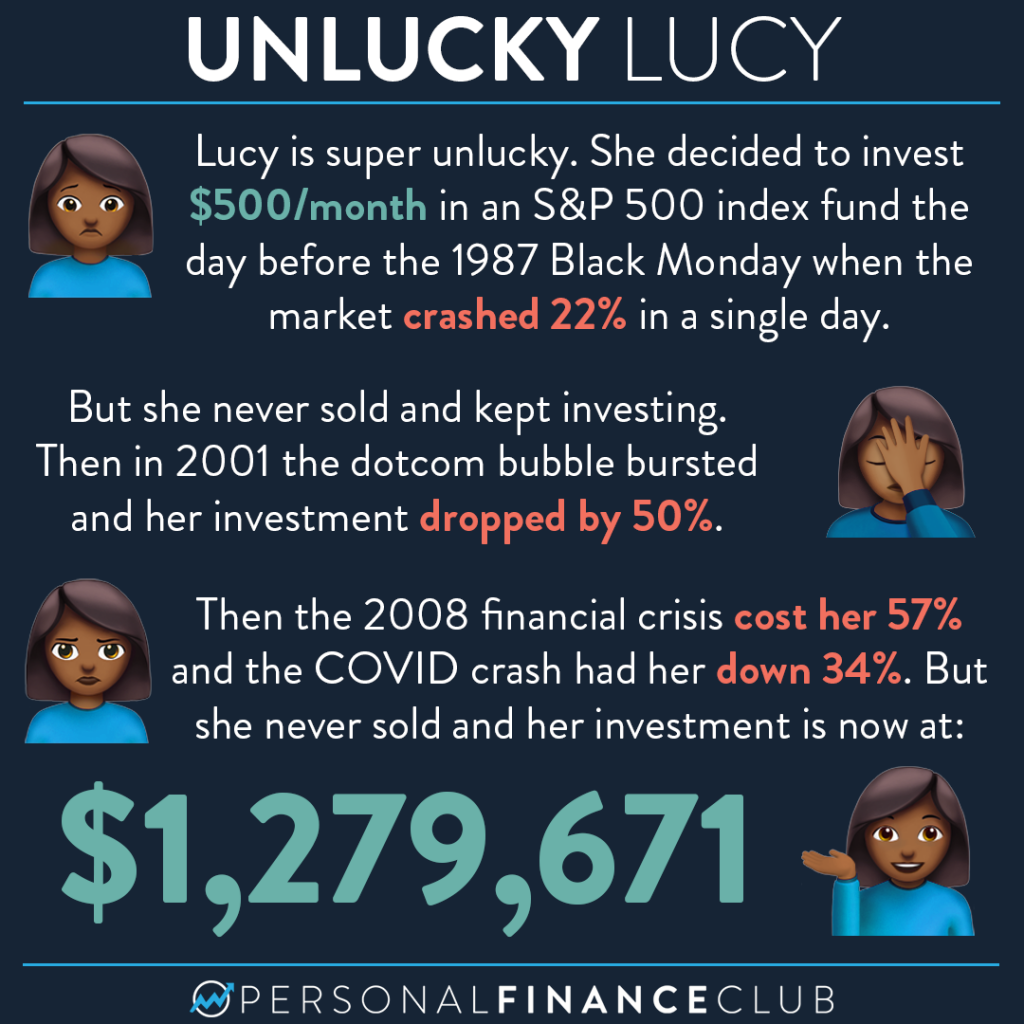

Stock market crashes make headlines. We hear about them all. The market crashed this March when everyone was realizing how serious COVID would be. The market crashed in 2007 when the banks were at risk of failing. The market crashed in 2000 when the dot com bubble burst. It crashed in 1987, a day now known as “Black Monday.”

What what doesn’t usually make headlines is what happens in between the crashes. The market marches upwards. Slowly, surely, quietly, but unrelentingly. Those upward marches make up for all the ground lost during the previous crash, then far outpaces previous record highs. That relentless upwards march of the stock market doesn’t make headlines because it’s not unusual. It’s basically always going on. In fact the market is up in about 75% of years. And unless we experience another crash in the next few days, the S&P 500 is looking to finish up about 14% on this crazy year.

So while Lucy may be “unlucky” that she started to invest the day of a big crash, that doesn’t really matter. What made her so successful is buying and holding over long periods. There’s a few short crashes in there, but she always stayed the course and took advantage of those long upward trends that never make headlines.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram