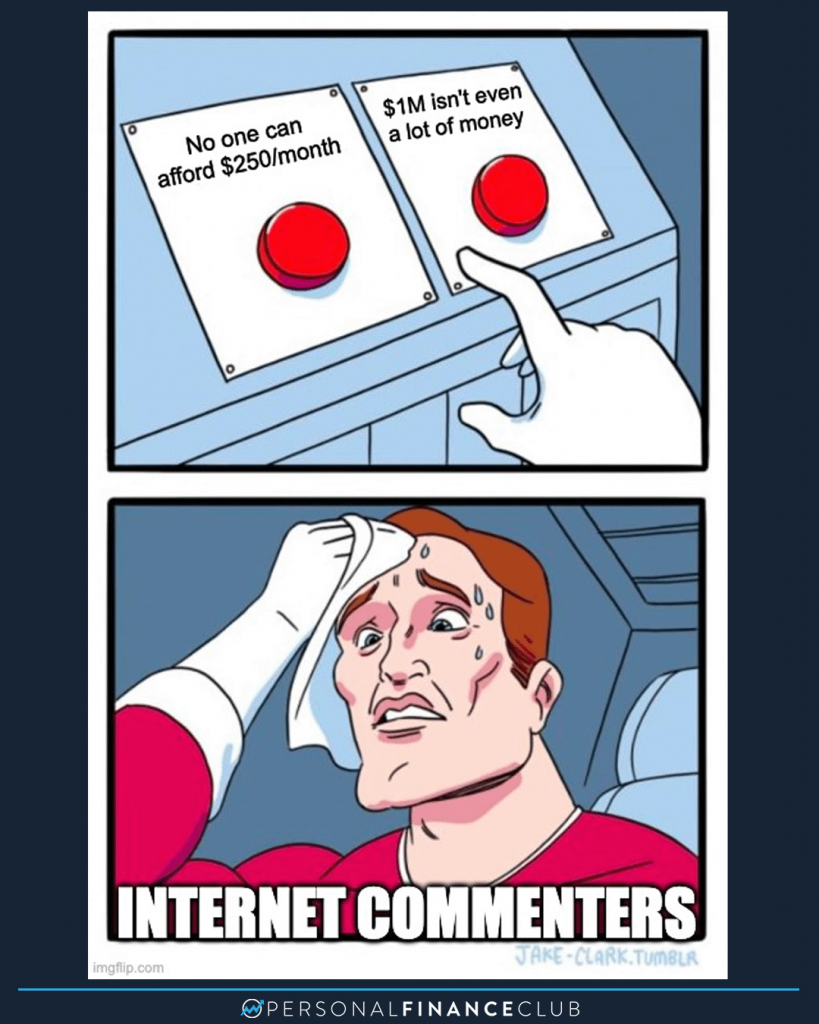

Whenever we talk about saving and investing to build wealth, we invariable get a host of comments that are some variation of these. To be fair, there’s a bit of truth to both. Let’s break them down.

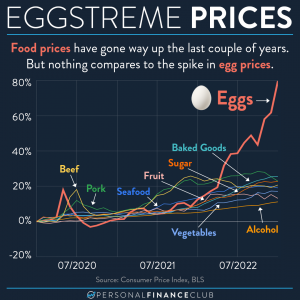

“No one can afford $250/month”. There’s a bit of truth to this. Money is absolutely tight. Things are getting more expensive. It’s easy for me to wave my hands in the air and say “just save hundreds of dollars a month!” But the reality on the ground can be much more difficult as real life happens. Housing, food, gas, kids, utilities, emergencies. Shit costs money yo. BUT, there are things you can do. Start with $10/month. Get in the habit. When you get raises at work devote part of that raise to increasing the savings rate. Look for ways to cut costs and add that. Once you see traction it starts to get easier.

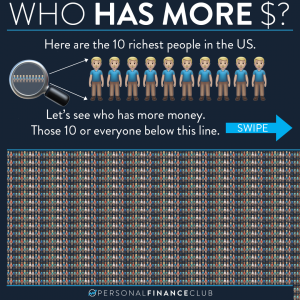

“$1M isn’t even a lot of money”. There’s a bit of truth (although a lot less) to this too. I was born in the 80s. If you were a millionaire in the 80s that was a big deal. $1M in 1980 is the equivalent of almost FOUR million today! But, a million is still a LOT of money. The median household net worth in the US is under $200,000. So if you get to $1M even you have FIVE TIMES more than the median household. That means 50% of Americans would REALLY like to be in that position. Plus, according to the 4% rule, a million bucks will kick off about $40,000/year of income (without risking principal) indefinitely. If you can’t afford $250/month, $40,000/year of free money forever is DARN TOOTIN’ GOOD.

It’s easy to be cynical. That’s why I like doing it so much. So I get it. Seeing some rich internet douchebag tell you how to get rich can feel so out of touch. But instead of looking for ways to prove it’s impossible, you will be better served by looking for steps to take in the right direction. Maybe that first step is just allowing yourself to envision it eventually working for you, then starting to make a plan to get there.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy