Money can be a very emotional and sensitive topic. People often feel shame around debt, feel behind in investing, feel anxiety around budgeting, etc. But if you can remove the shame and emotions, it really boils down to a pretty simple game. And that game generally benefits those who have money and punishes those who don’t.

If you have debt, that debt charges interest and requires payments. Those things pull you deeper into debt. But if you have investments, those investments (generally) go up in value and pay income while you own them! Getting yourself from below that zero line and out of debt, into the investing and growth phase is critical to building wealth.

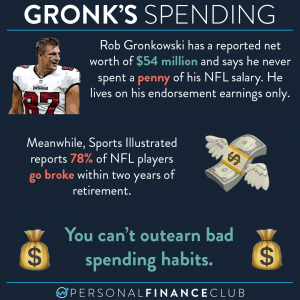

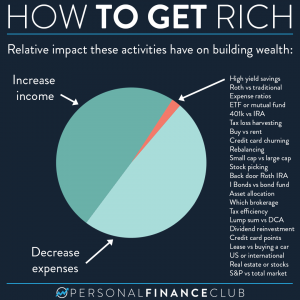

How do you do that? In short, working for an income! Increasing your income and decreasing your expenses provides the cashflow to move up in this game. The more aggressively you do that, the faster it goes. If you have $20K in debt and you make minimum payments, it will stick around for many years and likely accumulate more along the way. But if you go HAM, temporarily, and find $1,500/month extra (from cutting costs, working a second job, working overtime, selling stuff, etc) that debt will be down to zero in about 12 months!

Once your debt is at zero, the anchor is cut! Then the easy and fun part starts. Instead of plowing all your money into debt just to try to stay afloat, you can start pouring money into investments. The more you do, the more they help by providing even more income! Eventually you’ll get to a place where it’s a runaway snowball and you don’t need to add any more money at all and your investments can even cover your living expenses! That is financial independence!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!