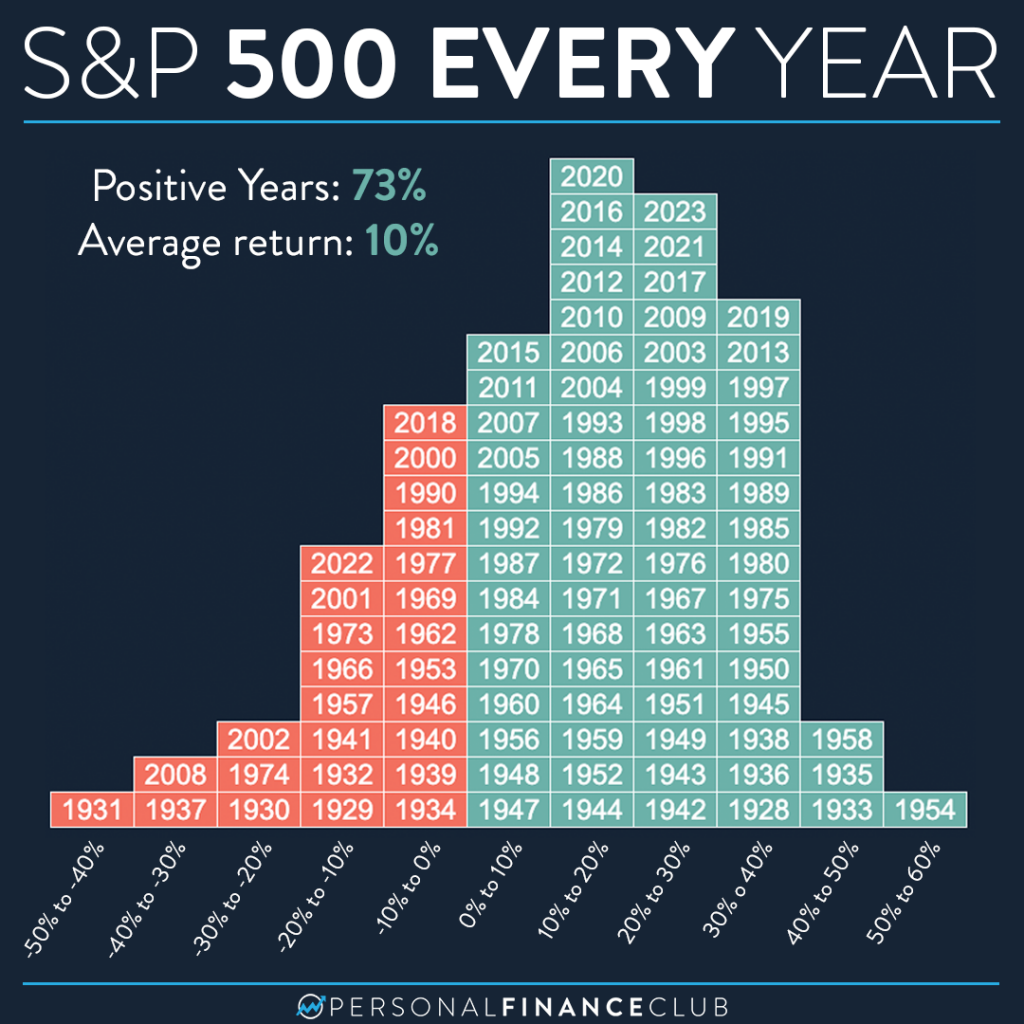

The market isn’t one step forward, one step back. It’s four steps forward, one step back. It’s important to never let that one step back get you scared and cause you to miss the upcoming four steps forward. Because investing in the stock market to build wealth only works when you stay invested over a long period of time.

This chart shows the calendar year returns of the S&P 500, including dividends, over the last 100 years (since 1928). A pessimist might notice that the market finished down double digits 14 times. But an optimist will focus on the fact that the market has been positive almost three quarters of the time!

What’s the main takeaway for you? Keep investing early and often. Down years are expected and part of investing. Buy more shares at a discount and reap the rewards when the market eventually bounces back. And it will eventually bounce back. It has a 100% track record of doing that!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane