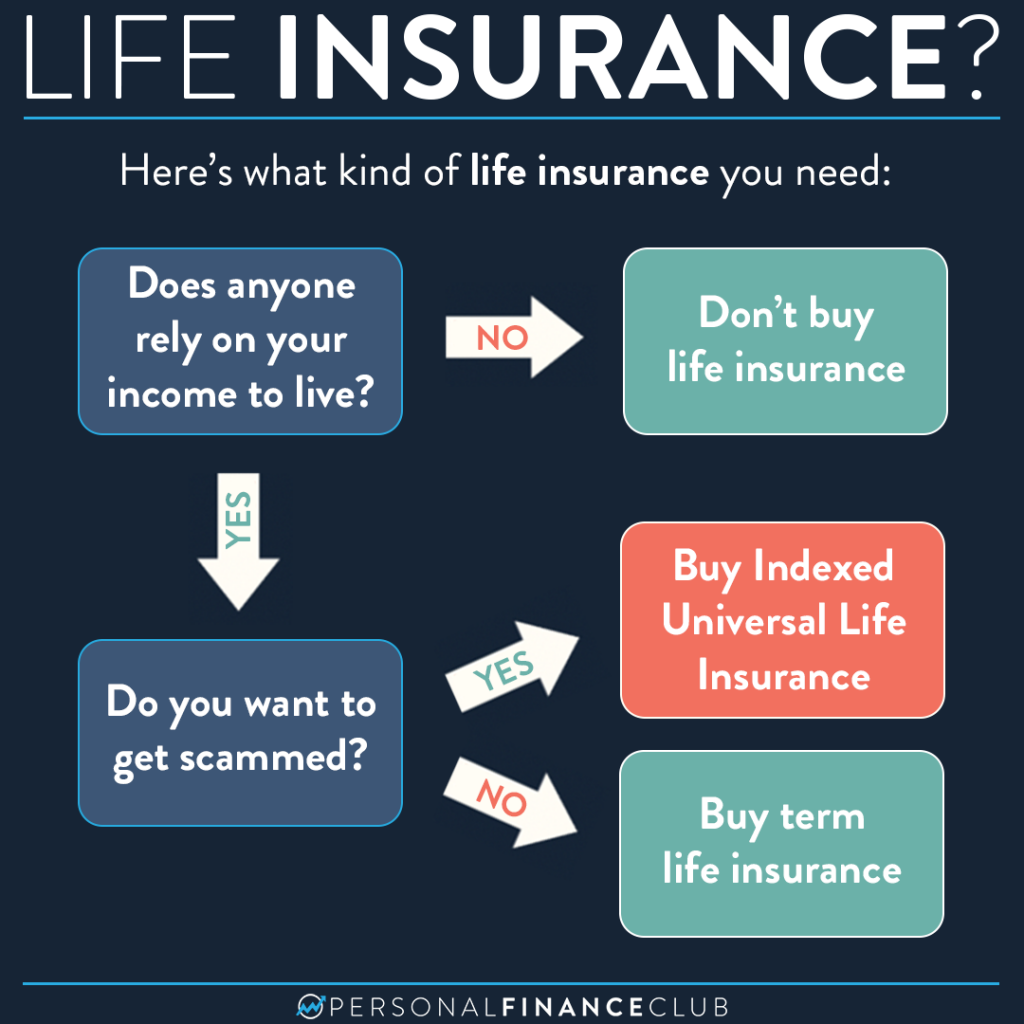

Life insurance can be very simple. If someone depends on your work (paid or in the home) to survive, you should buy life insurance. So if something happens to you, your dependents are financially covered.

But outside of term life insurance, it can be very complicated. There are many other types of life insurance, and they are all BAD. You should run in the other direction when you hear things like whole life, IUL, variable life, etc. They are expensive with lots of complicated rules. Insurance agents who are desperate for a commission will give you all sorts of nonsense to try and get you to buy one of these policies, so stay far away!!

If you need life insurance, buy an inexpensive term life policy. These policies cover a “term”, or a certain length of time. Once your dependents are no longer relying on you, you don’t need life insurance anymore.

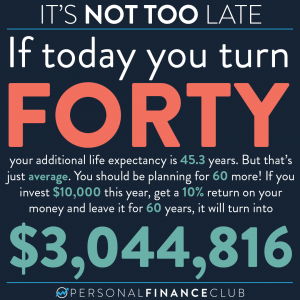

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!