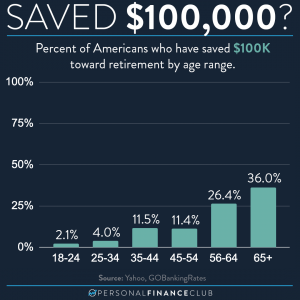

Remember that retirement isn’t an age. It’s an amount of money. Once your investments have grown to 25 times your annual spending, you are financially independent and can live off your investments forever! And on the flip side, nothing magical happens at 65 that allows you to stop working. If you don’t have your money invested and working for you, you’ll be working forever. (Do you think those 100 year old Walmart greeters are there because they love spending the day on their feet at the entrance of a Walmart?!)

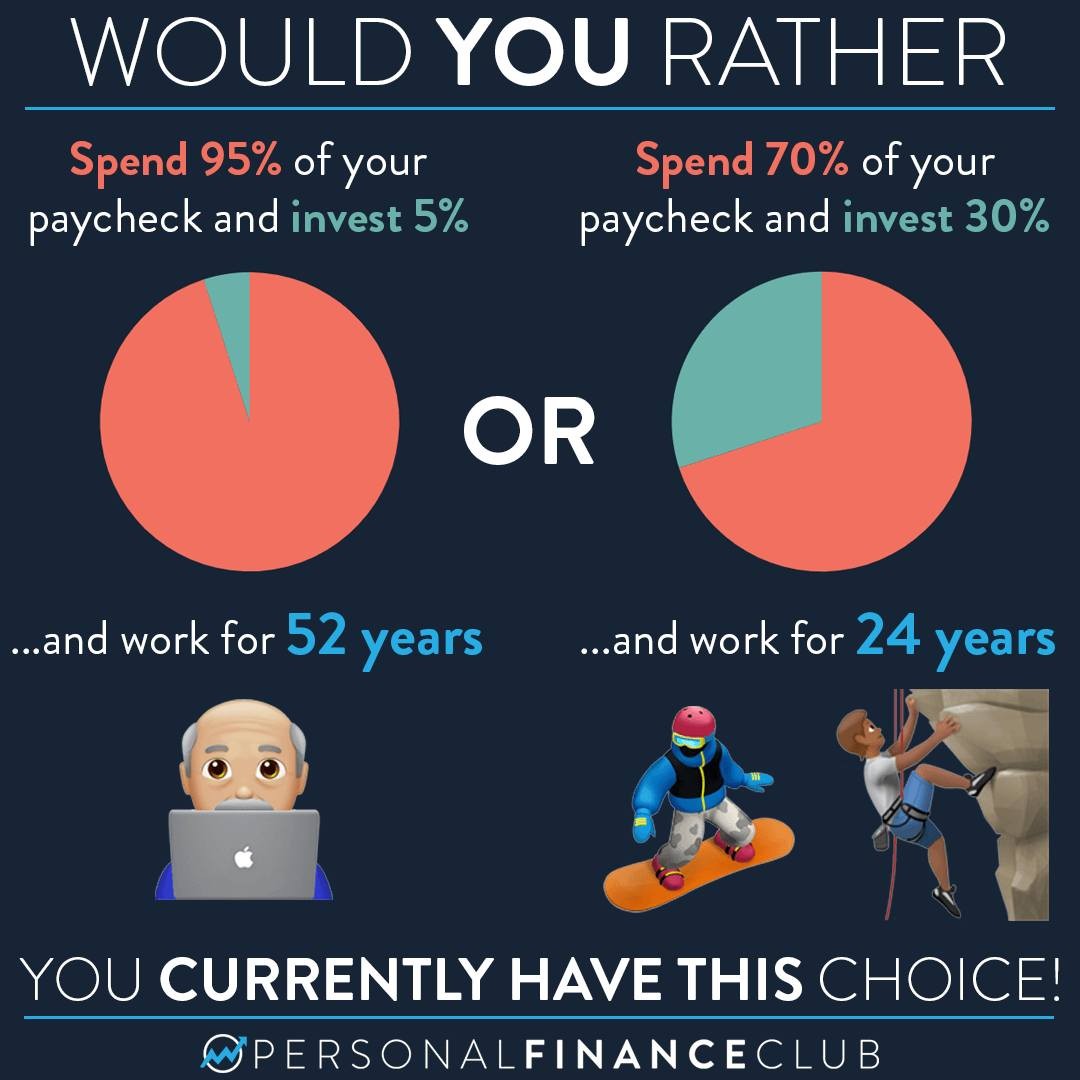

Spending less and investing more has a doubly effective impact. First, you’re saving and investing more to have more money later. But you’re also spending less, which brings that 25X retirement number down. Every dollar you move from the spend to invest bucket in your budget is buying you your life back!

If you’re wondering “is now a good time to invest in this bad market?”. YES!!! YES IT IS! The market has gone down looking BACKWARDS. That means it’s lower so you can buy in for cheaper and ride it UP going FORWARDS. The market is four steps forward, one step back. Stay in for the long term and make sure you’re there for the four steps forward.

These numbers are if you’re starting from ZERO. If you already have some money saved or invested, you may be that much closer to your financial independence number! I’ve got a free calculator on this website if you want to try your numbers out. What’s your saving rate? How many years until you hit FI?

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram