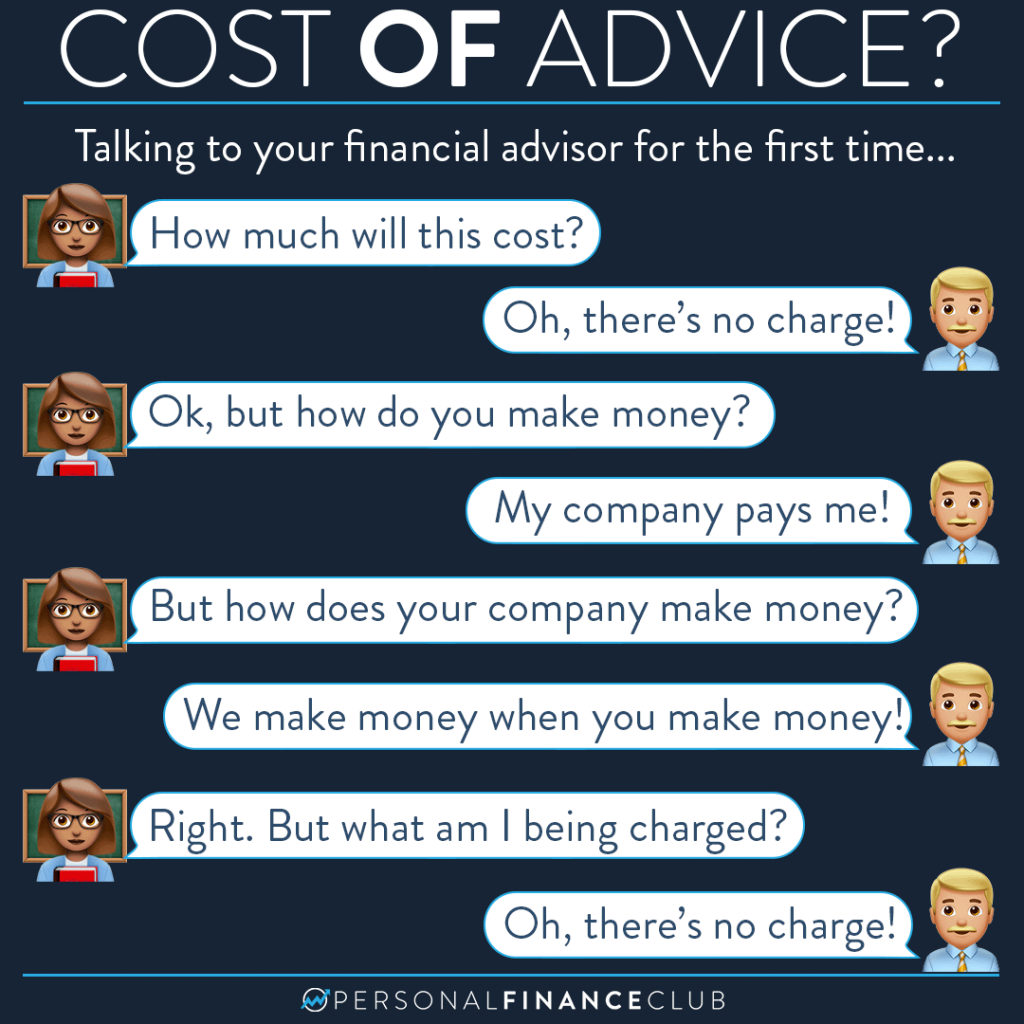

All of these lines are actual answers I’ve heard from real financial advisors when asked the supremely simple question, “how much does this cost?”

Back in the day these may have been satisfying answers to consumers. We thought money and investing was so complex, who are we to question the magic that happens behind the scenes that allows this company to provide financial advice and make us both money?

But lately, I think consumers are wisening up. We know there’s no such thing as free. And when you ask a straightforward question like “what does this cost?” and you get the runaround, you know something isn’t right.

Here’s the truth. If your advisor gives you an answer like this, they’re lying directly to your face. And it’s such a bold faced lie, it’s frankly offensive.

There’s a few different ways financial advisors actually make money.

• Loads. If you’re investing through a financial advisor there is often a “front load” or “back load” which is a fee charged to you when you buy or sell an investment. It’s usually 3.75% to 5.75% of whatever you put in, every time you invest.

• Expense ratios. Virtually every mutual fund and ETF charges an annual fee called an expense ratio. If you’re buying these funds through a financial advisor they’re likely to be quite high, like 1% per year. These won’t appear on your statement.

• Sweep/Account/Management fee. Your whole account may be charged a fee as well, often around 1% per year. This may be in place of OR in addition to the Load fees above.

• Monthly/Statement fee. Often you’ll be charged another fee just for keeping your account open.

So no, financial advisors are not volunteers. And they don’t magically make money from the sky when you make money. They’re charging you. And if you don’t understand how or how much, you absolutely should find out. If you’re looking to get financial advice with transparent, upfront pricing, check out Nectarine!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy