I just can’t get hype about a high-yield savings account. It has such a great name. HIGH-YIELD! Just what we love, right?! Yields that are high. But the best part about high-yield savings accounts is that cool sounding name.

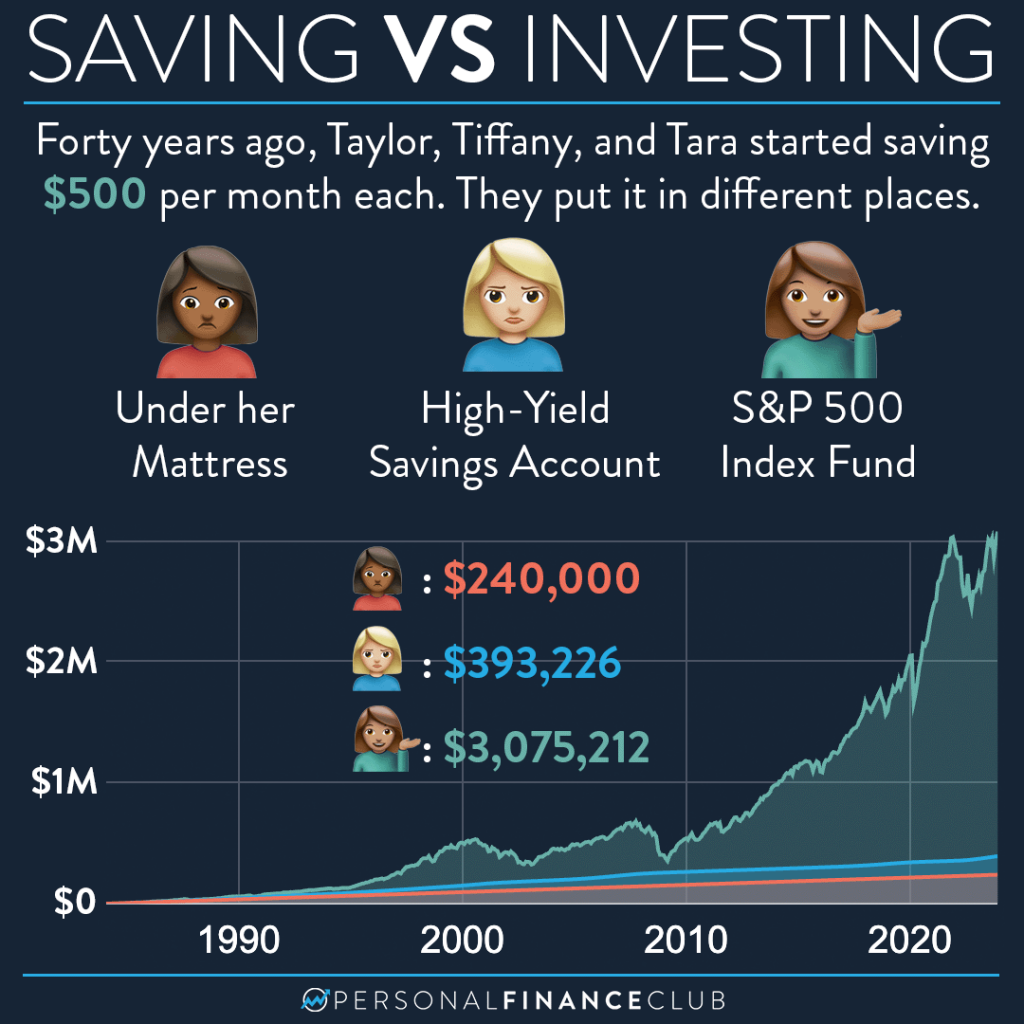

Look at this chart. After diligently saving for FORTY YEARS in a HYSA how much of an impact did it make to Tiffany’s life over keeping the cash under her mattress? Not much. Not retirement money. Certainly not retire early money.

Meanwhile Tara saved the EXACT SAME amount of money and ended up with about EIGHT TIMES more. Of course, Tara had to stomach the volatility of the market along the way. While Tiffany was reliably collecting interest based on the current rates in the market, Tara was on a much bumpier ride.

But that is the nature of investing. If you want a SURE THING that doesn’t go down in value, you have to accept the dramatically lower returns. And if you want the higher returns, you have to accept the risk of volatility and your investment going down in value (at least in the short term).

Personally, I use a HYSA for short term savings. Any money I plan to spend within a few years, I protect from that short term loss and collect my small interest so it’s ready to spend when I need it. Money I want to grow for more than a few years, I dump in the market with a plan not to touch it for a LONG time so I can see results like Tara!

If you haven’t started investing yet, as the say the best time was 20 years ago, but the second best time is today!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy