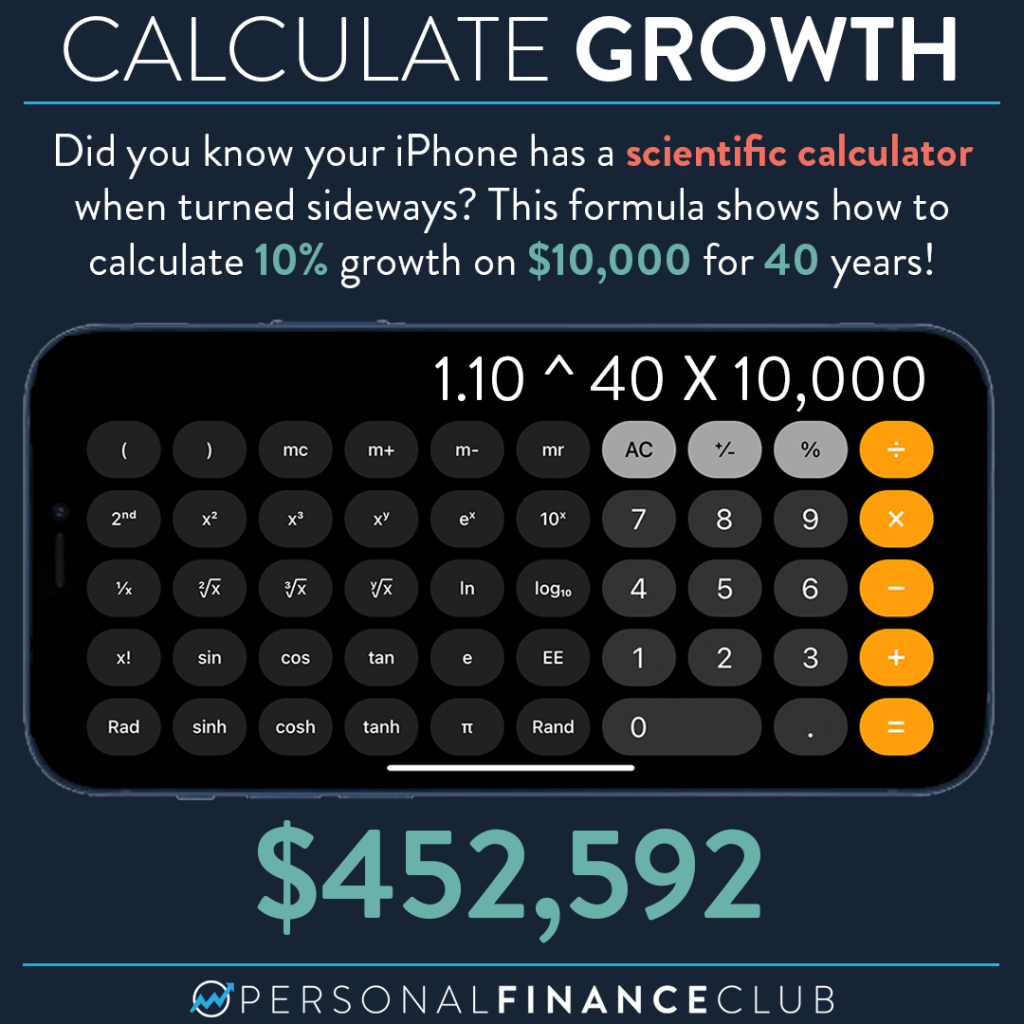

Sometimes people ask me how to calculate the numbers I use in my examples. Well, it depends on the example. Sometimes I download historical stock or index prices into a spreadsheet and model the growth. Often it’s using an online compound growth calculator. But for something simple, you can do it right on your calculator!

Here’s how this formula works: If you want to grow a number by 10% you multiply it by 1.1. So 10% growth on 10,000 is 10,000 X 1.1 = 11,000.

If you want to grow it by 10% TWICE, you just multiply it by 1.1 again. So two years of 10% growth on 10,000 would be 10,000 X 1.1 X 1.1 = 12,100.

Note that you can rewrite 1.1 X 1.1 as 1.1 ^ 2. (The power operator ^ is shown on the calculator as xʸ).

So 10% growth of 10,000 for two years is 10,000 X 1.1 ^ 2. So if you want to do 40 years, just enter the formula shown in this example!

Did you know about the scientific calculator on your iPhone?! Is this too much math!?

Thanks to @mattyj48 for the idea!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram