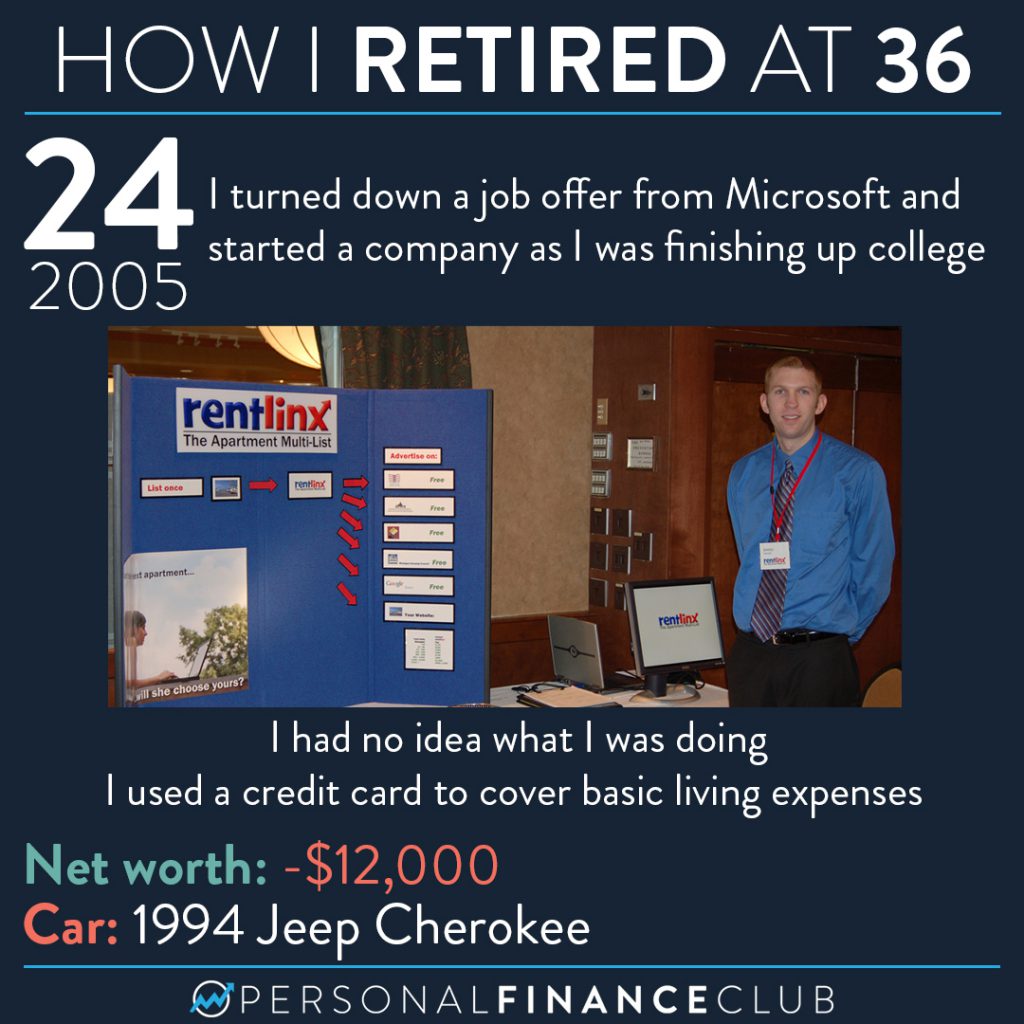

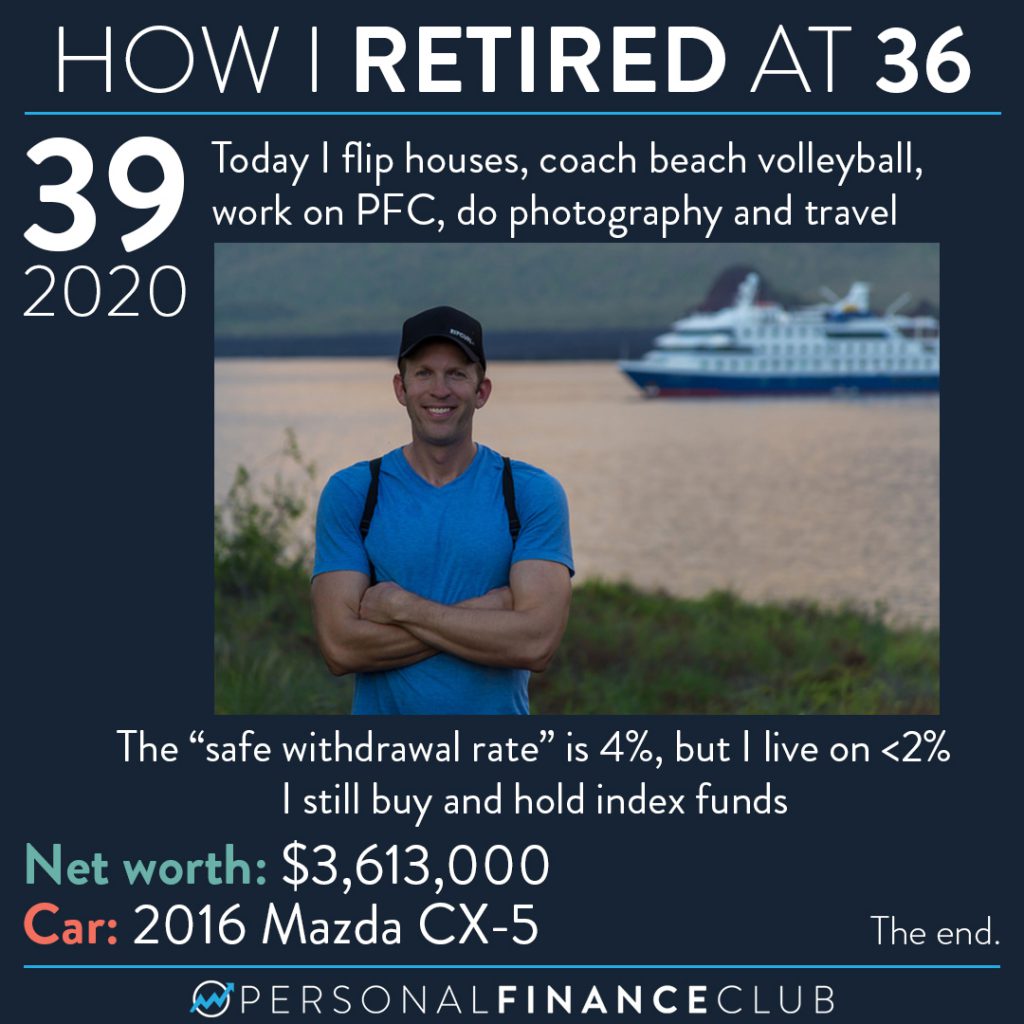

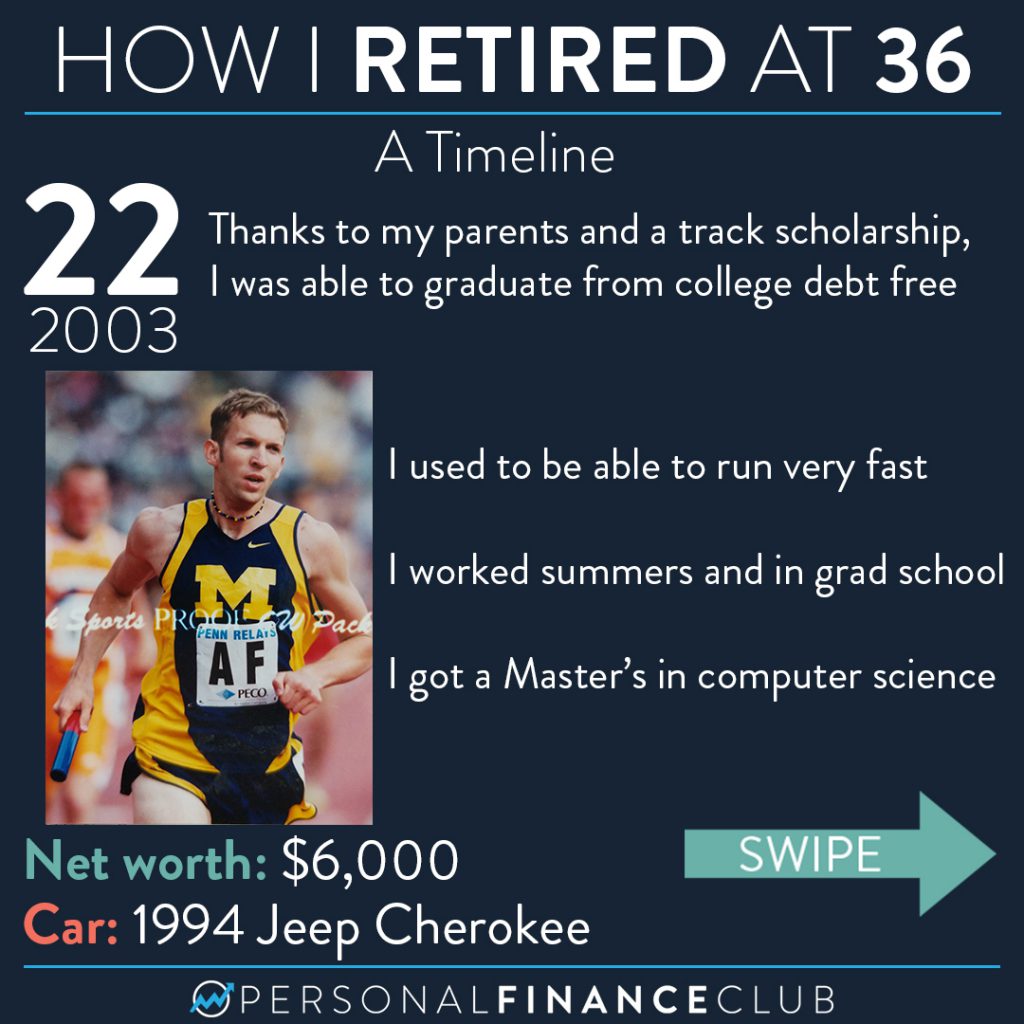

I often get asked how I “retired at 36” so here is a bit of my story!

This really isn’t supposed to be a “see how easy it is” or “anyone can do it the way I did” post. I fully acknowledge I had a huge amount of privilege and unfair advantages. Graduating from college debt free thanks mostly to my parents is something that was simply gifted to me and allowed me to start a company. Even as I grew my company I’m sure I benefited from the invisible tailwinds of being a tall, healthy, young, white, American male. I worked hard, but would my work have been received the same way if I walked into meetings as a female of color (for example)? I doubt it would have gone the exact same way.

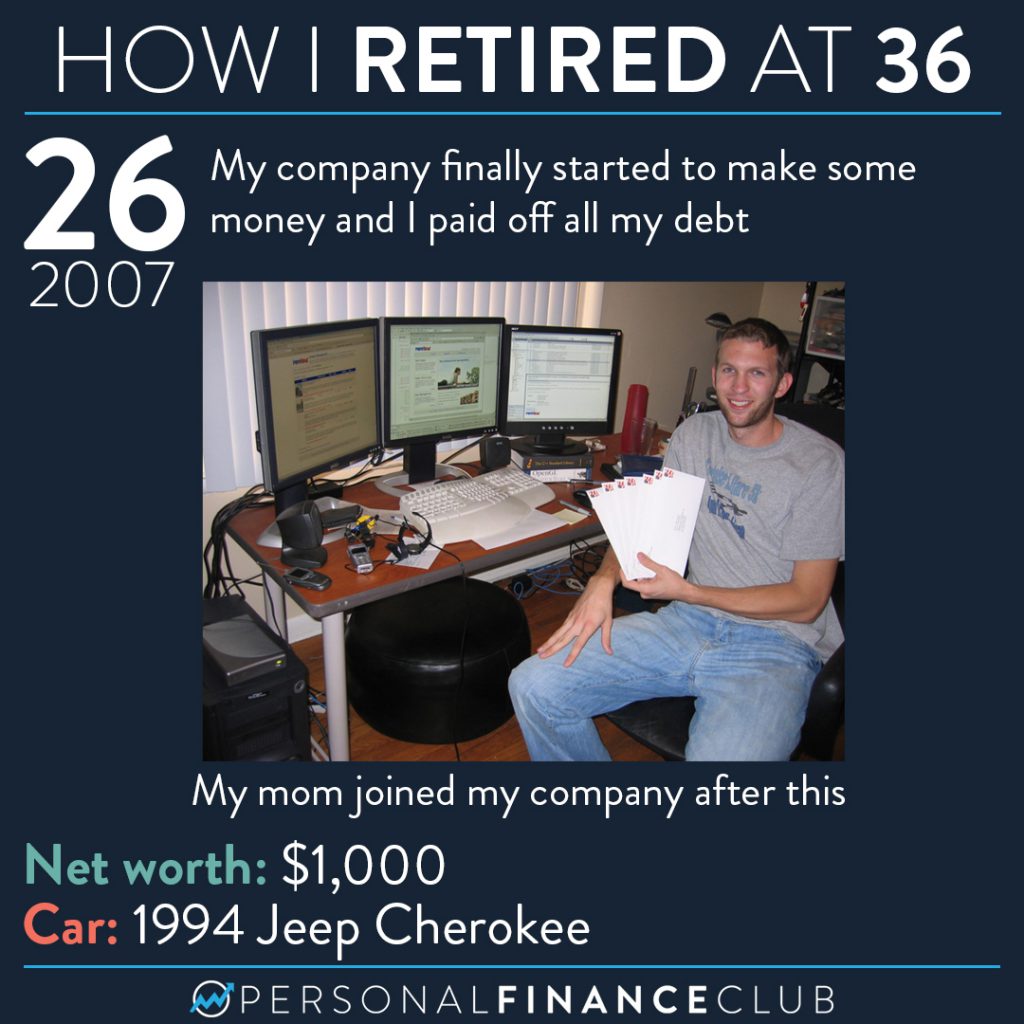

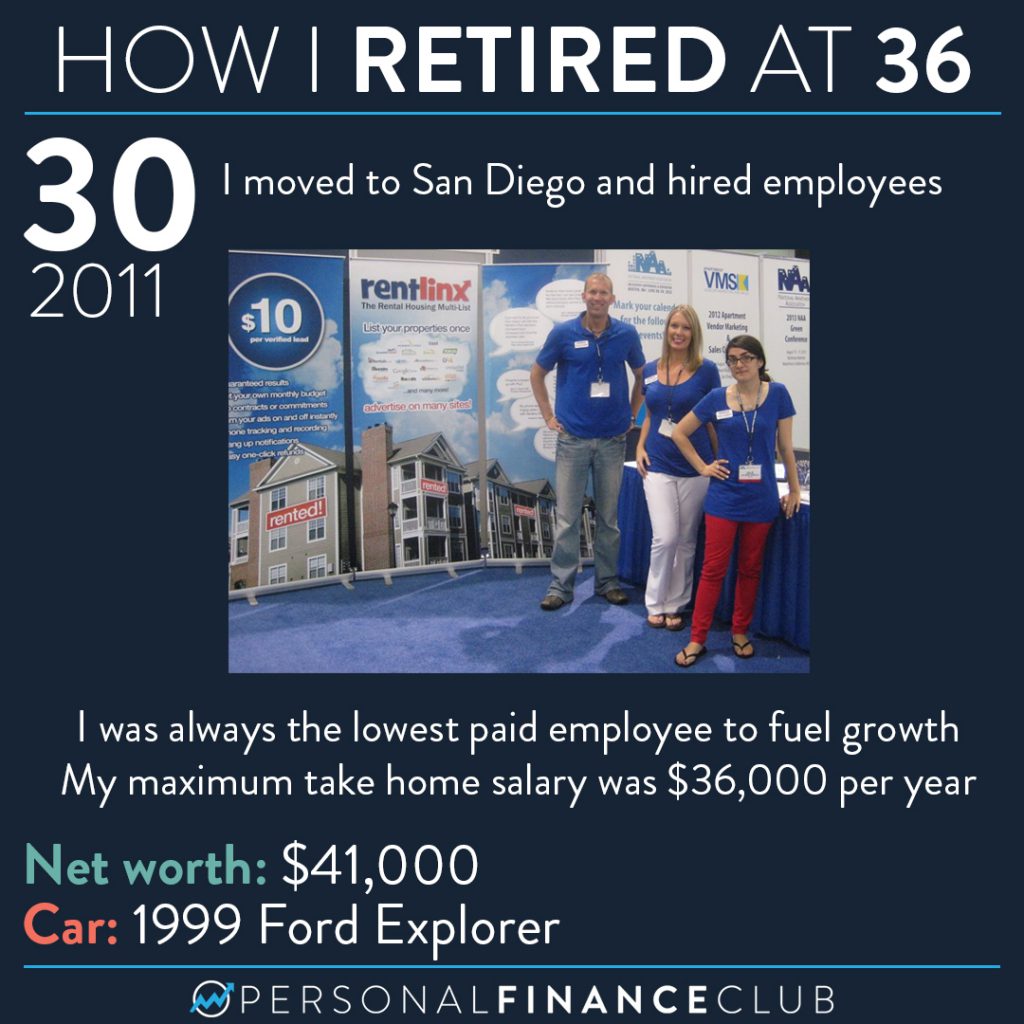

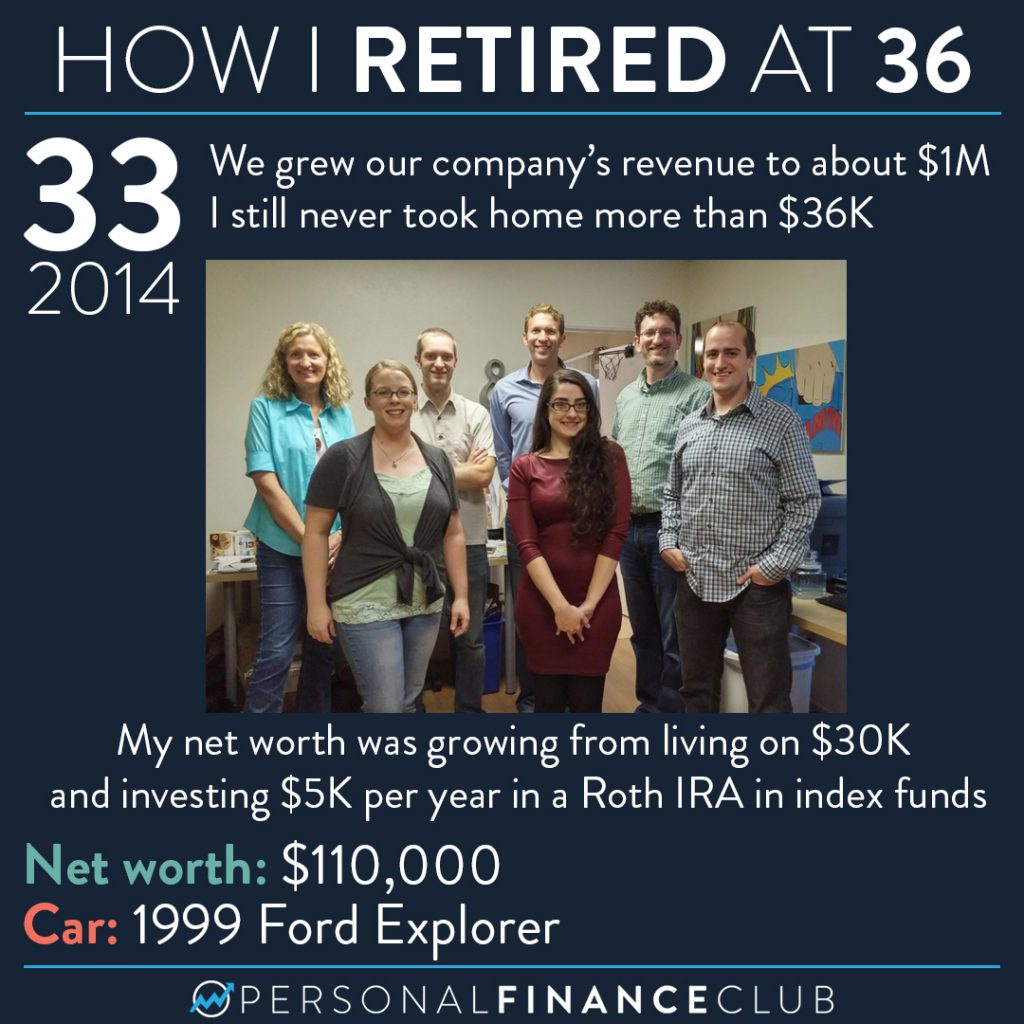

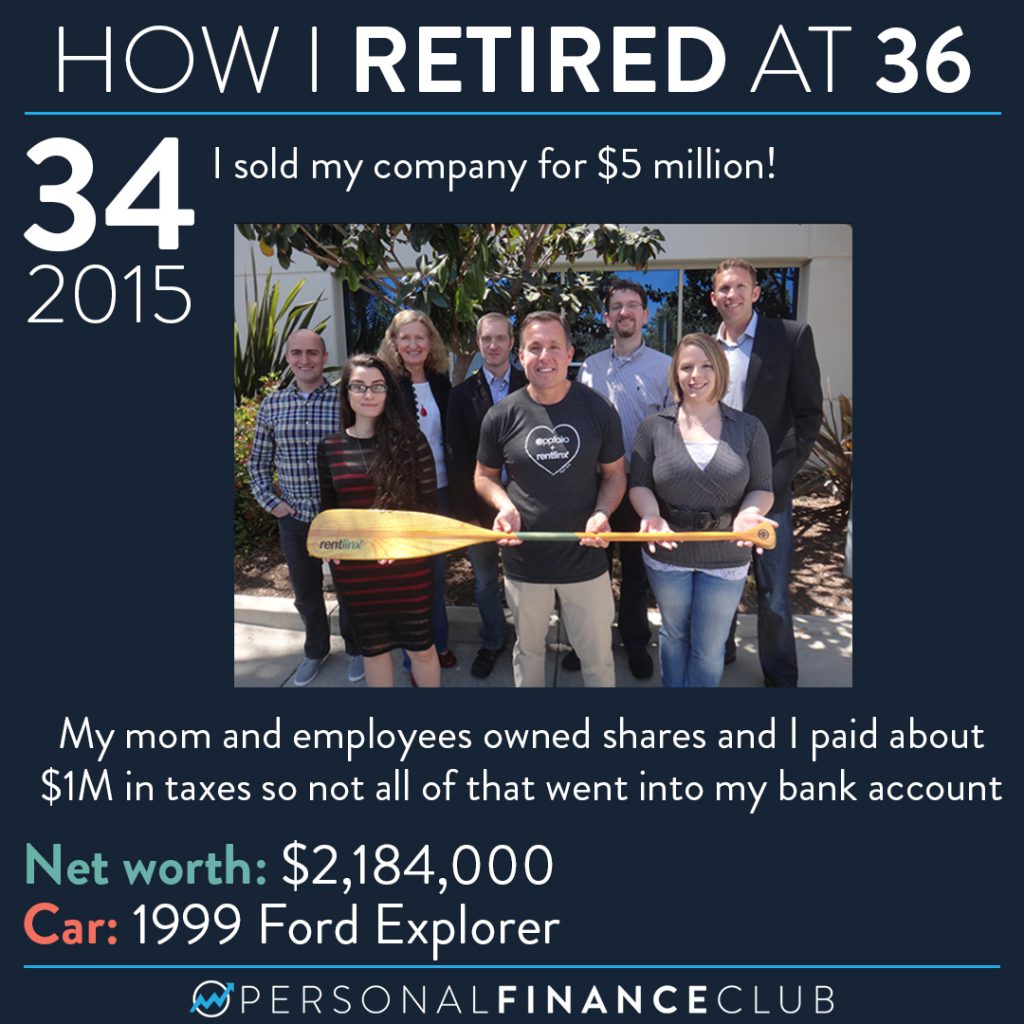

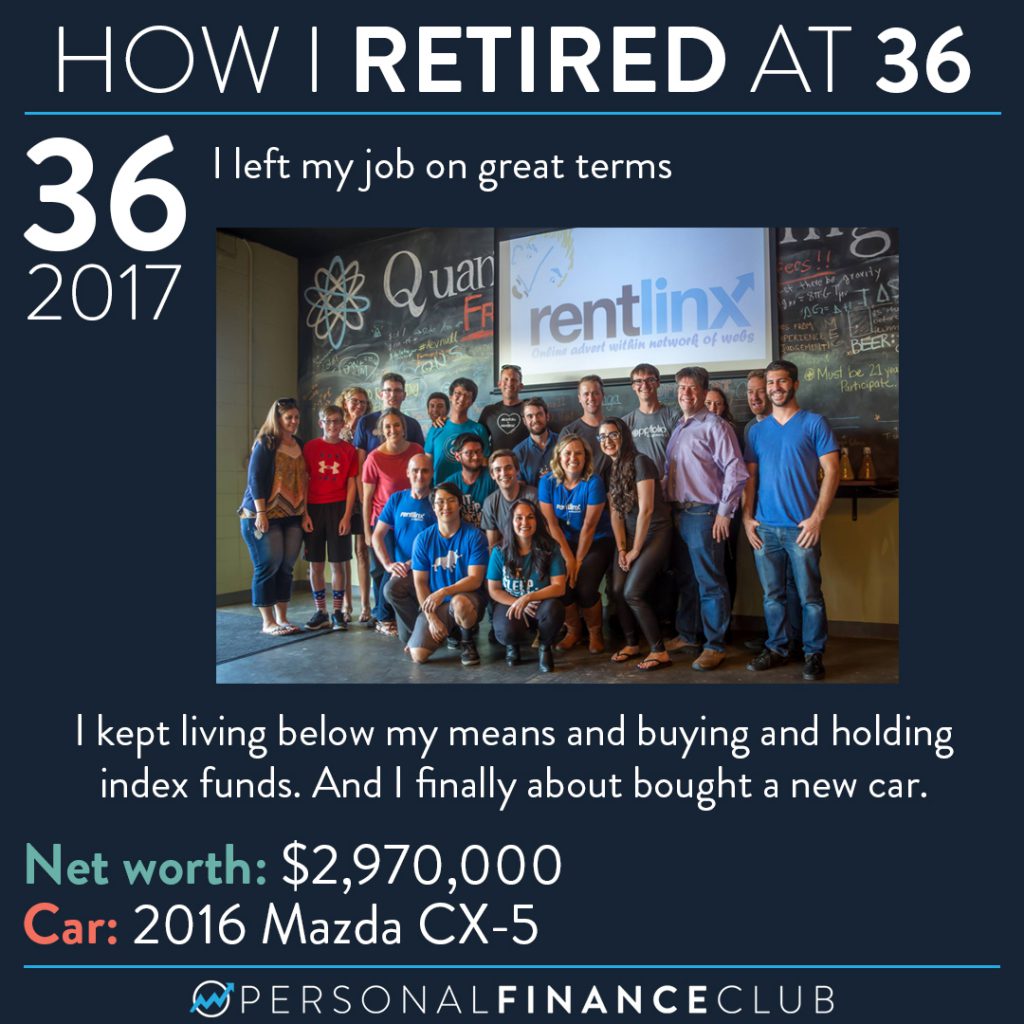

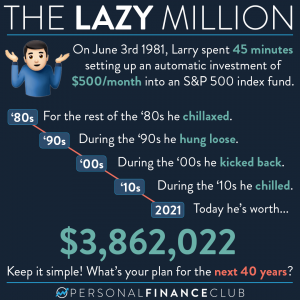

That said, I did grow my net worth to over $100K on $36K/year living in high cost of living San Diego. I was well on my way to millionaire status within another decade or two, even if I didn’t sell my company. Also, had I taken that Microsoft job and lived on a similar budget and invested the rest, I’d be almost where I am today (Maybe even ahead if I grew my Microsoft career). So, just because I had a windfall, don’t write off the most effective and efficient way to build wealth: Live below your means and invest early and often.

For you track fans, I ran the 400 and 800 in 46.8 and 1:49.8. I still hold a school record at the University of Michigan!

p.s. I first posted this last March when I had 2,600 followers. Now I’m over 30X that, so I figured I should share again?! Shout out to those OGs who have been following me for that long! I added an image and updated the last one with more recent information! My net worth is up $181,000 since last March!

– Jeremy