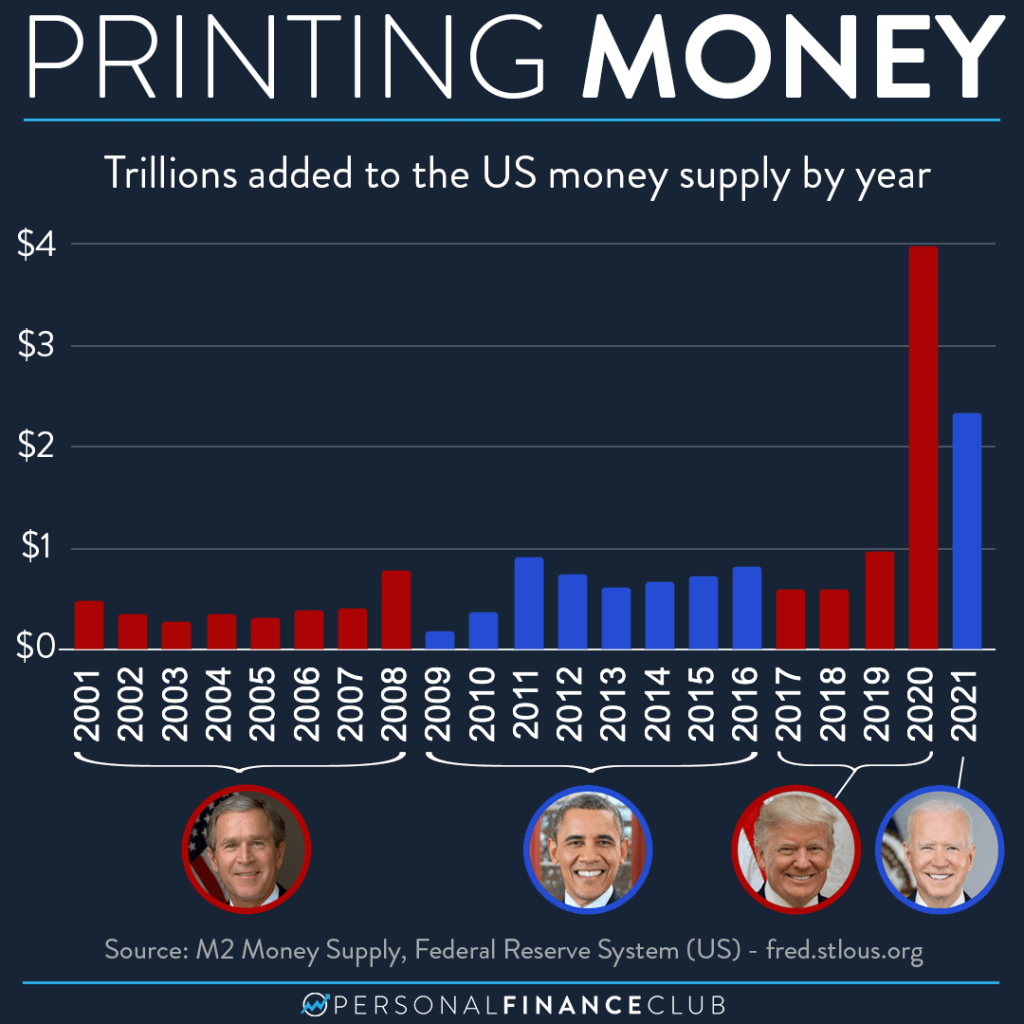

The other day I posted about how inflation was measured at 8.5% over the last year, the highest we’ve seen in about 40 years. I noted that two of the drivers of the inflation were global supply chain issues and the Russian war. Some commenters reasonably pointed out that gas prices were on the rise before the war began and a lot of money has been added to the US money supply recently.

As with most things economic, partisan political supporters are quick to point blame to the other side of the aisle when things don’t go well. Notably, a lot of people mentioned how inflation is falling squarely on the shoulders of Biden because he printed all this money. So I decided to look it up! Here are the real numbers.

This chart shows the change in the “M2” money supply in the US. Measuring how many dollars are out there turns out to be kind of a challenge, but M2 is a widely accepted metric. It basically counts dollars in cash, checking deposits, money market securities and other cash like stuff.

Notably there’s big spikes the last two years. Where did this money come from? A lot of it came from the COVID stimulus bills. Since 2020 there have been about 5.7 TRILLION dollars of said stimulus. This includes stuff like stimulus checks, enhanced unemployment benefits, small business loan forgiveness, etc. Of that 5.7 Trillion, about 3.8 trillion was passed in 2020 by a Republican controlled senate, a Democratic controlled house, and signed into law by President Trump. About a trillion of that was signed into law in late 2020 (by Trump) and didn’t get paid out until 2021 (so shown on this chart under Biden).

Does all this stimulus drive inflation? Yeah, probably. Is it Trump or Biden’s fault? Sure. Although on this issue it’s hard to blame them given the threat of a once in a century pandemic. And maybe the inflation we’re facing was the lesser of two evils considering the alternative risks. I’m sure these comments will be civil… 😳

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram