In this article, we’ll walk through step-by-step how to do a Backdoor Roth IRA including screenshots. This article shows Fidelity screenshots, but the concepts are the same for any brokerage.

Summary

- A Backdoor Roth IRA is a strategy for high income earners to subvert the Roth IRA contribution income limits

- Prepare for your Backdoor Roth IRA by ensuring you have no money in a Traditional IRA

- Contribute cash up to the contribution limit to an empty Traditional IRA

- Immediately convert your entire newly funded Traditional IRA to a Roth IRA

- Congress has attempted to close the Backdoor Roth IRA “loophole” but it remains legal in 2023

What is a Roth IRA?

If you’ve made it to this article, I’m sure you know that a Roth IRA is an investment account that can be used to grow money tax free. But it comes with some strings attached. One of those is income limits. If you make too much money, you’re not allowed to contribute new cash to a Roth IRA.

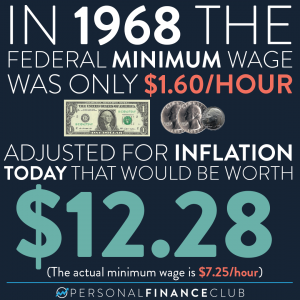

Roth IRA Income Limits for 2023

The table below shows the maximum “Modified Adjusted Gross Income” (MAGI) you can have and still be allowed to make the max contribution to your Roth IRA ($6,500 or $7,500 if you’re 50+ for 2023). Technically there is a “phase out” range above this income limit. If you’re just over you’ll be able to make a smaller contribution to your Roth IRA. However, since you generally don’t even KNOW your exact MAGI until tax time, it may make sense to just do a Backdoor Roth IRA if you’re close to this limit.

| Tax Filing Status | MAGI Income Limit |

| Single | $138,000 |

| Married Filing Jointly | $218,000 |

| Married Filing Separately | $0 |

What is a Backdoor Roth IRA?

If you want to contribute to a Roth IRA and you earn too much money, the Backdoor Roth IRA is an option to bypass those income limits. It’s a strategy that has been confirmed legal by the IRS. The strategy works like this:

- Clear out any Traditional or Rollover IRA money by rolling it to your employer 401k

- Contribute cash (usually the $6,500 max) to your now empty Traditional IRA

- Convert the $6,500 in your Traditional IRA to your Roth IRA

Normally a Traditional IRA is used to make tax-deductible contributions. But high income earners (especially those with workplace retirement plans like a 401k) aren’t eligible for that tax break. However, you still are allowed to CONTRIBUTE the money as long as you indicate “0” on the IRA tax deduction line of your taxes. You’re also allowed to convert a Traditional IRA to a Roth IRA at any income level. Since that $6,500 in the Traditional IRA has already been taxed when you earned it as income (and didn’t take the tax deduction), the conversion to Roth happens tax free with all $6,500 transferring to your Roth IRA. The end result is the same as if you contributed directly to the Roth IRA.

Talk to a CPA Territory

It’s worth mentioning that if you’re in a high enough income bracket to need a Backdoor Roth IRA, you’re likely in “talk to a CPA” territory. There may be specific tax issues in your situation that impact whether a Backdoor Roth IRA makes sense for you. If they advise it’s a reasonable strategy, this guide may be a great place to walk through the details.

The Pro Rata Rule

The big caveat to the Backdoor Roth IRA strategy comes in the form of the pro rata rule. It says that when you’re converting money from a Traditional account to a Roth account, if there is both pre-tax and post-tax money in that Traditional account it must be converted proportionally.

As an example, let’s say you have $58,500 in a Rollover IRA that was rolled over from a previous employers Traditional 401k. If you do a post-tax $6,500 contribution to a Traditional IRA you’ll then have $58,500 pre-tax and $6,500 post-tax for a total of $65,000. If you convert that $6,500 in your Traditional IRA to a Roth IRA, the IRS will say, “Hey, only 10% of your IRA money is post-tax and 90% is pre-tax so when you convert this $6,500 to Roth, we’re going to tax you on 90% of it”. Getting taxed on a Traditional to Roth conversion misses the point of a Backdoor Roth IRA. You can convert a Traditional to Roth at any point (paying the tax on the entire amount) but generally high income earners want to delay that until they’re in a lower tax bracket.

But there’s a way to clear out your Traditional IRA without paying any tax which clears the path for a Backdoor Roth IRA.

Step 1: Clear out your Traditional IRA

If you don’t have money in a Traditional or Rollover IRA you can skip this step and go to step 2. For those that do, you’ll need to clear out that money to avoid the pro rata rule.

The pro rata rule applies to individual accounts, SEP IRAs, and SIMPLE IRAs, but not workplace retirement plans (like a 401k or 403b). The strategy here is to roll over all the money in your Traditional and Rollover IRA to a workplace 401k leaving your individual IRAs empty. If you have a lot of money in a Traditional IRA and don’t have a workplace retirement plan, or it’s distasteful due to high fees or poor investment options, your Backdoor IRA journey may end here. That’s ok, you can always invest unlimited money in a regular brokerage account!

If you do need to move Traditional money to a 401k, here’s how you do it. Fair warning, it’s not a very romantic process and likely requires printing and mailing a couple forms.

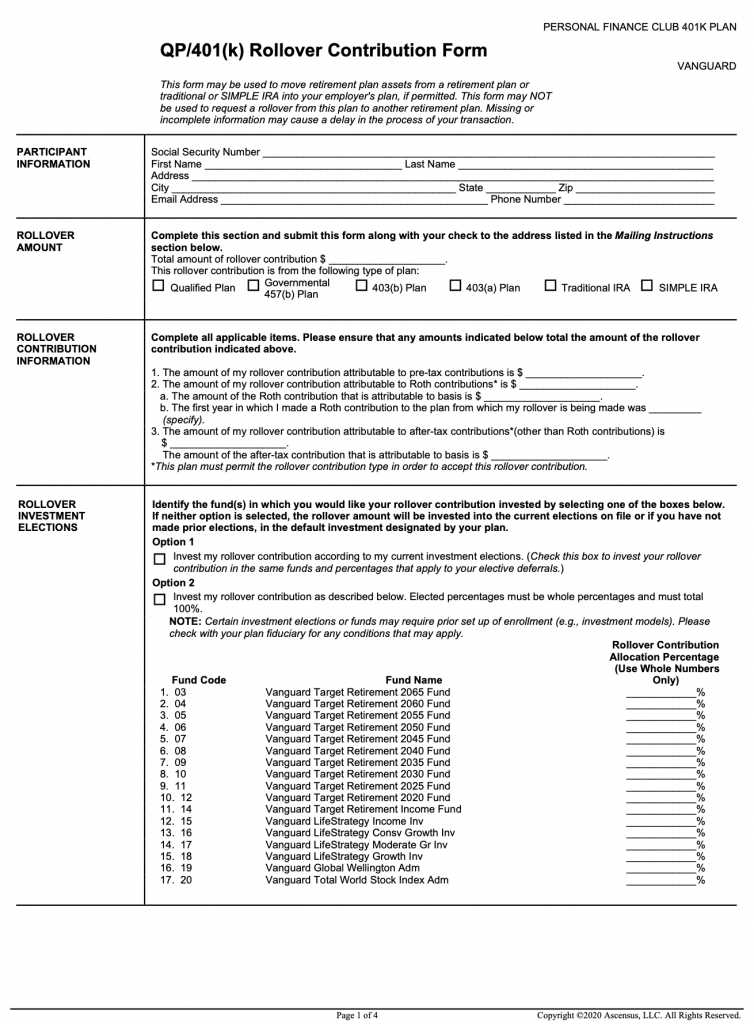

- Contact your employers 401k administrator or your HR department. Confirm that your 401k plan allows for incoming rollovers. You’ll likely have to request and fill out a “401(K) Rollover Contribution Form” that tells your 401k to expect the incoming transfer and what to do with it. My 401k is with Vanguard and the form looks like this:

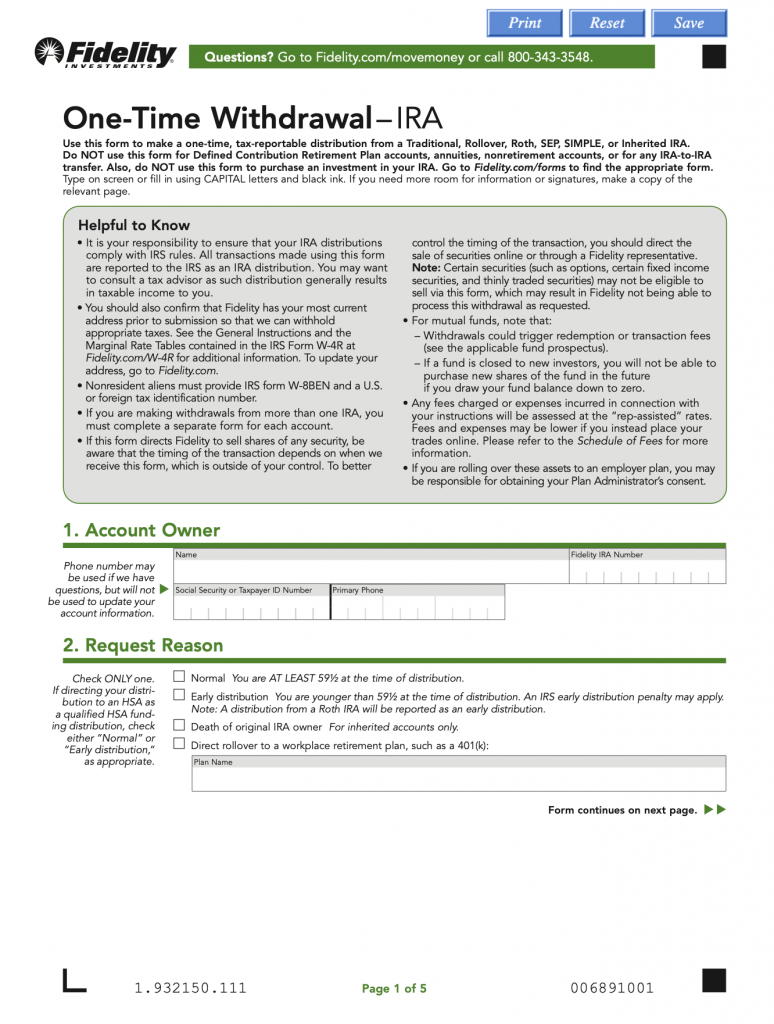

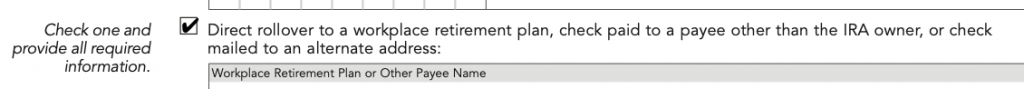

- Call your IRA brokerage and inform them you would like to do a “direct transfer rollover” from your Traditional IRA to your workplace retirement plan. You’ll likely have to complete a “One-Time Withdrawal IRA” form. Make sure to carefully fill out that form, because the result will be the draining of your IRA and a check mailed from your IRA brokerage to your 401k brokerage. Your results my vary depending on these two brokerages. My IRA was with Fidelity and the form looks like this:

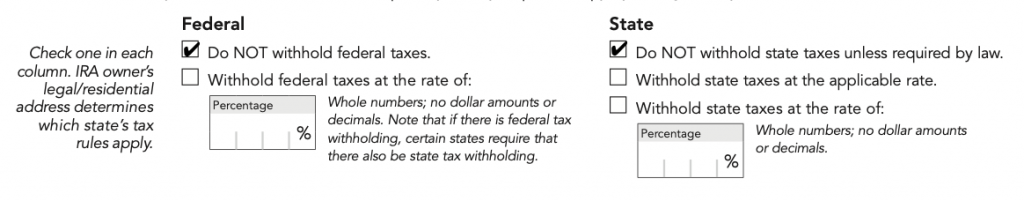

Like I said, not a very romantic process. But in theory, submitting these forms to these brokerages will result in your IRA money moving directly to your 401k. There should be no tax impact for doing this. Be careful on your withdrawal form to indicate it is a direct rollover and not to withhold taxes. If your IRA brokerage misunderstands and sends you the money directly as though it’s a withdrawal, there will likely be associated taxes and penalties. Here’s how I filled out those boxes:

Since there are big companies and checks being mailed around, expect this to take a couple weeks. Take care to verify this all works correctly. If your IRA money is lost, that would be much worse than any benefit of the Backdoor Roth IRA tax break. Once the money is out of your Traditional and Rollover IRAs, you’re ready to move to Step 2 of the Backdoor Roth IRA!

Step 2: Contribute Cash To A Traditional IRA

If you never had a Traditional IRA or your Traditional IRA was automatically closed when you rolled over the entire account, you’ll need to open a Traditional IRA. This is an easy process that takes a few minutes and can be completed online. I started mine by heading to Fidelity.com. Click “Open an Account”

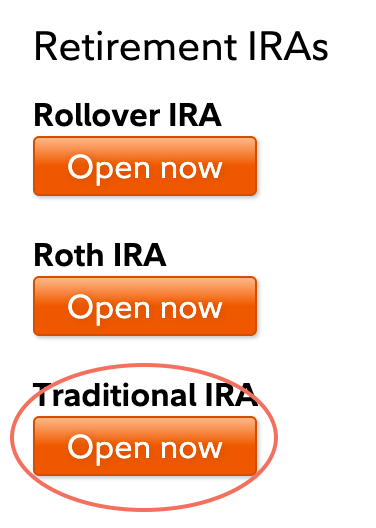

Choose a Traditional IRA

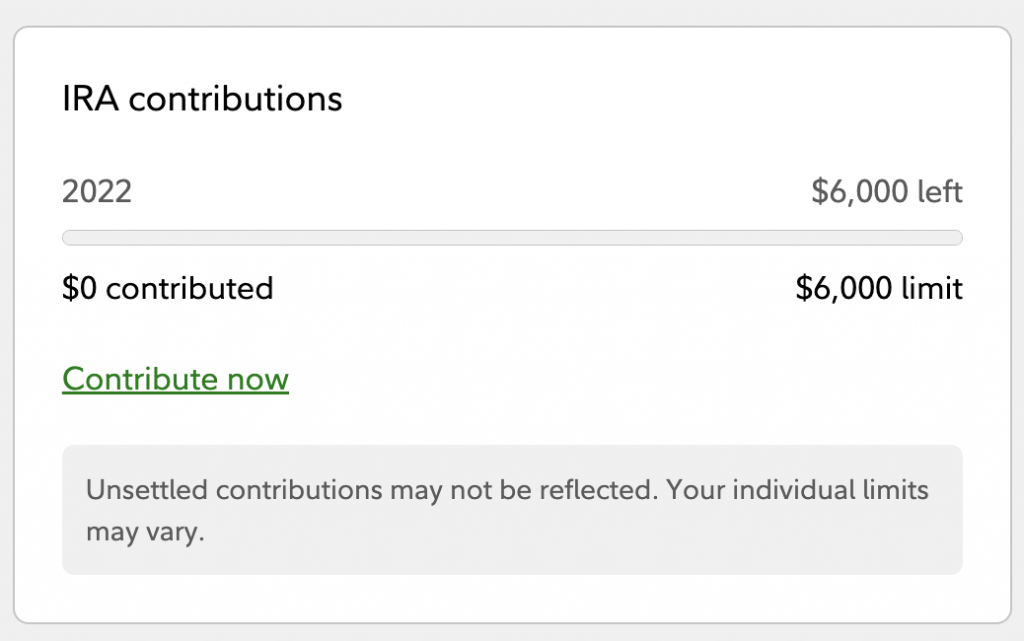

Fill out your details and your account should be opened! You’ll then see that there have been no contributions to your IRA so click “Contribute Now”.

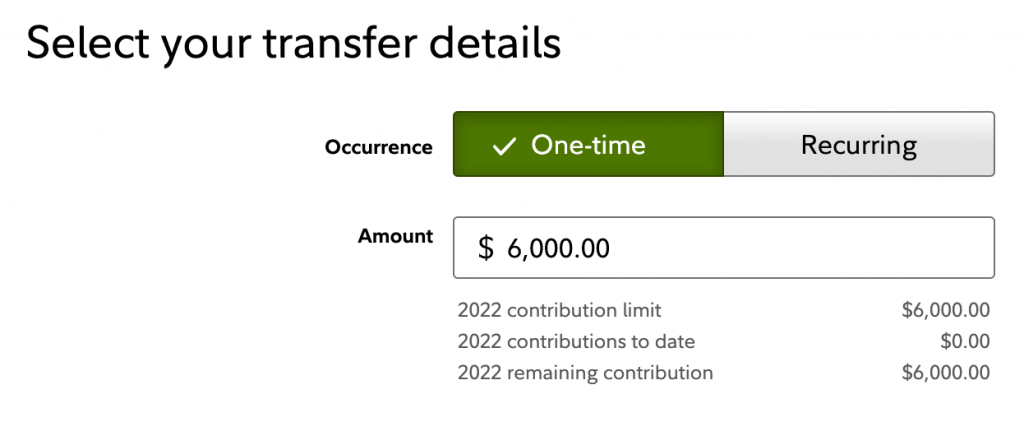

Follow the steps. It’s not strictly required you max out the limit and do it all at once, but it saves hassle from having to walk through these steps multiple times. So I did a one-time contribution to max out the contribution limit for the year.

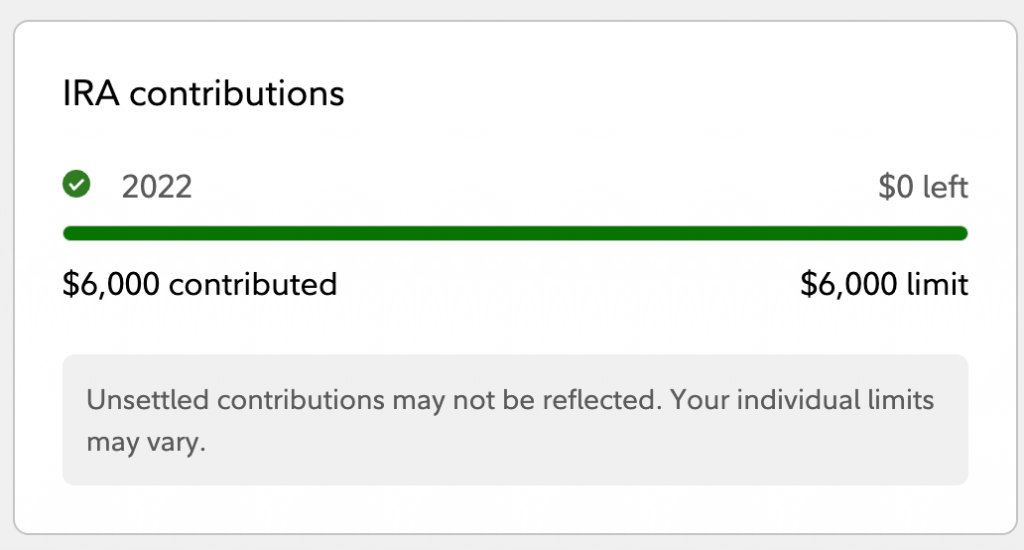

Once your contribution is made, you’ll see that you have now maxed out your IRA contribution for the year!

Note that there is nowhere in Fidelity to indicate this is a special “non-deductible” contribution. That is handled when you file your taxes. IRS Form 8606 (Nondeductible IRAs) should be completed and submitted with your 1040. Or let your tax preparer know you made a nondeductible contribution.

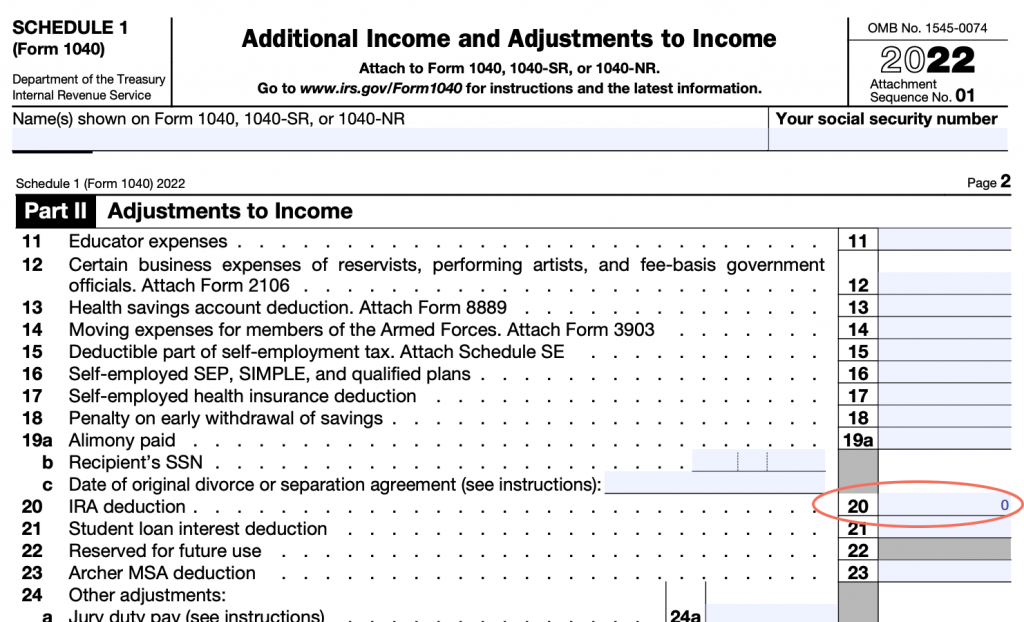

On IRS Form 1040 Schedule 1, Section 2 you’ll also indicate that you are not taking the IRA tax deduction. Taking these steps ensures that you’ve told the IRS this money has already been taxed and avoids the possibility of getting taxed on that money again when it’s converted to a Roth IRA.

Now that you have post-tax money in a Traditional IRA, the next step is to do the conversion from Traditional to Roth!

Step 3: Convert Your Traditional IRA to a Roth IRA

In theory this step can happen moments after step 2, but in my experience you need to wait a couple days for the money to settle in the Traditional IRA before it can be converted to the Roth IRA. If you don’t yet have a Roth IRA, you’ll need to open one similar to the steps for opening a Traditional IRA in Step 2.

When the money is settled in the Traditional IRA, you initiate the conversion by simply clicking the Transfer button.

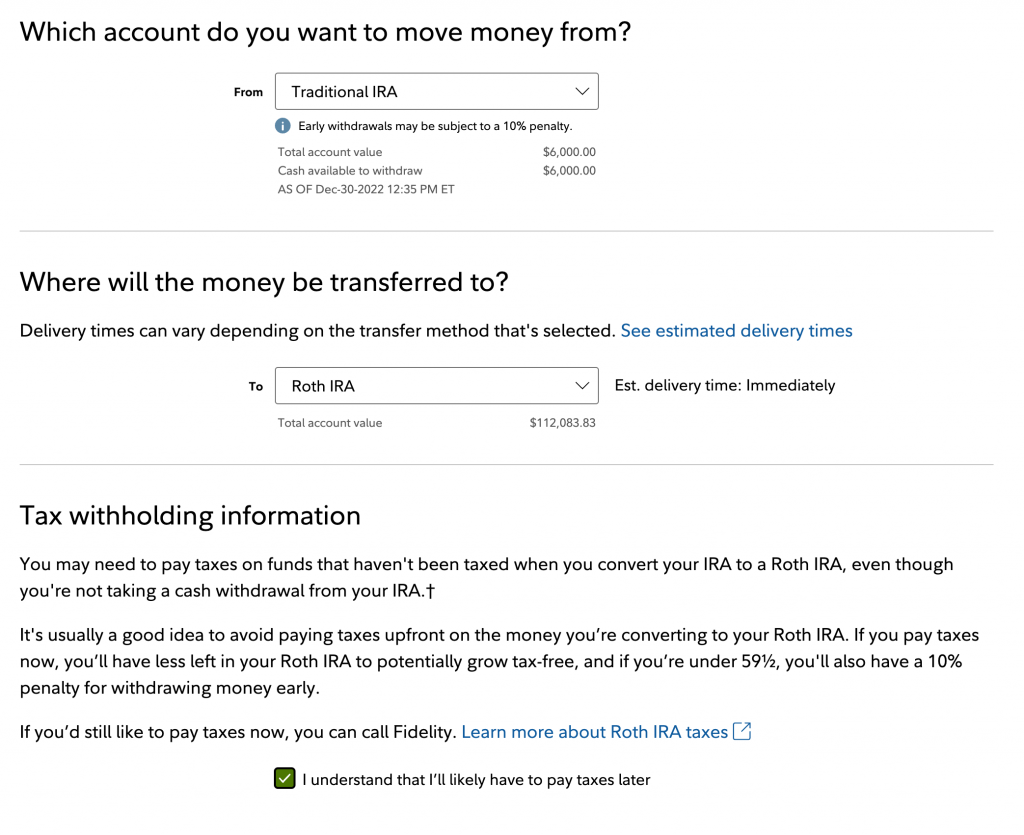

Choose that you’re moving money from your Traditional IRA to your Roth IRA. There will be a warning that you’ll have to pay taxes on this. Normally that’s true when converting from Traditional to Roth, but in this case, since you never took the Traditional tax deduction, there is no pre-tax money to tax and this won’t be a taxable event.

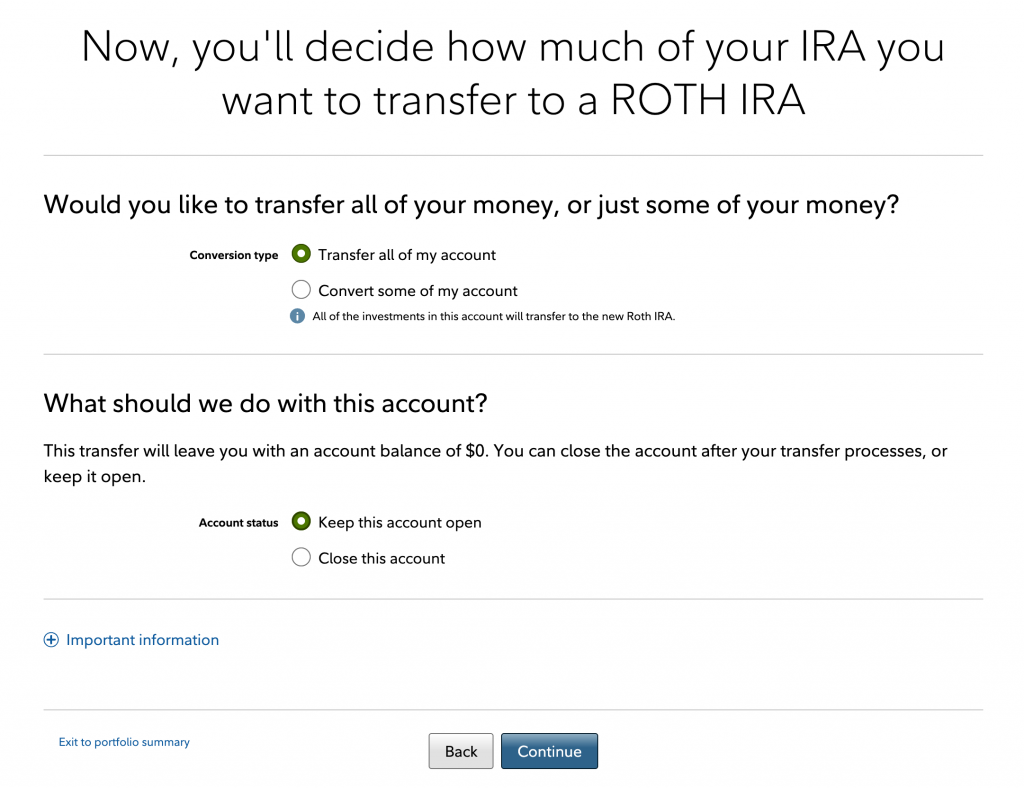

Choose to convert all of the money and leave the account open (so you can use it next year).

If you see an error that says “An issue prevented us from submitting your transfer. Please try again later.”, it’s likely that you need to wait for the contribution to the Traditional IRA to settle. In my experience, you can do the conversion to Roth one day after the Traditional contribution. Once you’ve done this conversion, you’ve done it! You legally made a non-deductible Traditional IRA contribution and a legal Traditional to Roth IRA conversion. You have completed a Backdoor Roth IRA!

Step 3A: Don’t Forget to Invest Your Roth IRA Money

Now that you have $6,500 of uninvested cash sitting in a Roth IRA, don’t forget to invest it! Remember a Roth IRA is simply an empty account on its own. It doesn’t grow unless you invest it. So click the “Trade” button, choose your investments, and make sure all of that cash gets invested. I suggest considering a target date index fund!

Is This All Legal?

Yep, although some in Congress have pushed to close this “loophole”, it’s still legal as of 2023. Personally I think the income limits are kind of silly as billionaires aren’t evading millions in taxes thanks to a $6,500 Roth IRA contribution. Instead, it’s placing an undue burden on middle class people to figure out these complex rules around IRA contributions. But alas, if you’ve made it this far in this article, you’re a financial superstar and I’m sure you will do great!

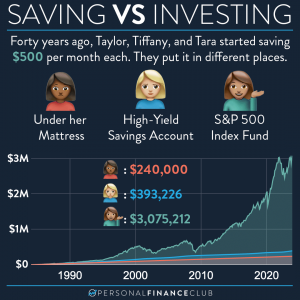

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!