The picture on the left is me in my last rental (a one bedroom converted from a garage) and on the right is me sitting in front of the condo I purchased back in 2019!

I paid $712K for the condo and today it’s worth almost $850K! $138K growth in under two years! Amazing, right?! Actually, even including the increase in my home value, I’m about $250K LESS wealthy than I would have been if I stayed in that apartment!

Why is that? Let’s break it down. First my monthly expenses. Note that I paid CASH for my condo. Literally sent them a $712K wire and got the title. No loan, no bank. I own it 100% free and clear without a mortgage payment.

Yet still, my monthly costs to live here are about the SAME that I paid in rent! Here’s the monthly breakdown:

Property tax: $742

Insurance: $62

Utilities: $162 (was included in my rent)

HOA: $250 (covers water, insurance, landscaping, etc)

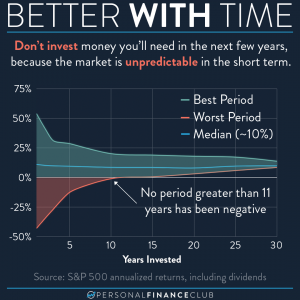

Added up that’s $1,222 totally sunk cost every month and I didn’t even include maintenance or realtor fees! But there’s an even worse force at work: Opportunity cost. I took $812K out of the market (purchase price plus $100K for a remodel). While the value of my home has gone up, it has gone up much less than if I left it in a target date index fund. If I was still renting, that money in a target date index fund would be worth $1.1 million!

Over the almost 2 years I’ve lived here, my home has appreciated about 9%/year. Amazing! But the market has been up almost 20%/year over that time. Historically home values in the US have increased about 4%/year while the market has increased 10%. That’s a BIG difference.

So when you buy a home, remember there are lots of sunk costs that aren’t going towards the principal of your home. Plus, there’s the opportunity cost of making those huge chonky payments to a bank and a slowly appreciating asset instead of to an investment.

That doesn’t mean renting is always better, but either way your housing is a cost. Focus on spending less and investing more!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram