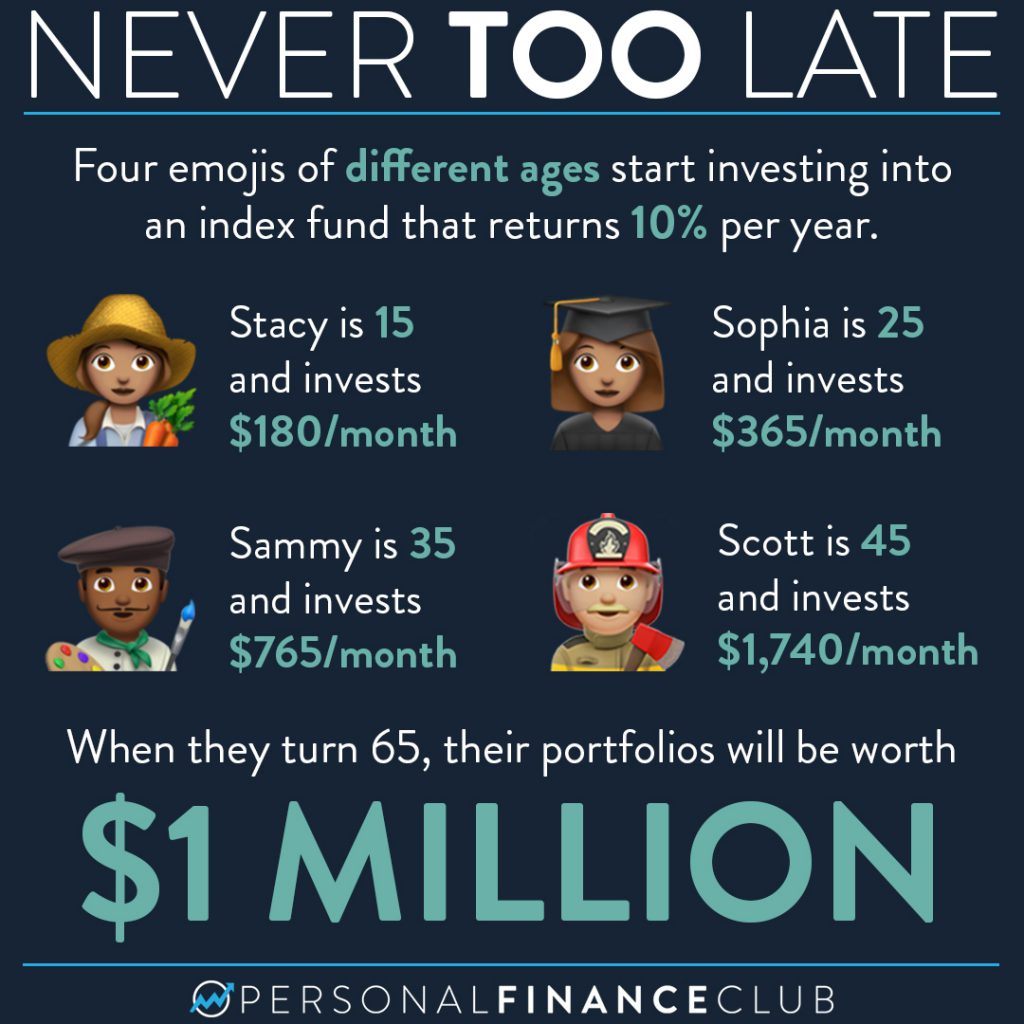

We often get asked by late bloomers what they can do in order to catch up. To be honest, there isn’t a shortcut for this, aside from investing more money. Starting later than 45? Invest more money. Want to retire before 65? Invest more money. Want to retire with more than $1 million? You know the drill 🙂

“But $1 million won’t be worth much after accounting for inflation!” Right. These numbers are adjusted for it. So each of our four emoji friends will have $1 million in TODAY’S dollars whenever they turn 65. How was this calculated?

First, we are assuming a 10% annual rate of return because that is the average yearly return of the stock market over the past 100 years. And we adjusted it for inflation, at an assumed rate of 3% annually. Even though inflation today has been higher, over the past 100 years it has averaged 3%. So if you take 10% and subtract 3%, you get 7%, which is what we used to make our projections. So, inflation is factored in and you would be retiring with $1 million of today’s dollars.

Want to see how much you need to invest per month in order to hit YOUR retirement goal? Try out the ‘Investment growth retirement calculator’ on our website! It’s under the ‘Tools’ section. You can enter in your own numbers like your age, starting investment, retirement age, and cost of living.

What is the takeaway here? The earlier you start, the better, so that your money has more time to grow, regardless of your age. So what are you waiting for?! Stop scrolling through IG, experiment with that retirement calculator, and start plowing away money into an index fund!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane.

via Instagram