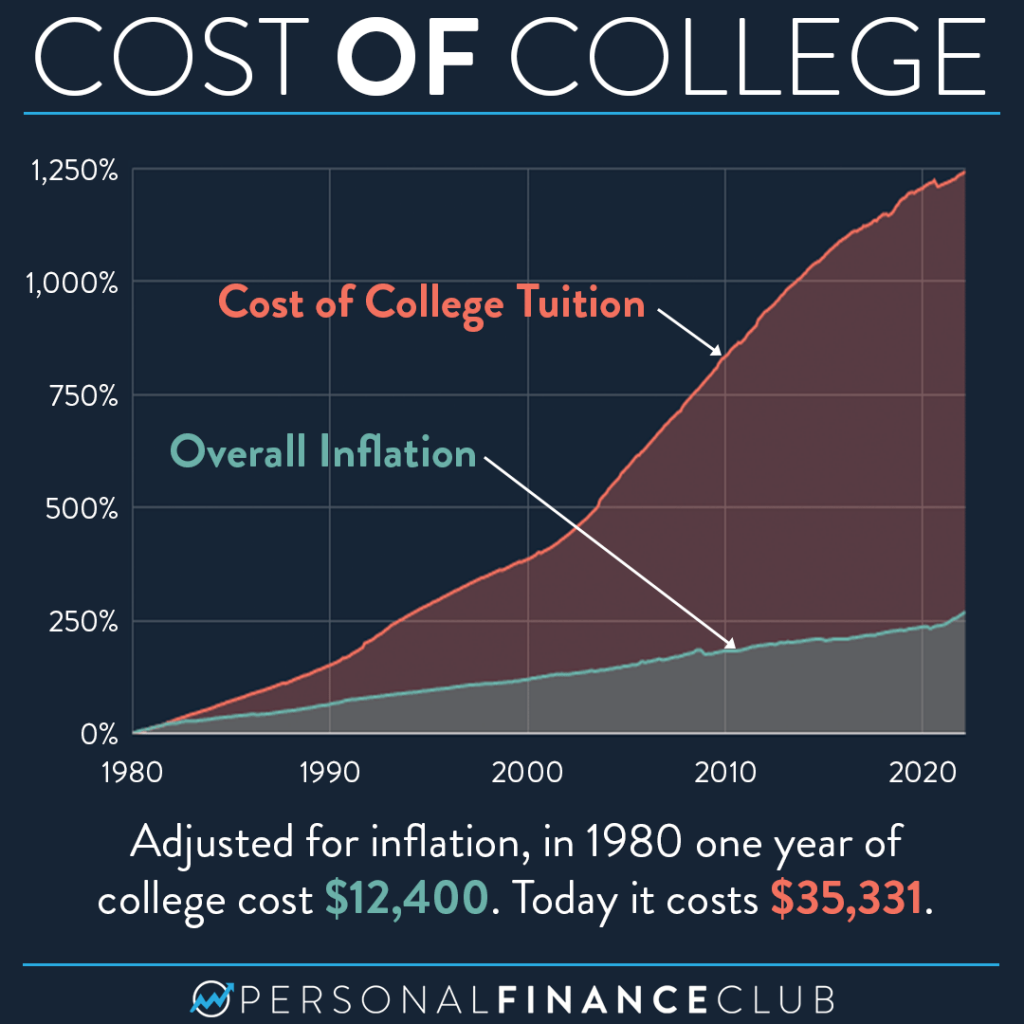

The US has found itself in an unplanned and unintended arms race of college tuition. It started innocently enough. In 1950 the cost of tuition was reasonable. Eventually some who had trouble footing the tuition bill up front needed loans. Loaning money to further someone’s education is a noble cause, and in 1958 the first federal student loan program was created. Now more students could attend college, and simply pay back the modest amount loaned once they were gainfully employed. Hooray!

But colleges need to compete to attract students and advance their own self interest. If a rival school gets a better gym, cafeteria, dorms, lecture halls, etc, it must be met with an escalation to remain on top. Tuition goes up to cover the costs. In a normal market, price sensitive consumers would push back. “No way I’m going to THAT school, it’s not worth it.” But these 17 year olds making life altering decisions aren’t paying with their own money, they’re paying with this abstract student loan monopoly money. And after all, it costs what it costs and you can’t put a price on a good education.

I’m about to sound like a curmudgeonly boomer (I’m not! My parents are boomers!) but I graduated from the University of Michigan in 2003. When I lived in the dorms, they were pretty simple. Tile floor, concrete block walls. Basic cafeteria with trays and large stainless tubs full of the food of the day. I went back to visit a few years ago and it was literally unrecognizable. It looked like a five star resort inside. Fancy cuisine stations from around the world, totally remodeled and rebuilt. I loved that for the students experience, except for the debt they were unknowingly signing up for.

So the arms race continues. Colleges ramp up costs to compete, and the money keeps flowing from the student loans thrown on the backs of teenagers without nearly the life experience necessary to make informed decisions. Tell the teenagers in your life to be careful of this trap and be price sensitive when making college decisions!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram