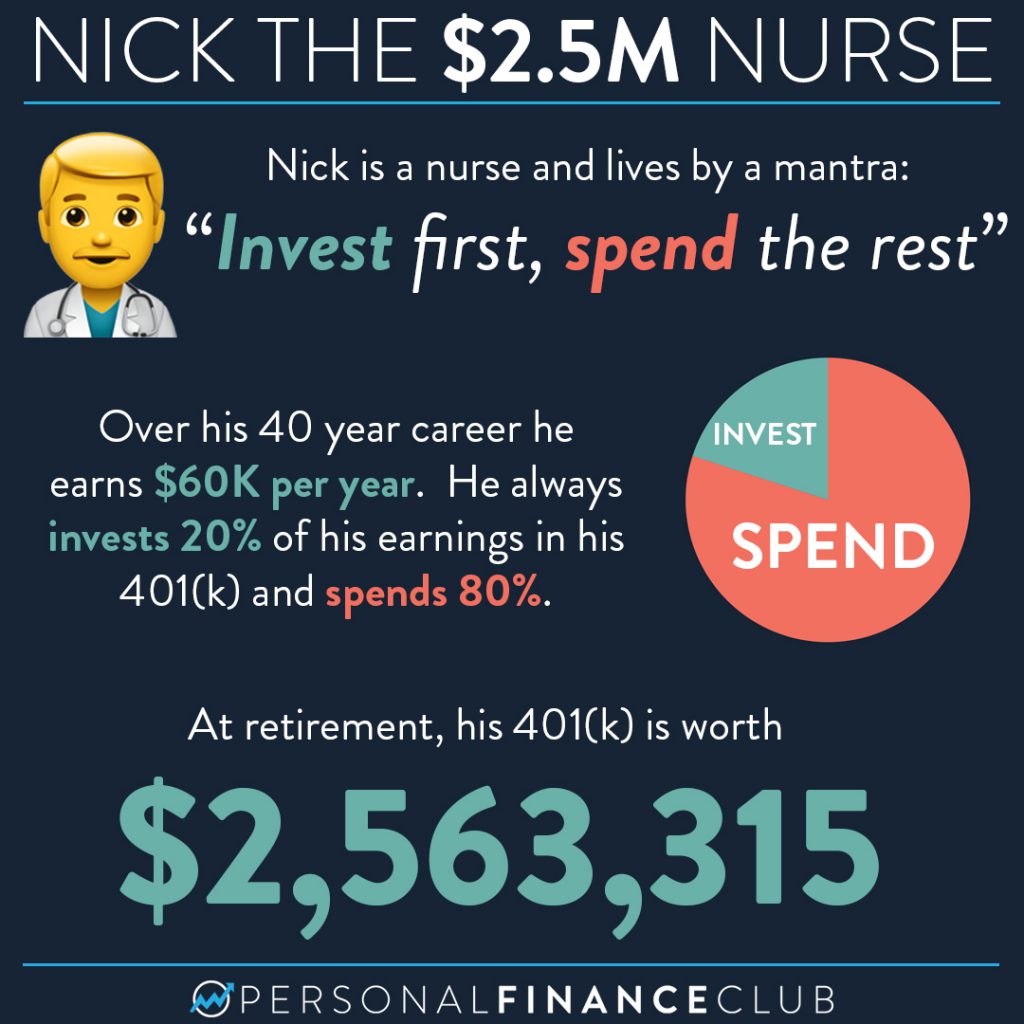

Nick literally spends 15 minutes on investing his entire life. The day he gets hired, he enrolls in his 401(k) plan, ramps up the contribution rate to 20% of his salary and chooses a target date index fund. He never touches it again.

Over the next 40 years, the 20% comes off the top of his paycheck before he ever sees it. Each and every paycheck for 40 years, he’s investing more and more into his index fund. The index fund is going up in value and throwing off dividends that get reinvested to buy even more. The market crashes, Nick invests more. The market recovers, Nick invests more. Nick never looks at it. His investments return 7%/year after inflation. (About the average inflation adjusted return of the US stock market over the last 100 years)

When he’s ready to retire, he finally logs into his account and pleasantly surprised to see he’s now a multi-millionaire. With $2.5M to spend in today’s dollars, since we accounted for inflation.

In retirement, assuming that same 7% growth, his investments kick off about $175,000/year. Nick realizes he’s getting a huge pay raise after he stops working!

If Nick chose a “traditional” 401k, he would owe tax on the money when he withdrawals it in retirement. (But he would have more money to spend during his working years). If Nick chose a “Roth” 401k, that $2.5M would be 100% tax free! (But he would have paid more tax during his working years)

That’s it guys. That’s the secret. That’s the two rules. Live below your means and invest early and often.

– Jeremy

via Instagram

September Sale!

September Sale!