On December 29th, 2021 Vanguard Target Retirement Funds all dropped in share price by as much as 14% in a single day. In this article I break down what happened, how it impacts you, and why it happened.

Summary:

- The share price of Vanguard Target Retirement Funds dropped by as much as 14% on 12/29/2021

- The underlying funds remained flat on that day

- This was caused by a large capital gains payout

- Investors’ total investment value wasn’t impacted

- This may impact investors taxes if the fund is held in a taxable account

- Make sure dividend reinvestment is turned on

What Happened?

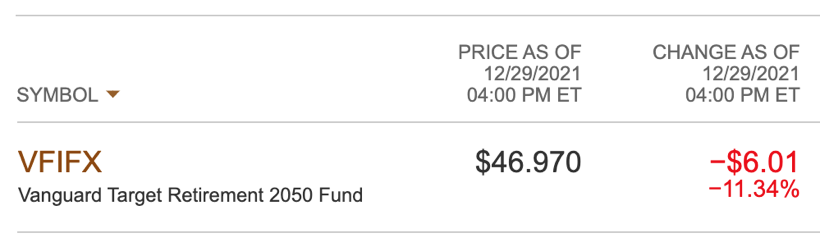

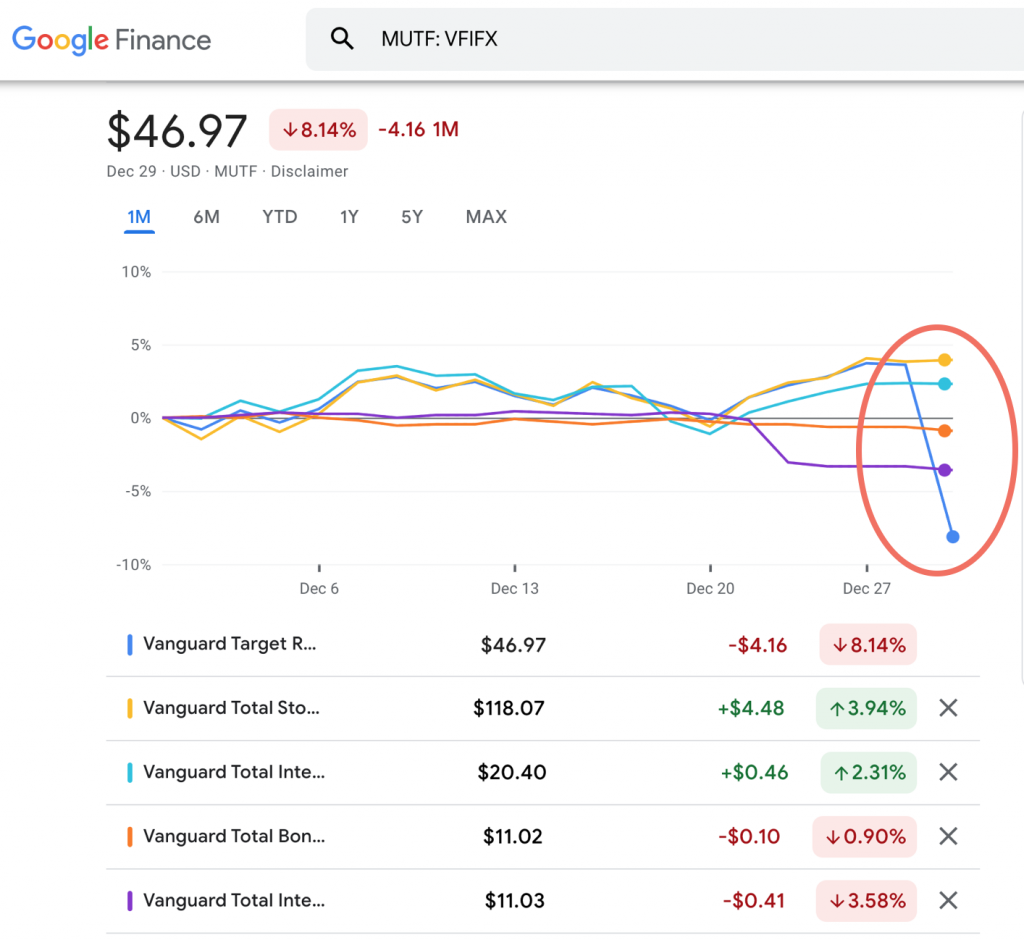

If you own a Vanguard Target Retirement Fund and you looked at your returns after 12/29/2021 you likely saw a huge drop in the share price. For example, here’s the daily return of the fund VFIFX showing an 11.34% drop:

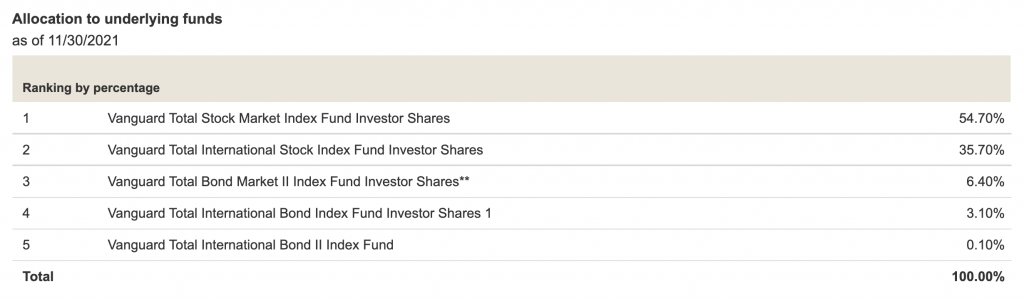

This fund is made up of just five underlying funds as shown on the mutual fund details page and below:

A target date fund is just a “fund of funds” so it should behave as a weighted average of the underlying funds. But if we look at how those funds fared on the same day, they were all almost perfectly flat, while the target date fund had a huge share price drop as shown here:

If the underlying funds were flat, why did the target date fund see a huge share price drop? It was caused by a huge capital gain payout. Basically, investors were all paid a large chunk of cash and the share price was lowered to reflect that payment.

To illustrate this, remember that the growth of your investment value in a mutual fund is comprised of two parts:

- Share Price

- Dividends & Capital Gains

Mutual funds own a bunch of stocks, bonds or other funds. As time goes on, those underlying investments pay dividends and capital gains. The mutual fund takes that cash and internally reinvests it, buying more investments. The value of all those internal dividends and investments is reflected in the share price. Then on a fixed schedule it pays out the accumulated value of the dividends. Vanguard’s Target Retirement Funds pay out these annually as shown on their distribution page.

An Example of Why This Doesn’t Impact Investment Value

Imagine an investor named Ashley who owns 100 shares of fund ABCDX and which has a share price of $10.

- Ashley’s investment value = 100 shares X $10/share = $1,000

ABCDX does a capital gain payout of $1 per share. That means for each share owned, Ashley gets $1 in cash. To account for that payout, the share price drops by $1 per share to $9. Now let’s look at Ashley’s situation:

- Ashley’s investment value after capital gain distribution = 100 shares X $9/share + $100 cash = $1,000

So you can see it didn’t actually cost Ashley any money, rather just transferred share price to cash. But, as a good investor, Ashley doesn’t want the cash right now. She has automatic dividend reinvestment turned on, so that cash is immediately put to use to buy more shares at the new $9 price. $100 can buy 11.1 shares at that price. So after her dividend reinvestment this is Ashley’s situation:

- Ashley’s investment value after dividend reinvestment: 111.1 shares X $9/share = $1,000

What This Looks Like in Real Life

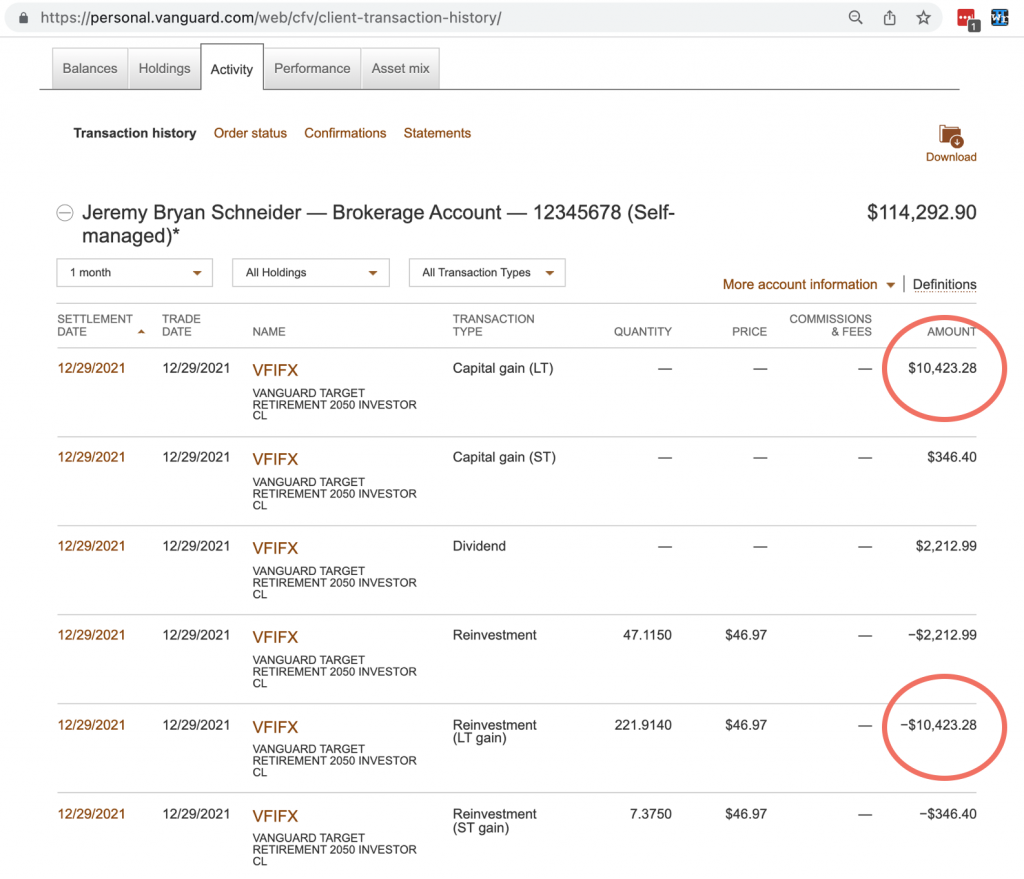

Here’s a look at my actual Vanguard brokerage account which is invested in VFIFX. You can see the capital gains and dividend payouts that are immediately reinvested:

What tax impact does this have?

There are two main categories of investment accounts:

- Tax advantaged retirement accounts (e.g. IRAs, 401ks, 403bs, etc)

- Regular taxable brokerage accounts

If you hold these funds in a tax advantaged retirement account, this capital gains payout has zero tax impact on you. That’s because tax advantaged accounts aren’t tax on gains or distributions along the way. They’re only taxed on your income at the beginning (in the case of Roth accounts) or the withdrawals at the ends (in the case of Traditional accounts).

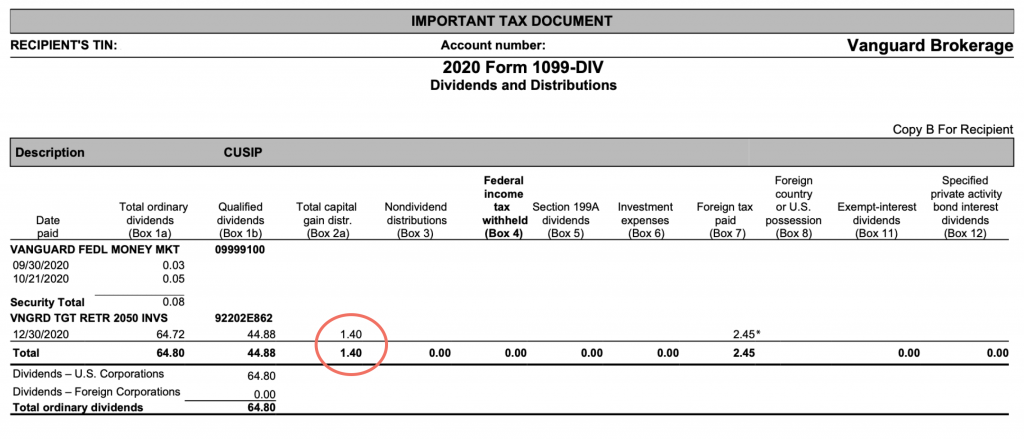

If you hold these funds in a regular/taxable brokerage account, this will impact your taxes. Early in 2022 you’ll receive a 1099-DIV tax form that reports your dividends and capital gains distributions for the year. Here’s a look at mine from 2020. Note that it only shows $1.40 in capital gains for 2020.

When I receive my 2021 1099-DIV it will show a much bigger number in the capital gain box. I will owe tax on that gain for 2021, but at the lower long term capital gain rate. Since my fund actually DID go up in value that much I could simply sell some of my shares to cover that tax burden. Additionally, since that’s an actual gain it’s going to be due one day when you sell your investment. Getting taxed sooner rather than later represents a slight tax inefficiency, but generally doesn’t have a large impact on the long term growth of your investment.

Why did this happen?

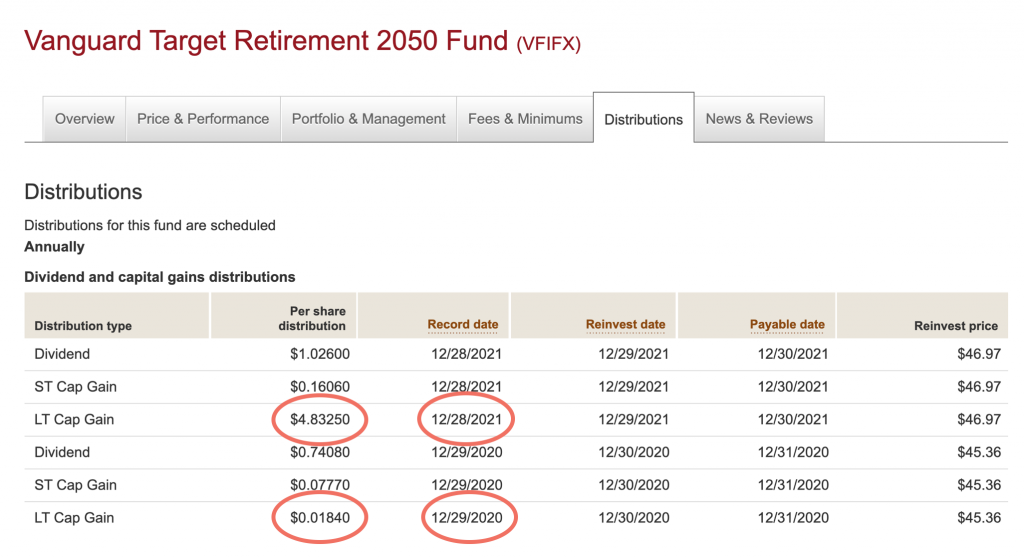

If you look at the distributions page for a target retirement fund, you’ll see it pays out distributions annually. For VFIFX, in 2020 there was a $0.0184 per share long term capital gain distribution, or about 0.04%. In 2021 that same distribution was $4.8325 or 10.3%.

That’s over a 250X increase year over year in long term capital gains distributions. That huge distribution is why we saw the share price tank on 12/29/2021.

That said, the “why” is a little harder to answer. I called Vanguard to ask them and wasn’t satisfied with their answer. They said the reasons are:

- Underlying investments did far better

- Securities turned over

- Bonds matured, replaced

The “investments did better” answer is basically nonsense. Sure 2021 was a great year for the market, but so was 2020. And it certainly doesn’t explain a 250X increase. “Securities turned over” is likely the reason, but that really doesn’t get at the heart of “why”.

My theory is that there was some big internal churn for some reason. i.e. Let’s say a huge company that uses Vanguard for their 401ks wanted to switch funds or leave Vanguard or something. To cash them out, Vanguard would have to sell a huge chunk of the underlying funds in order to fund those withdrawals. Those sales may have triggered the capitals gains distributions we see here. But truth be told, that theory is pretty speculative and I haven’t been able to get a straight answer from anything Vanguard provides. If anyone knows, please share!

What do to

Hopefully you see there wasn’t actually a crash, rather it was just the way mutual funds account for their growth. That said there are still some best practice takeaways here:

- Don’t freak out – One of the most important traits of a successful investor is the ability to “stay the course”. This crash happened to just be an accounting detail, but one day we’ll see a 10% and beyond crash of the market. Staying with your investment strategy is how you win long term.

- Dividend reinvestment – Make sure dividend reinvestment is turned on. Otherwise, big distributions like this will end up as cash dragging down the growth of your portfolio.

- Prioritize tax advantaged accounts – If your investments are held in a tax-advantaged retirement account with dividend reinvestment turned on, you can sleep right through this entire article because it doesn’t impact you at all. Getting as much of your investments into these accounts is one of the best ways to maximize your returns.

- Consider ETFs – I’m a big fan of target date index funds due to their diversification and ultimate simplicity, but this type of surprise and murkily explained distribution may certainly be a cause for concern in a taxable account. ETFs don’t have this issue which is one of the reasons they’re so quickly gaining in popularity. Although at the moment, I’m not aware of a target date ETF, so you would have to manage your asset allocation yourself in something like a three fund portfolio.

- Follow the two rules – At the end of the day the impact of this entire article barely moves the needle on any investment account in a meaningful way. If you want to become more wealthy follow the two rules of Personal Finance Club: 1.) Live below your means and 2.) Invest early and often. That’s what’s gonna make you rich, not optimizing how you realize capital gains.