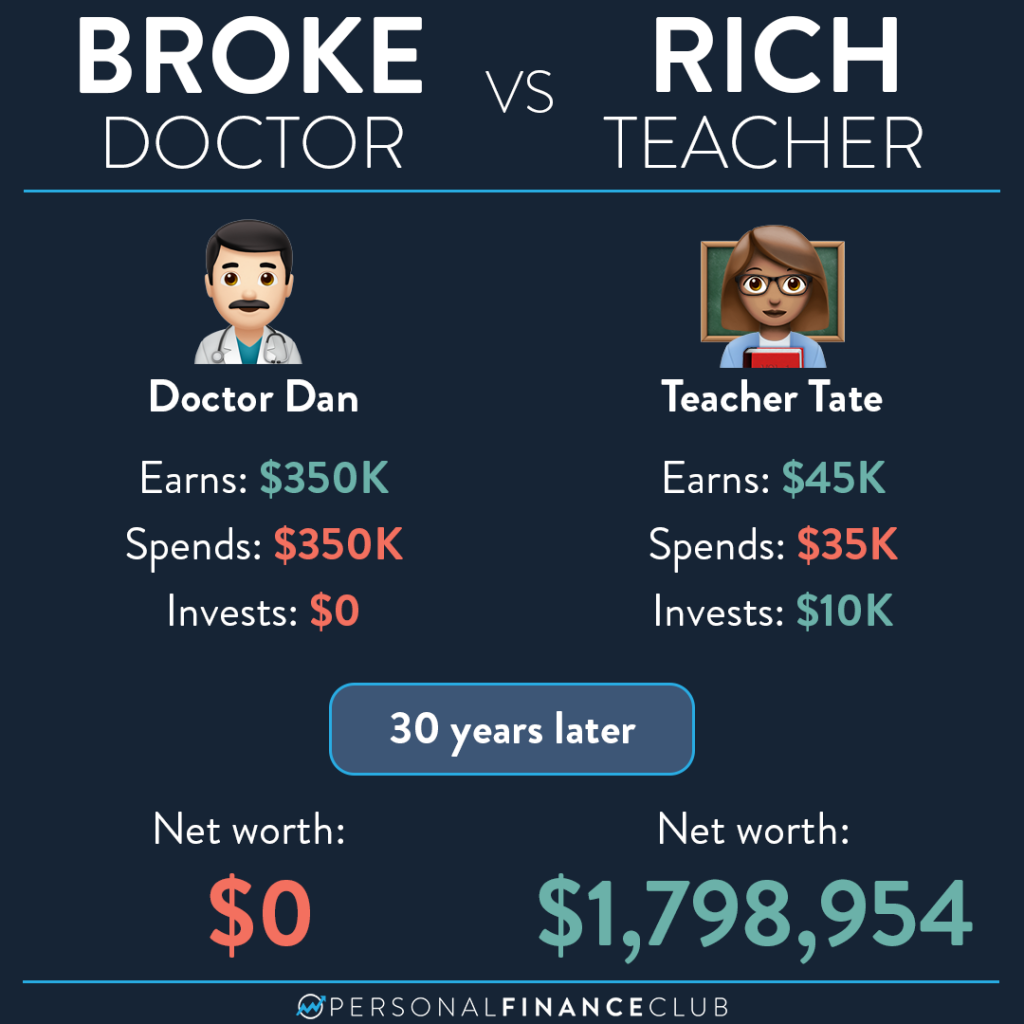

Having high income seems great, but that alone won’t guarantee your ticket to financial independence. Unless you are spending less than you make and consistently investing the difference, high income won’t get you very far.

It’s easy to think you will start saving as soon as your income is higher. But there’s a trap that is easy to fall into with higher income.

With the extra money that hits your account each paycheck, you start spending a little more. You go out to dinner more often. Maybe you start flying first class. And then it’s time to upgrade the car. And maybe even buy a bigger home. Before you know it, you aren’t even able to save any money.

The magic happens when you boost your income, maintain your current expenses, and aggressively invest the difference every single month.

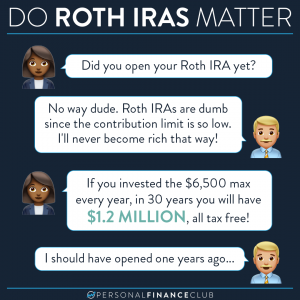

Where does this leave you? Focus on paying off any high interest debt. And then consistently invest a portion of your income each month. If you can’t afford to save a lot right now, that’s okay. Start with $50 per month. And then keep boosting it higher whenever you can. It’s less important how much you save. It’s more important that you start!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane